Beware the Risks of the annual tax on enveloped dwellings

Owning UK property through a corporate or “enveloped” structure can expose you to unexpected charges — especially the annual tax on enveloped dwellings.

This is a tax designed to target residential properties owned by companies, partnerships involving companies, or collective investment schemes (CIS). Landlords and property investors must be alert: if your domestic property falls within the rules, failing to comply could lead to serious penalties.

In this revised guide, we’ll explain how the annual tax on enveloped dwellings (often abbreviated ATED) works in 2025, highlight key traps, exemptions, and how you can work with Trueman Brown to safeguard your investments.

What Is the annual tax on enveloped dwellings?

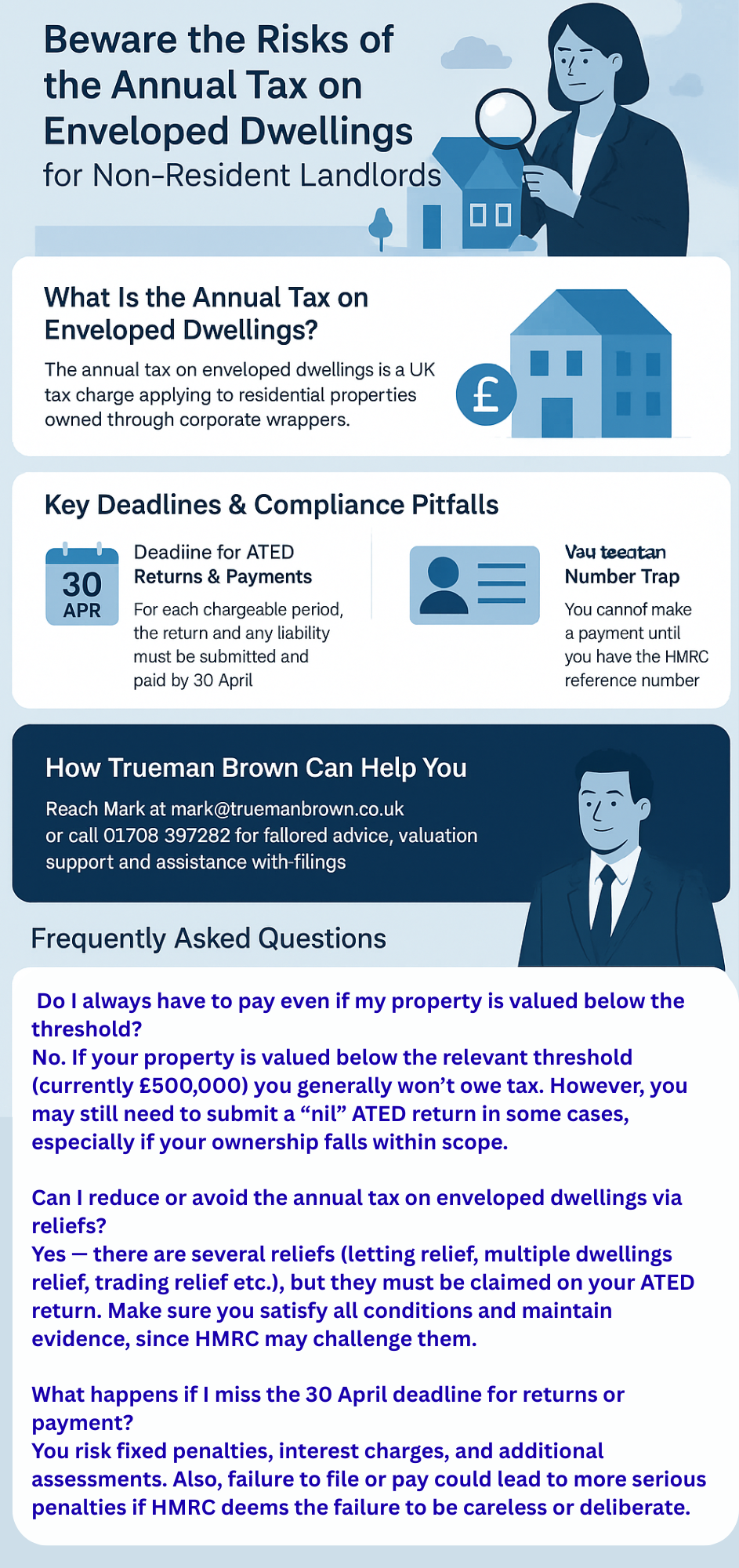

the annual tax on enveloped dwellings is a UK tax charge applying to residential properties owned through corporate wrappers. It is intended to prevent tax avoidance by using companies or funds to hold high-value residential real estate.

