Our guide to employers about auto-enrolment

Employers are now expected to understand and act on auto-enrolment responsibilities from the very first employee they hire.

This guide explains what auto-enrolment means, who it applies to, the key steps you need to take and how you can stay compliant.

At Trueman Brown we help local employers through every stage of the process.

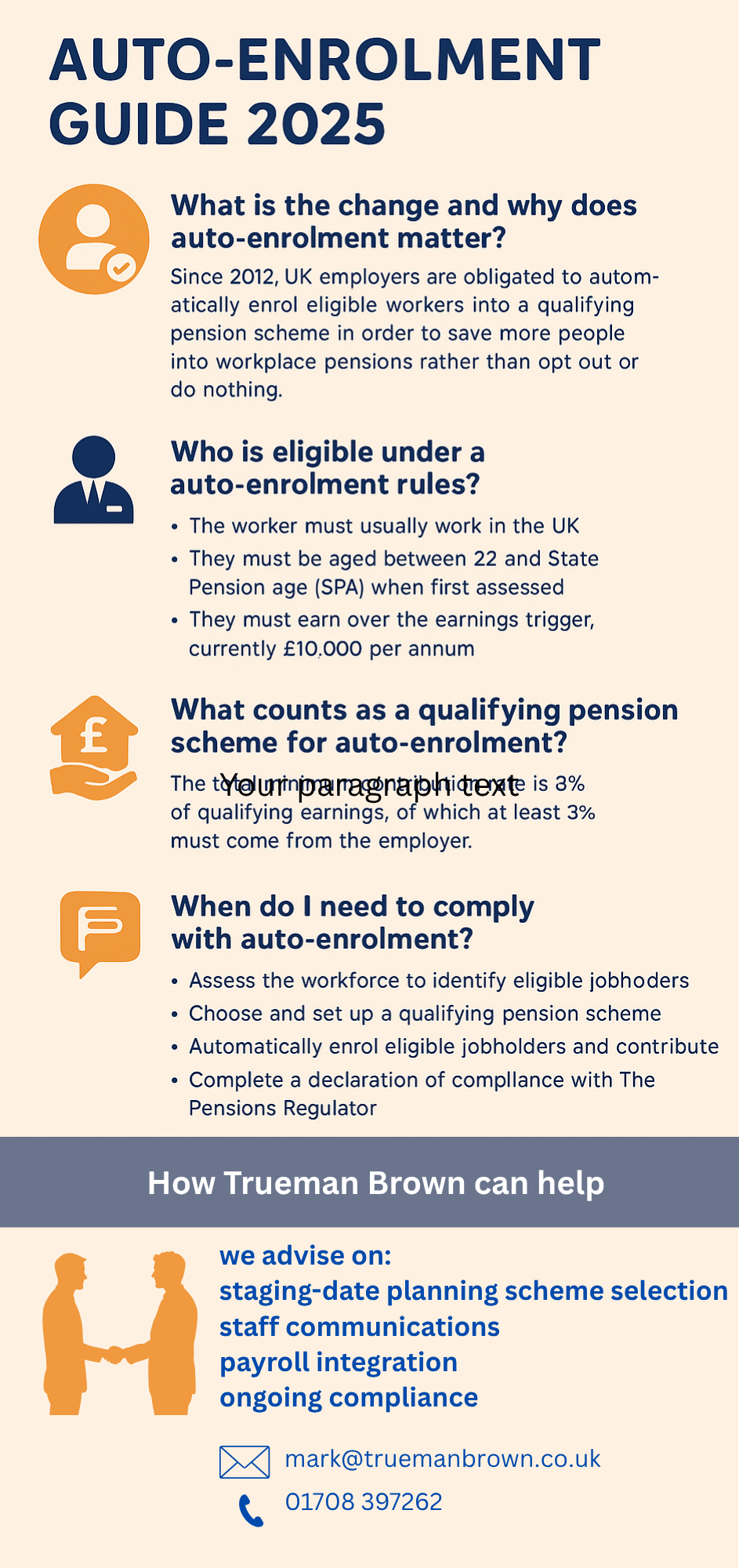

What is the change and why does it matter?

From 2012 onwards the UK introduced the obligation for employers to automatically enrol eligible workers into a qualifying pension scheme.

The idea is to shift the default so more people save into a workplace pension rather than opt out or do nothing.

Who is eligible under auto-enrolment rules?

Under the current rules:

-

The worker must usually work in the UK.

-

They must be aged between 22 and State Pension age (SPA) when first assessed.

-

They must earn over the earnings trigger, currently £10,000 per annum.

