Your Definitive Guide to capital allowances

If your business invests in assets or equipment, understanding capital allowances is essential.

Capital allowances allow you to claim tax relief on certain capital expenditure, rather than treating the full cost as an immediate expense.

This guide from Trueman Brown walks you through how capital allowances work, what’s eligible, recent changes, and how we can help you make the most of your claims.

What are capital allowances?

When you purchase an asset for your business — such as machinery, equipment, or integral features of a building — you can often deduct the full cost immediately from your taxable profits.

Instead, capital allowances let you claim tax relief over time, or sometimes immediately under certain reliefs.

The capital allowances regime is essentially the way HMRC replaces accounting depreciation for tax purposes.

If your business uses the cash basis for tax, there are limitations: generally you cannot claim capital allowances under the cash basis (though there are exceptions for cars).

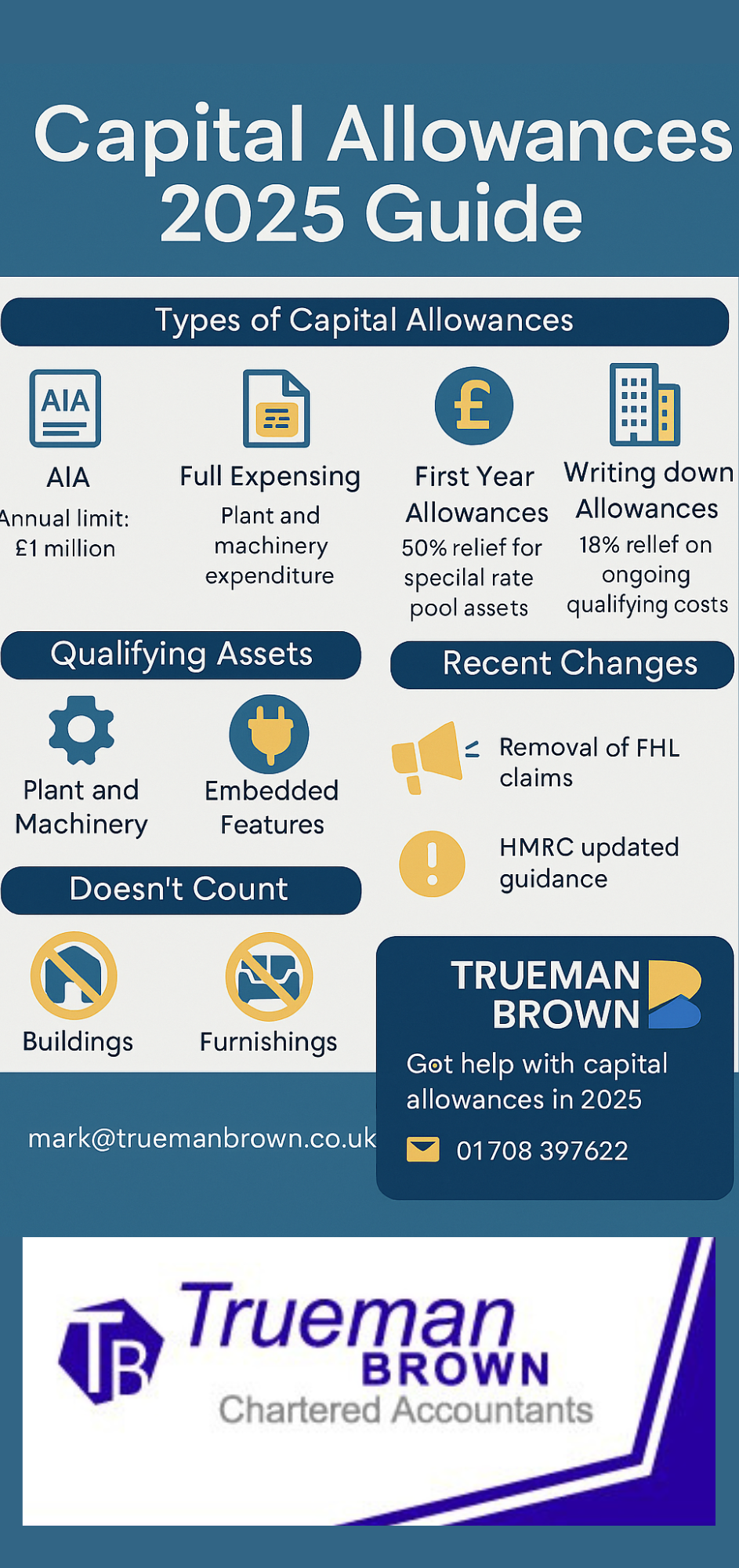

Key types of capital allowances

Annual Investment Allowance (AIA) – full relief for many assets

Currently, the AIA limit is £1 million per year (from 1 January 2019 onward).