The tax regime was first extended in 2016 to cover properties valued up to £500,000. Over time, the thresholds, bands, and reliefs have evolved. As of 2025:

-

the annual tax on enveloped dwellings applies to residential properties with a value above a certain threshold (currently £500,000 or more).

-

It applies only to dwellings held by companies, partnerships with a corporate partner, or CISs, not to individual private owners.

-

Owners must file annual tax returns (ATED returns) even if no tax is due (for example, if reliefs apply).

-

Reliefs and exemptions exist but must be actively claimed via relief declarations.

Because of the significant penalties for non-compliance, it’s critical to understand whether your property is subject to the annual tax on enveloped dwellings and take the correct steps before deadlines.

Key Deadlines & Compliance Pitfalls for the annual tax on enveloped dwellings

One of the largest risks when dealing with the annual tax on enveloped dwellings is missing filing or payment deadlines. Here are the essential compliance points:

Deadline for ATED Returns & Payments

For each chargeable period (which runs from 1 April to 31 March), the ATED return must be submitted, and any liability paid, by 30 April following the start of the period.

For example, for the 1 April 2024 – 31 March 2025 period, the return and payment deadline is 30 April 2025.

If a return is filed late or the payment is late, you can incur substantial penalties plus interest.

The Reference Number Trap

When you file an ATED return, HMRC will issue an ATED reference number. The catch: you cannot make a payment until you have that reference. HMRC may take several days to issue it, potentially delaying payment and risking late payment interest or penalties.

This lag is a classic trap for unwary taxpayers subject to the annual tax on enveloped dwellings, and one you should anticipate.

Valuation Reference Date & Revaluation

Originally, valuations for the annual tax on enveloped dwellings were tied to 1 April 2012 (or acquisition date if later). But to keep things relevant, HMRC occasionally allows or demands revaluations via banding checks or supplementary valuations.

If your property’s value is close to a threshold, you may request a Pre-Return Banding Check from HMRC (if within ±10% of a band). But HMRC may refuse to grant checks if you intend to claim reliefs that would reduce your liability to nil.

You must also keep proper valuations and documentation if HMRC challenges your declared valuation.

Who Is Caught by the annual tax on enveloped dwellings?

Not every property or ownership structure is subject to the annual tax on enveloped dwellings. You should check carefully whether your property falls under its scope.

Types of Dwelling

The property must be a “dwelling” (i.e. residential) — certain property types such as hotels, guesthouses, care homes, prisons, or military accommodation may be excluded.

Ownership Structure

the annual tax on enveloped dwellings only applies when the property is held by:

-

A limited company

-

A partnership where one or more partners are companies

-

A collective investment scheme (CIS)

It does not apply to individuals holding property directly in their own name.

Value Threshold

As of now, only properties with a value £500,000 or above (or that were valued over that threshold at the relevant valuation date) are within scope of the annual tax on enveloped dwellings.

If your property is below that, you may not need to make a return or pay tax — though you may still need to file a “nil return” in some cases.

Reliefs & Exemptions

Several reliefs exist (subject to conditions) which may reduce or eliminate an ATED liability for the annual tax on enveloped dwellings. Common reliefs include:

-

Letting relief (if property is let out on a commercial basis)

-

Property trading relief

-

Multiple dwellings relief

-

Disabled persons’ relief

-

Property which is not dwellings (as above)

You must file a relief claim with your ATED return; HMRC doesn’t automatically grant them.

Penalties, Interest & HMRC Challenge

Failure to comply with the annual tax on enveloped dwellings regime can trigger a cascade of financial risks:

-

Late filing penalties: Fixed penalties escalating over time

-

Late payment interest: Charged from the due date until actual payment

-

Additional assessments: HMRC may raise assessments if they dispute your valuation or relief claims

-

Surcharges: In some cases, additional penalties for careless or deliberate default

Additionally, if HMRC believes that a property was deliberately structured to avoid the annual tax on enveloped dwellings, they may pursue anti-avoidance or general anti-abuse rules (GAAR) arguments.