If those criteria are not met, the worker can still join a pension scheme, but the employer may not be obliged to enrol them under auto-enrolment duty.

What counts as qualifying pension scheme?

To meet your duties you must select a “qualifying pension scheme” — one that meets the minimum standard set by regulation.

You can use your existing scheme if it meets the test, or use a default such as the National Employment Savings Trust (NEST) scheme.

What contributions are required under auto-enrolment?

Under the current regime:

-

The contribution is calculated on “qualifying earnings” (for 2025/26, between £6,240 and £50,270).

-

The total minimum contribution rate is 8% of those qualifying earnings, of which at least 3% must come from the employer

The employee covers the balance (typically 5%, which includes tax relief)

While this rate has applied since 6 April 2019, employers should monitor for review because changes have been proposed.

When do I need to comply with auto-enrolment?

If you are a new employer (or you have not yet assessed your staging date) your duty under auto-enrolment begins when the first employee reaches your “duties start date”.

You must:

-

Assess your workforce to identify eligible jobholders.

-

Choose and set up a qualifying pension scheme.

-

Automatically enrol eligible jobholders and contribute.

-

Write to them and tell them how auto-enrolment affects them.

-

Complete a declaration of compliance with The Pensions Regulator.

If you miss your start date you should still take action immediately — late compliance may lead to penalties.

How do I assess my workforce for auto-enrolment?

You should go through a checklist of the following under auto-enrolment:

-

Identify staff aged between 22 and SPA.

-

Identify those earning over the trigger.

-

Determine whether the staff member is already in a qualifying pension.

-

Choose whether to apply “postponement” (you can delay enrolling a worker for up to 3 months if certain conditions apply).

-

For those who qualify, process their enrolment and ensure you pay contributions.

Communicating with staff under auto-enrolment

As part of your auto-enrolment duties you must write to all eligible jobholders (and those you choose not to enrol) explaining:

-

The date they were enrolled.

-

The pension scheme in question.

-

How much they and you will contribute.

-

How to opt out, if they wish.

You must not pressure or influence staff to opt out — the option to “choose out” must be freely given.

Paying contributions and paperwork for auto-enrolment

Once you’ve enrolled staff under auto-enrolment, you must:

-

Deduct contributions from salary, add the employer contribution.

-

Pay contributions to the pension scheme by the deadline (no later than the 22nd of the next month, or 19th if by cheque).

-

Maintain records of who you enrolled, when, contributions etc.

Failure to comply can lead to fines or enforcement by the Pensions Regulator.

What future changes might affect auto-enrolment?

While the current rules have been stable for some time, there are active discussions and powers under the Pensions (Extension of Automatic Enrolment) Act 2023 that allow for reforms to the auto-enrolment regime — for example: lowering the age threshold from 22 to 18, or removing the lower earnings limit so contributions might apply from the first pound earned.

Although no firm timetable has been announced, employers should be aware of potential changes and plan accordingly.

How Trueman Brown can help with your auto-enrolment preparations

If the task of setting up and managing your auto-enrolment duties feels daunting, we can help.

At Trueman Brown we advise on: staging-date planning, scheme selection, staff communications, payroll integration and ongoing compliance.

For expert support with auto-enrolment, send an email to mark@truemanbrown.co.uk or call 01708 397262 and we’ll happily guide you through the process.

Let us help you put strong pension processes in place so you stay compliant and give your employees the reassurance of a quality workplace pension.

FAQ – Auto-enrolment: Frequently Asked Questions

Q: Can I delay enrolling some staff under auto-enrolment?

A: Yes — you can use “postponement” for up to three months for certain employees (for example new starters). But you still must assess them and choose whether postponement applies.

Q: Does auto-enrolment apply to someone aged under 22?

A: Not for the main duty. The current rules apply to those aged 22 and over up to State Pension age. However changes are proposed to reduce the age to 18.

Q: What happens if my employee opts out?

A: You must still enrol them first under your auto-enrolment duty. They can opt out (within one calendar month) and receive a refund of their contributions (subject to scheme rules). You must re-enrol eligible jobholders every three years.

Q: What’s the minimum contribution rate under auto-enrolment?

A: For 2025/26 the minimum contribution is 8% of qualifying earnings, with a minimum employer contribution of 3%.

Q: What if I don’t comply with auto-enrolment?

A: The The Pensions Regulator can impose penalties including fines and enforcement notices. It’s important to stay on schedule and keep accurate records.

Q: Can I choose to contribute more than the minimum under auto-enrolment?

A: Yes — many employers offer higher contributions or match employee contributions above the minimum, but the minimum duty remains the legal floor.