You can’t claim AIA on cars (except in limited circumstances), or on assets you already owned before using them in the business.

Full expensing and first-year capital allowances

One of the most significant recent changes is that the government has made full expensing permanent.

This means that for qualifying expenditure on “main rate” plant and machinery, you can claim 100 % relief in the year of purchase as a capital allowance.

For special rate assets — such as integral features (heating, ventilation, lifts, etc.) and some long-life assets — there is a 50 % first year allowance (FYA). The remaining balance then goes into the special rate pool and is written down annually (typically at 6 %) under capital allowances rules.

Note: HMRC recently updated its guidance on what counts as “unused and not second-hand” for the purposes of first year allowances.

If you combine new and used parts in creating an asset, only the new and unused part may qualify for the 100 % or 50 % relief.

Writing down allowances (WDA)

If an asset does not qualify for full expensing, AIA, or FYA, or part of the cost remains after those allowances, you can claim writing down allowances (WDA).

These allow you to claim a percentage of the remaining value each year.

For most plant and machinery in the main pool, the rate is 18 %.

For special rate pool assets (integral features, long-life assets), the rate is 6 %.

Structures & Buildings Allowance (SBA) and embedded capital allowances

While you generally cannot claim for the building itself, the Structures and Buildings Allowance (SBA) lets you claim relief on new non-residential structures at 3 % per year under current rules.

Additionally, embedded capital allowances (i.e. fixtures and integral features within a building — such as HVAC, lighting, lifts, wiring, etc.) may be claimed under capital allowances, rather than being treated as part of the building cost.

Other special capital allowances

Other reliefs exist for specific purposes, such as research and development capital allowances (RDCAs) which permit 100 % capital allowance for qualifying R&D capital expenditure.

Also, land remediation relief may allow additional relief when cleaning up contaminated land, sometimes up to 150 % of qualifying costs.

Some “freeport” or “investment zone” special tax sites receive enhanced capital and structure allowances for expenditure incurred in those zones, subject to sunset dates.

What assets or items qualify for capital allowances?

Plant and machinery

Most capital allowances claims fall under plant and machinery. This includes a wide range of business assets: machinery, equipment, computer systems, furniture, tools, vehicles (in certain cases) and integral building features (if eligible).

“Machinery” typically means anything with moving parts (even locking mechanisms). “Plant” refers to equipment used in the trade. Whether something counts as “plant” rather than part of the building can be a delicate judgment.

Integral features or embedded items

Certain parts of a building (e.g. heating, ventilation, lifts, fire alarm, wiring) may qualify via embedded or integral feature capital allowances rather than SDA.

Buildings and structures

You cannot claim capital allowances on the fabric of an industrial or agricultural building itself, but you can for new non-residential structure costs under SBA at 3 % per annum.

Cars, vans and vehicles

Cars are subject to special rules. Only new, unused cars with ultra-low emissions may qualify for a 100 % first year allowance under some rules (e.g. zero emissions) — but this is restricted and phased down in many cases.

For higher emission cars, they fall into the main or special pool and are subject to the normal writing down allowances.

Vans and lorries (commercial vehicles) are generally eligible for AIA or full expensing as plant & machinery, subject to conditions.

Note: there was a recent decision to reverse guidance changes on double cab pick-ups; prior guidance had attempted to treat them differently.

Furnished holiday lets (FHL) — a closing window

If you operate furnished holiday lets (FHLs), it’s important to act before 5 April 2025. From that date, new expenditure in FHLs will no longer qualify for capital allowances, although existing pools remain and writing down allowances will continue.

So if you have a furnished holiday let, review your capital expenditure plans now to ensure you claim all eligible capital allowances before the regime changes.

How to calculate entitlement to capital allowances

Pooling and writing down

Assets are normally grouped into either the main pool or a special rate pool. The main pool is written down at 18 %, and the special rate pool at 6 %, on a reducing balance basis.

Some assets (e.g. long-life assets, or integral features) must be placed in the special rate pool. Short-life assets may be elected out of the pool or treated separately, especially to benefit on disposals.