Given evolving HMRC practices, your valuation, relief claims, and compliance should be robust and documented.

Recent Updates & Rule Changes (2025) on annual tax on enveloped dwellings

To keep you up to date, here are some recent changes or developments in the realm of the annual tax on enveloped dwellings:

-

Thresholds and bands — While the standard threshold of £500,000 remains, HMRC continues to review inflation, and the valuation bands may be adjusted in future Budgets. Be aware of announcements around threshold changes.

-

Digital filing & HMRC changes — HMRC increasingly insists on digital (online) submission, with tighter validation checks and digital penalties.

-

Stricter valuation scrutiny — HMRC is more frequently challenging valuations, especially in markets with volatile pricing. Ensure you have independent professional valuations to support your declared band.

-

Enhanced anti-avoidance focus — HMRC is more vigilant about arrangements designed to circumvent the annual tax on enveloped dwellings, especially cross-border ownership, bare trusts, or intermediated structures.

-

Penalty regimes tightened — Recent HMRC updates have introduced steeper penalty rates and interest rates for late payment or late filing, particularly for non-resident or corporate taxpayers.

Because the rules are evolving, you should not assume that past practices always apply — always check the latest HMRC guidance or consult a specialist.

How Trueman Brown Can Help You with the annual tax on enveloped dwellings

Navigating the annual tax on enveloped dwellings can be complex, especially for non-resident landlords, corporate structures, or properties on the margin of thresholds. At Trueman Brown, we assist you in all aspects:

-

Assessing whether your property is subject to the annual tax on enveloped dwellings

-

Obtaining and reviewing valuations to support your ATED return

-

Preparing and submitting ATED returns and relief declarations

-

Managing communications and disputes with HMRC

-

Advising on structural changes to minimise exposure

-

Handling late compliance or historical disclosures

To discuss your specific situation, you can reach Mark at mark@truemanbrown.co.uk or call us on 01708 397262. We’ll provide tailored guidance and help you stay compliant with confidence.

Frequently Asked Questions about the annual tax on enveloped dwellings

Q1: Do I always have to pay even if my property is valued below the threshold?

A1: No. If your property is valued below the relevant threshold (currently £500,000) you generally won’t owe tax. However, you may still need to submit a “nil” ATED return in some cases, especially if your ownership falls within scope.

Q2: Can I reduce or avoid the annual tax on enveloped dwellings via reliefs?

A2: Yes — there are several reliefs (letting relief, multiple dwellings relief, trading relief etc.), but they must be claimed on your ATED return. Make sure you satisfy all conditions and maintain evidence, since HMRC may challenge them.

Q3: What happens if I miss the 30 April deadline for returns or payment?

A3: You risk fixed penalties, interest charges, and additional assessments. Also, failure to file or pay could lead to more serious penalties if HMRC deems the failure to be careless or deliberate.

Q4: Can HMRC challenge my valuation?

A4: Yes. HMRC frequently scrutinises valuation evidence, particularly in volatile markets or where your valuation is near a band edge. It’s crucial to retain a professional valuation report and documentation.

Q5: What if I acquired the property after 1 April 2012?

A5: In that case, the relevant valuation date is typically the acquisition date (or a date agreed with HMRC) rather than 1 April 2012. Always check with a specialist to determine the correct base valuation.

Q6: Does the annual tax on enveloped dwellings apply to individuals or personal ownership?

A6: No. It only applies when the property is owned by a company, partnership with a corporate partner, or a CIS. Individual private owners are not caught by ATED.

Q7: How often must I re-evaluate or re-submit entries?

A7: You must submit or re-submit an ATED return each year by 30 April. If ownership, valuation, or relief eligibility changes, you must reflect that in your next return. You may also request a banding check if your valuation is close to thresholds.

Q8: Can you help me with a late or historic ATED return?

A8: Absolutely. At Trueman Brown, we offer support with late filings, disclosures, remediation, and liaising with HMRC to regularise your standing under the annual tax on enveloped dwellings.

If you’d like help with your specific property or situation, or want us to prepare a tailored compliance plan, just contact Mark at mark@truemanbrown.co.uk or call 01708 397262.