Introduction: The Benefits of Spouse Wages in 2025–26

In the 2025–26 tax year, employing your spouse within your business can be a strategic move to optimise tax efficiency.

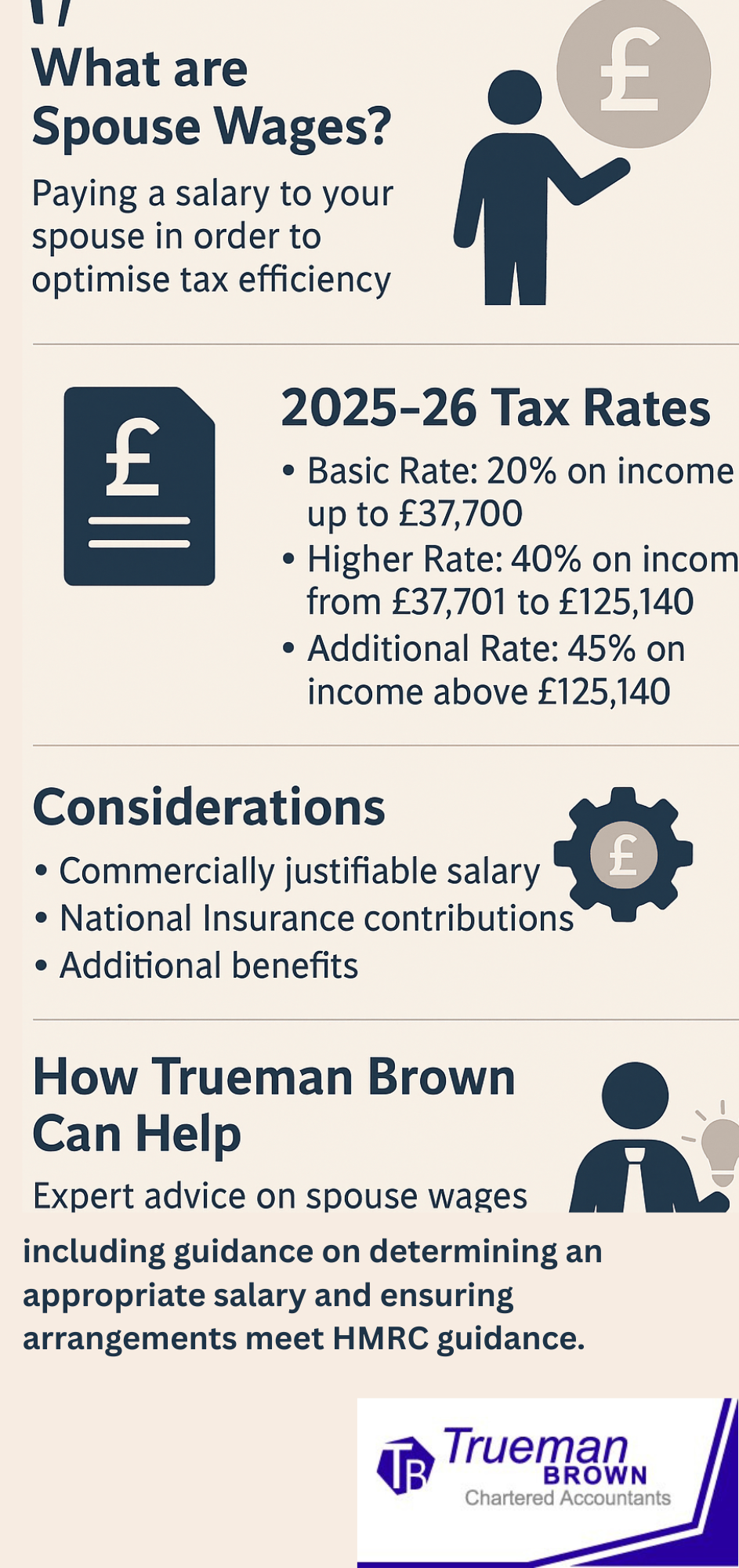

By paying a salary that utilises their personal allowance and potentially places them in a lower tax bracket, you can achieve significant tax savings. This approach, known as “spouse wages,” involves remunerating your spouse for their work in the business, thereby redistributing income in a tax-efficient manner.

Understanding the 2025–26 Tax Rates and Personal Allowance

For the 2025–26 tax year, the standard personal allowance remains at £12,570. Income above this threshold is taxed at the following rates:

-

Basic Rate: 20% on income up to £37,700

-

Higher Rate: 40% on income from £37,701 to £125,140

-

Additional Rate: 45% on income above £125,140

It’s important to note that for every £2 earned over £100,000, the personal allowance is reduced by £1, effectively eliminating the personal allowance for incomes over £125,140.

Structuring Spouse Wages: Key Considerations

1. Determining a Commercially Justifiable Salary

The salary paid to your spouse should reflect the market rate for the work performed. This ensures compliance with tax regulations and justifies the expense as a legitimate business cost. For the 2025–26 tax year, a salary that utilises the full personal allowance without exceeding the basic rate threshold is optimal.

2. National Insurance Contributions

For the 2025–26 tax year, the primary threshold for National Insurance contributions is £242 per week (£12,570 annually).

Earnings above this threshold are subject to employee National Insurance at 8% up to the upper earnings limit of £967 per week, and 2% on earnings above this limit.

Employing your spouse at a salary that aligns with these thresholds can help manage National Insurance liabilities effectively.

Additional Benefits of Employing Your Spouse

-

Pension Contributions: Contributing to a pension scheme for your spouse can provide tax relief and enhance retirement savings.

-

Marriage Allowance: If your spouse has unused personal allowance, they can transfer up to £1,260 to you, reducing your tax liability. House of Commons Library

-

Income Splitting: By distributing income through spouse wages, you can potentially reduce the overall tax burden for your household.

How Trueman Brown Can Assist

At Trueman Brown, we specialise in providing tailored tax strategies for small business owners.

Our team can help you navigate the complexities of employing your spouse, ensuring compliance with current tax laws and maximising potential tax savings. We offer:

-

Salary Structuring Advice: Guidance on determining an appropriate salary for your spouse.

-

Tax Planning: Strategies to optimise tax efficiency through spouse wages.

-

Compliance Assurance: Ensuring all arrangements meet HMRC requirements.

Contact Trueman Brown today to learn how employing your spouse can benefit your business and personal finances.

Frequently Asked Questions

Q1: Can I pay my spouse a salary below the National Minimum Wage?

No, the salary must be at least equal to the National Minimum Wage for the work performed.

Q2: What if my spouse doesn’t have any income?

Even without other income, your spouse can still utilise their personal allowance through the Marriage Allowance.

Q3: Are there any restrictions on the type of work my spouse can do?

Your spouse should perform genuine work for the business, and records should be kept to substantiate this.

Q4: How does employing my spouse affect my business’s tax position?

Paying a salary to your spouse can reduce the business’s taxable profits, leading to potential tax savings.

Q5: Can I make pension contributions for my spouse?

Yes, pension contributions for your spouse can be a tax-efficient way to save for retirement.