Investing in Your Business: A Guide by Thurrock Accountants

When it comes to growth, sustainability, and long-term success, strategic investment is key. That’s why working with Thurrock Accountants can make a significant difference in helping entrepreneurs and business owners make informed financial decisions.

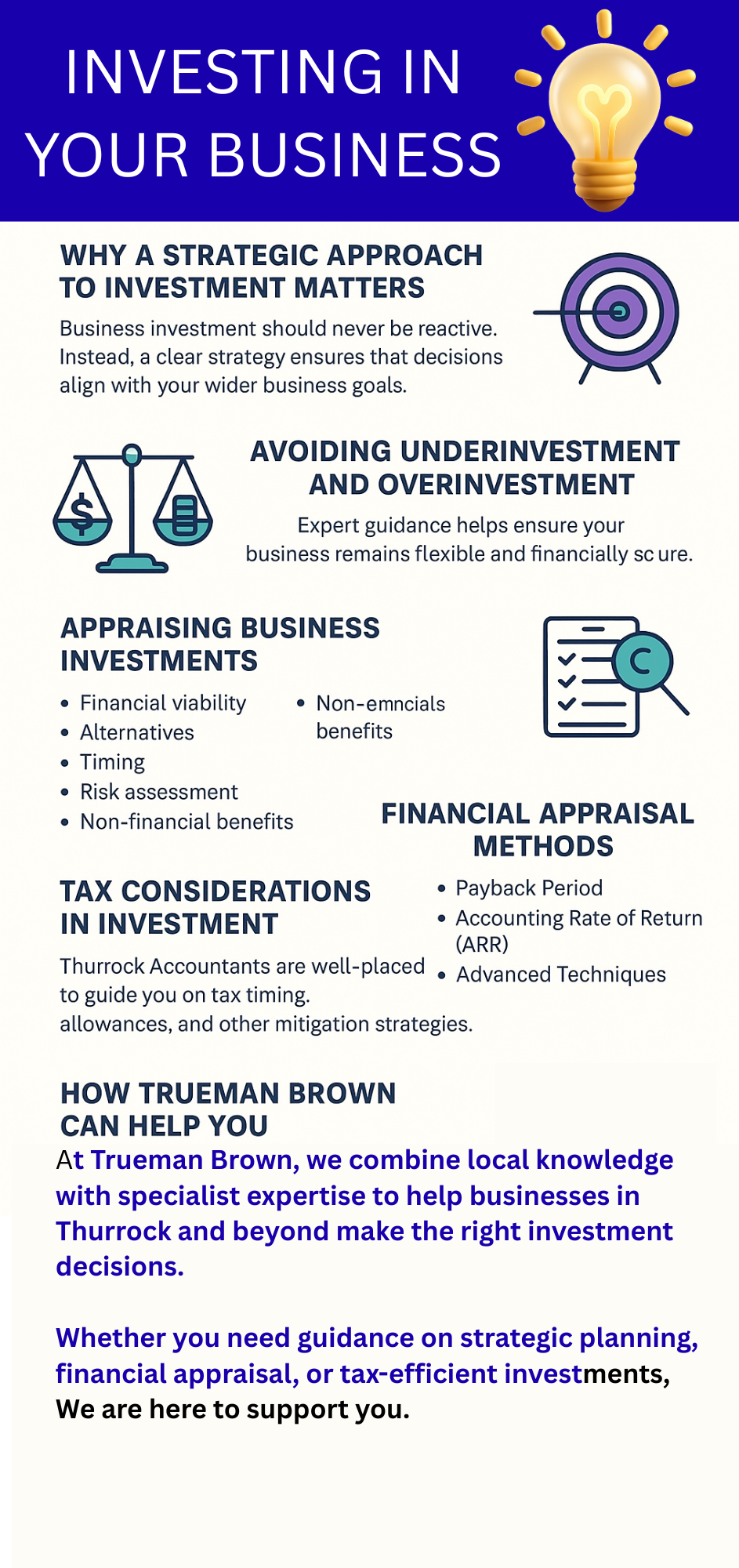

Why a Strategic Approach to Investment Matters

Business investment should never be reactive. Instead, a clear strategy ensures that decisions align with your wider business goals.

Thurrock Accountants regularly advise clients to review their investment plans within the context of overall growth, rather than treating them in isolation.

Avoiding Underinvestment and Overinvestment

Cutting back too heavily on investment can cause missed opportunities, while overspending can strain financial resources.

Striking the right balance is crucial, and expert guidance from Thurrock Accountants helps ensure your business remains flexible and financially secure.

Thurrock Accountants Can Help In Appraising Business Investments

Before committing to any investment, a thorough appraisal is essential. Consider:

-

Financial viability – availability of funds, effect on cash flow, and ROI

-

Alternatives – leasing versus purchase, or exploring different projects

-

Timing – immediate versus phased investments

-

Risk assessment – competitor changes, economic shifts, or internal factors

-

Non-financial benefits – improved operations, employee satisfaction, or reputation gains

Thurrock Accountants can support you in reviewing these factors and ensuring each decision is data-driven.

Thurrock Accountants Will Use Financial Appraisal Methods

-

Payback Period: Calculating how long it takes to recover your initial investment.

-

Accounting Rate of Return (ARR): Assessing expected profitability over time.

-

Advanced Techniques: Net Present Value and Internal Rate of Return for a deeper analysis of long-term projects.

Working with Thurrock Accountants ensures these methods are applied consistently and accurately, helping you compare projects on a like-for-like basis.

Thurrock Accountants Can Explain Tax Considerations in Investment

Investments can create opportunities for tax relief.

For example, the Annual Investment Allowance may reduce tax liabilities on certain assets.

Thurrock Accountants are well-placed to guide you on tax timing, allowances, and other mitigation strategies.

How Thurrock Accountants Can Help You

At Trueman Brown, we combine local knowledge with specialist expertise to help businesses in Thurrock and beyond make the right investment decisions.

Whether you need guidance on strategic planning, financial appraisal, or tax-efficient investments, our team of Thurrock Accountants is here to support you.

📧 Contact us today at mark@truemanbrown.co.uk

📞 Call us directly on 01708 397262

Final Thoughts From Thurrock Accountants

Investing in your business is not just about money—it’s about building resilience, unlocking opportunities, and planning for the future.

With the support of trusted Thurrock Accountants, you can make confident, informed choices that drive sustainable growth.

Frequently Asked Questions (FAQ)

1. Why should I use Thurrock Accountants when investing in my business?

Thurrock Accountants provide expert advice on financial planning, investment appraisal, and tax efficiency. Their guidance helps ensure your decisions align with long-term business goals.

2. What types of investments can Thurrock Accountants help me with?

They support a wide range of investments including new equipment, technology, expansion projects, and property, ensuring each is assessed for risk, return, and tax implications.

3. How do Thurrock Accountants assess the financial viability of an investment?

They use proven methods such as Payback Period, Accounting Rate of Return, Net Present Value, and Internal Rate of Return to compare opportunities and identify the best financial outcomes.

4. Can Thurrock Accountants help me with tax relief on investments?

Yes. They guide you through allowances such as the Annual Investment Allowance, ensuring you benefit from available tax relief while planning strategically for future liabilities.

5. How do I get started with Trueman Brown’s Thurrock Accountants?

You can reach the team directly at mark@truemanbrown.co.uk or call 01708 397262 to arrange a consultation tailored to your business needs.