Understanding VAT Rules for Restaurants: Takeaways and Dine-In Explained

Navigating VAT rules for restaurants can be a minefield, especially for small businesses in the catering industry.

Mistakes in applying the correct VAT can have serious financial consequences, particularly for businesses trading above the VAT registration threshold.

This guide breaks down how VAT applies to different food sales, including takeaways and meals eaten on the premises.

Food Items and VAT Rules for Restaurants

Not all food is taxed equally. Some items are zero-rated, while others are standard-rated.

For instance, uncooked meat, fish, and vegetables are zero-rated, while fizzy drinks and bottled water are standard-rated.

Even similar products can have different VAT treatment—cakes are zero-rated, but chocolate-covered biscuits may be standard-rated depending on classification.

Eating Inside a Restaurant: VAT Rules for Restaurants

When food is consumed on-site, VAT rules for restaurants are straightforward: all purchases are standard-rated, regardless of whether the food itself is normally zero-rated. This also applies to:

-

Tables and chairs outside the restaurant

-

Shared food courts with seating areas

Takeaway Food Shops and VAT Rules for Restaurants

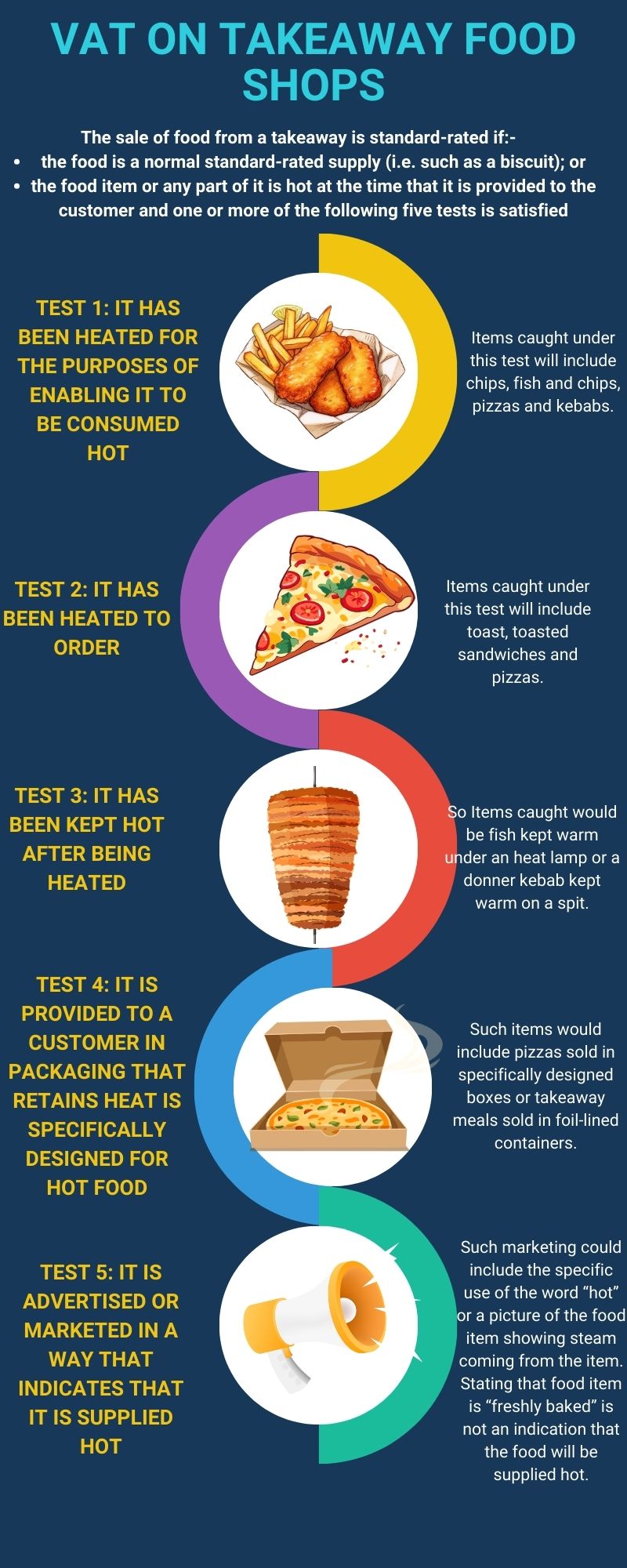

VAT on takeaway food can be trickier. Food sold from takeaways is standard-rated if:

-

It is normally standard-rated (e.g., biscuits)

-

Any part of the food is hot at the point of sale and meets one of five HMRC tests:

Test 1: Heated for consumption

Includes items such as chips, pizzas, and kebabs.

Test 2: Heated to order

Examples: toasted sandwiches, custom pizzas.

Test 3: Kept warm after heating

Examples: fish under heat lamps, kebabs on a spit.

Test 4: Supplied in heat-retaining packaging

Pizzas in boxes or foil-lined takeaway containers.

Test 5: Marketed as hot

Marketing terms like “hot” or images showing steam. “Freshly baked” does not qualify.

Examples from HMRC

Example 1: Greggs Cornish pasties sold cold meet none of the five tests, so they remain zero-rated.

Example 2: Beef joints kept warm in a cabinet meet Test 3, making them standard-rated. If cooled and repurposed for cold sandwiches, they become zero-rated again.

How Trueman Brown Can Help with VAT Rules for Restaurants

Understanding and applying VAT rules for restaurants correctly is vital for small businesses.

Trueman Brown offers expert guidance to ensure compliance and prevent costly mistakes.

Reach out to mark@truemanbrown.co.uk or call 01708 397262 to get tailored advice for your restaurant or takeaway business.

FAQ: VAT Rules for Restaurants

Q: Are all restaurant meals standard-rated for VAT?

A: Yes, meals consumed on-site are always standard-rated.

Q: Are takeaways always standard-rated?

A: No, only if the food is hot at sale or meets one of the HMRC hot food tests.

Q: How do I know if my takeaway food qualifies as zero-rated?

A: Check if the item is normally zero-rated and fails all five HMRC hot food tests.

Q: Can Trueman Brown help me understand VAT for my restaurant?

A: Absolutely. Contact mark@truemanbrown.co.uk or call 01708 397262 for expert assistance.