New Employers: Beware the Auto-Enrolment Trap

New employers face a critical compliance hurdle from the moment they hire their first worker—automatic enrolment into a workplace pension scheme.

Since the 2017 rule change, The Pensions Regulator has taken a firm stance on enforcement, and overlooking these duties can lead to costly penalties.

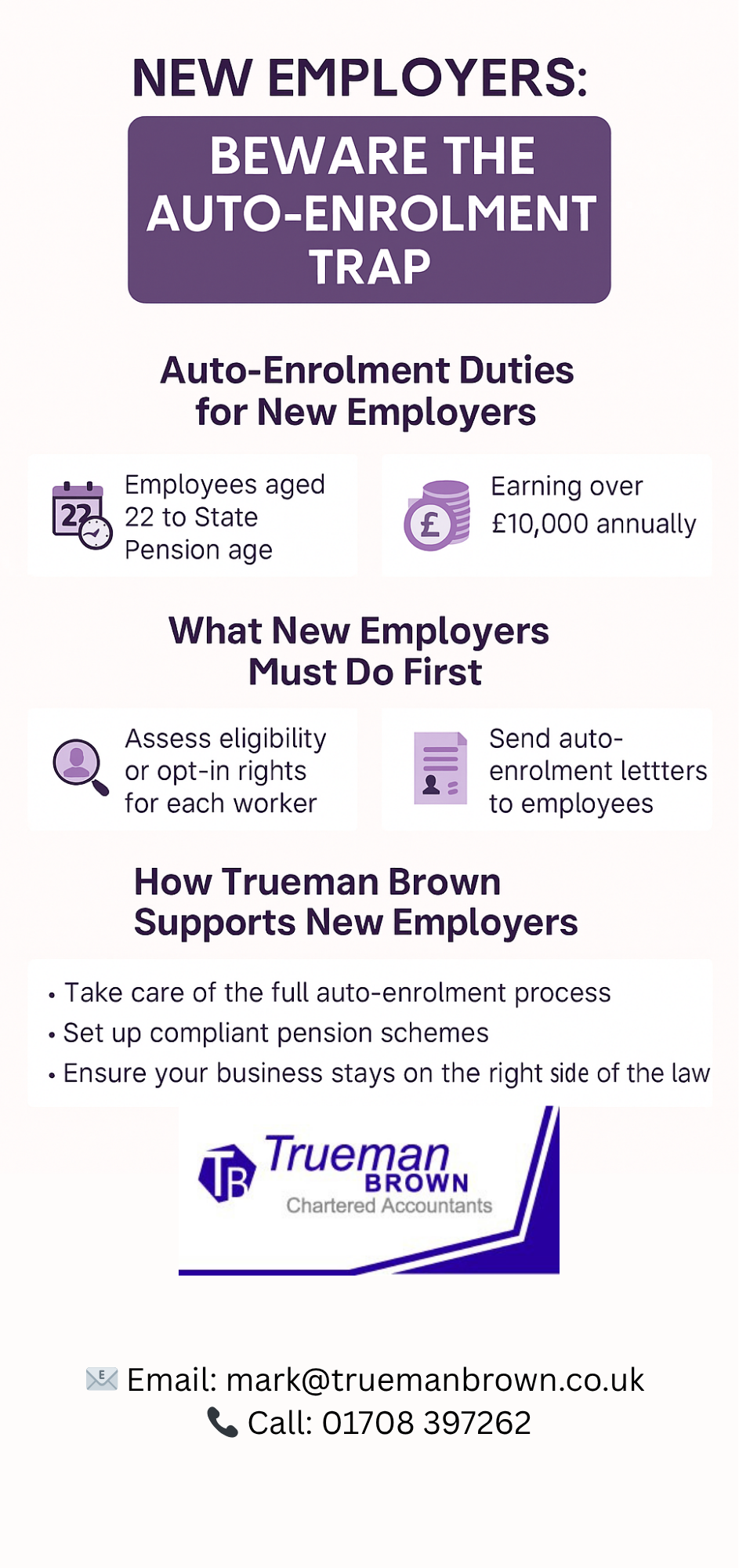

Auto-Enrolment Duties for New Employers

From the day a new employer takes on staff, they’re subject to workplace pension obligations.

If any employee is:Aged between 22 and State Pension age Earning over £10,000 annually (£833 monthly or £192 weekly)…they must be automatically enrolled into a qualifying pension scheme unless they opt out.

Even if no employees meet the auto-enrolment threshold, new employers may still have duties.

Staff earning below the threshold can request to opt in, triggering the need to set up a scheme.

Director-Only Companies

Director-only companies are exempt from auto-enrolment :

- There’s more than one director and at least one has a contract of employment

- A non-director employee is hired

- Once a new employee joins, the company is treated as a new employer and must comply immediately.

What New Employers Must Do First

New employers should:

- Assess all workers for eligibility or opt-in rights

- Send each employee a letter outlining their auto-enrolment status and rights

Trueman Brown offers ready-to-use letter templates to simplify this process.

Non-Compliance: A Costly Mistake for New Employers

The Pensions Regulator has ramped up enforcement. Failing to comply can result in:

- Fixed penalties of £400

- Escalating daily fines based on staff count

New employers must act promptly to avoid these financial and reputational risks

How Trueman Brown Supports New Employers

At Trueman Brown, we guide new employers through every step of the auto-enrolment process.

From assessing eligibility to setting up compliant pension schemes, we ensure your business stays on the right side of the law.

📧 Email: 📞 Call: 01708 397262

FAQs for New Employers

Q: Do I need to auto-enrol part-time staff?

A: Yes, if they meet the age and earnings criteria.

Q: What if my employee opts out?

A: You must still set up the scheme and keep records of their decision.

Q: Can I postpone auto-enrolment?

A: Postponement is allowed for up to three months, but you must notify employees in writing.

Q: What happens if I miss my duties?

A: The Pensions Regulator may issue fines and take enforcement action.

Q: Is there software to help manage auto-enrolment?

A: Yes, Trueman Brown can recommend and help implement payroll solutions that automate compliance.