If a pool’s remaining balance falls below £1,000, you may write it off completely rather than diseconomically carry it onward.

Matching expenditure to relief types

You should first apply AIA or full expensing (or FYA) to the qualifying part of your expenditure, and then allocate any remaining balance into pools for writing down allowances. This maximises relief.

Timing and bringing expenditure forward

Because corporation tax rates or allowances may change, bringing forward or delaying capital expenditure can affect the value of capital allowances relief.

For example, claiming £100,000 capital allowance is worth more at, say, 25 % than at 19 %.

You do not have to claim the full allowance in a year; you can claim less to preserve headroom in later years if profits are low.

Disposals, balancing allowances and charges

When you dispose of an asset or your business ends, the written down value may give rise to a balancing allowance (if value is lower) or balancing charge (if higher than expected).

If an asset was elected out of a pool or treated as a single asset pool, special rules apply.

Section 198 elections on property transactions

When buying or selling a commercial property, you must properly allocate (via a Section 198 election) which embedded capital allowances are passed to the buyer or retained by the seller — usually within two years of completion. Failure to do so may forfeit capital allowances.

Recent updates to capital allowances rules

-

In 2025, HMRC published amendments clarifying the capital allowances manual, including updates on how computer software is treated, and clarifying meaning of “new and unused” expenditure for first year allowances.

-

Full expensing was made permanent, rather than a temporary measure.

-

Spring 2025 confirmed continuation of the £1 million AIA, and reaffirmed certain 100 % and 50 % reliefs for qualifying assets.

-

HMRC updated guidance in June 2025 particularly on mixing used and new parts in an asset for first year allowances.

-

Some uncertainty remains around interpretation of “plant,” leasing rules, and contributions to expenditure, which HMRC continues to review.

-

The special rules for FHL capital allowances are being phased out — affecting claims from 5 April 2025 as noted above.

It’s crucial to stay on top of changes, since mis-application can lead to lost relief or HMRC challenges.

How Trueman Brown can help you with capital allowances

Navigating the capital allowances rules can be complex, and missing opportunities can cost you substantial tax relief. At Trueman Brown, we specialise in maximising capital allowances claims for local businesses. Here’s how we can assist:

-

Conduct detailed capital allowance reviews and surveys to identify qualifying assets

-

Advise on structuring expenditure to take advantage of AIA, full expensing, and first year allowances

-

Help with embedded/ integral feature allocations within property costs

-

Prepare and file the necessary elections (e.g. Section 198) and ensure deadlines are met

-

Handle disposals and balancing charges correctly

-

Monitor HMRC guidance updates to adjust your strategy

If you’d like to discuss how capital allowances might help your business, drop us a line:

Mark@truemanbrown.co.uk

01708 397262

We’ll be happy to review your current and planned capital expenditure and help you secure the maximum relief.

Frequently Asked Questions (FAQ)

Q: What is the difference between capital allowances and ordinary expenses?

A: Ordinary expenses are costs you can deduct in full in the year they are incurred (e.g. office supplies). Capital allowances apply to longer-lasting business assets, allowing tax relief over time (or sometimes immediately via first year reliefs).

Q: Can I claim capital allowances retrospectively?

A: Yes — you can typically claim capital allowances going back several years provided the asset is still owned and in use by your business, and you have the evidence. HMRC’s help-sheet HS252 provides guidance.

Q: Do all types of businesses qualify?

A: Yes — sole traders, partnerships, limited companies, landlords (in certain cases) may claim capital allowances, provided the expenditure qualifies.

Q: Why can’t I claim capital allowances under the cash basis?

A: In most cases, if you use the cash basis for profits, you cannot also claim capital allowances. There is a narrow exception for cars under the cash basis rules.

Q: What happens when I sell an asset?

A: When you dispose of an asset, you may face a balancing charge (if the sale proceeds exceed the tax written down value) or receive a balancing allowance (if proceeds are less). The asset’s pool allocation and election choices impact this.

Q: How does the FHL rule change affect me?

A: From 5 April 2025 (for unincorporated businesses) and 31 March 2025 (for corporate FHLs), new capital allowances claims for furnished holiday lets will no longer be allowed — although existing pools may continue to be written down.

Q: Can I claim for assets imported or leased?

A: Yes in many cases, though leasehold arrangements and contributions to expenditure have special rules. HMRC continues to clarify these in updated guidance.

If you have further questions or would like us to examine your assets and future plans, just email mark@truemanbrown.co.uk or call 01708 397262.