Trueman Brown, your trusted local accountants and tax advisers, are here to guide you through the nuanced landscape of inheritance tax implications, especially when it comes to monetary wedding gifts.

The traditional wedding registry may be taking a backseat as couples consider the advantages of receiving cash gifts, and we’re here to shed light on the tax implications.

According to the Institute of Chartered Accountants in England & Wales (ICAEW), cash gifts can be an excellent way to sidestep inheritance tax, provided certain conditions are met.

For the exemption, the couple must have a UK residence, and the gift must be given on or before the wedding day.

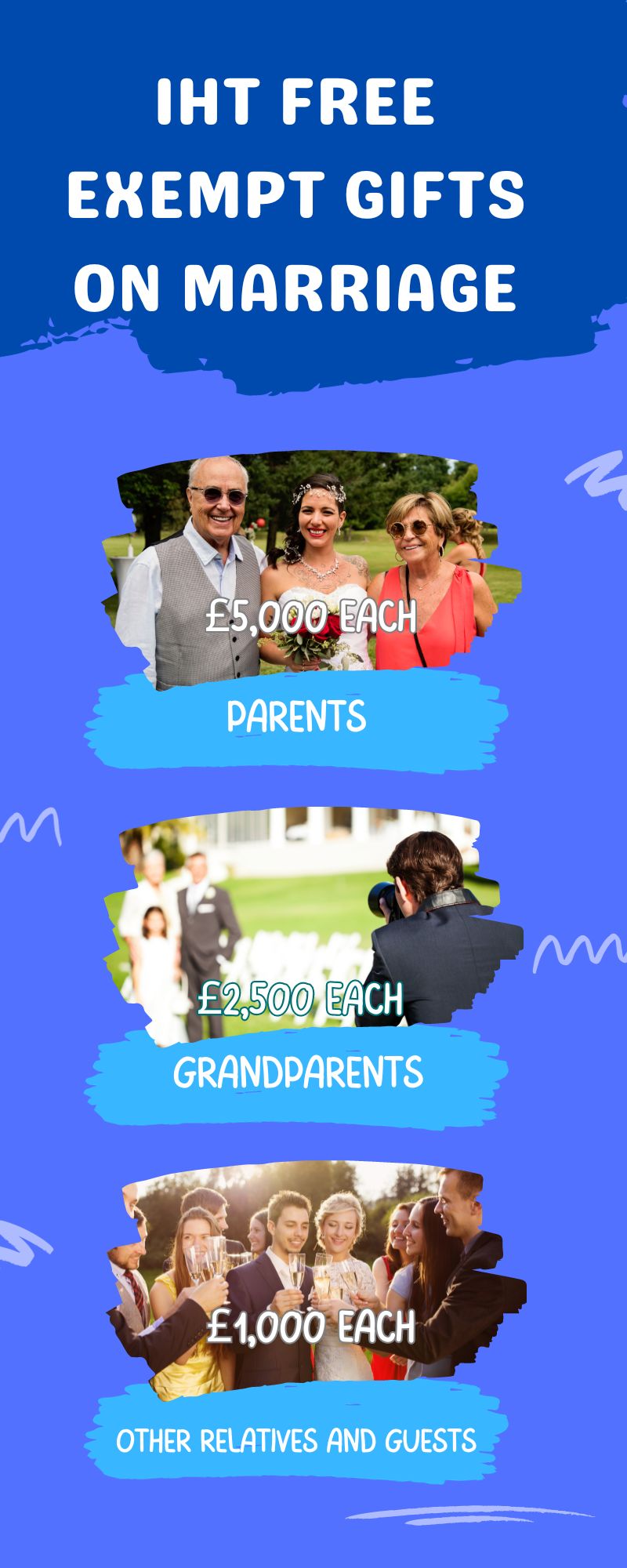

The amount exempt from inheritance tax varies based on the giver’s relationship with the couple.

Parents can generously gift up to £5,000 IHT free, grandparents up to £2,500, and other relatives and friends up to £1,000 IHT free each.