Avoiding Common VAT Errors on Mileage Allowance Claims

Many businesses overlook opportunities when dealing with mileage allowance — in particular, reclaiming the VAT on employee mileage claims.

If you reimburse employees for business travel using their own vehicles, understanding how to structure and document your mileage allowance claims properly is critical to avoid HMRC penalties or lost input tax relief.

In this article we’ll explore common mistakes in mileage allowance VAT claims, updated rules you need to watch, and how to ensure your claims are robust and defensible.

Why Mileage Allowance VAT Claims Are Tricky

The full rate you pay per mile includes fuel, depreciation, insurance, repairs, and wear and tear, but only the fuel portion can attract VAT that the business may reclaim (if properly documented).

Another complicating factor is the interaction with the VAT road fuel scale charge (especially after the changes from 1 May 2025). If you reimburse fuel costs or claim input tax on fuel used for vehicles with private use, you may be required to pay output tax via the scale charge.

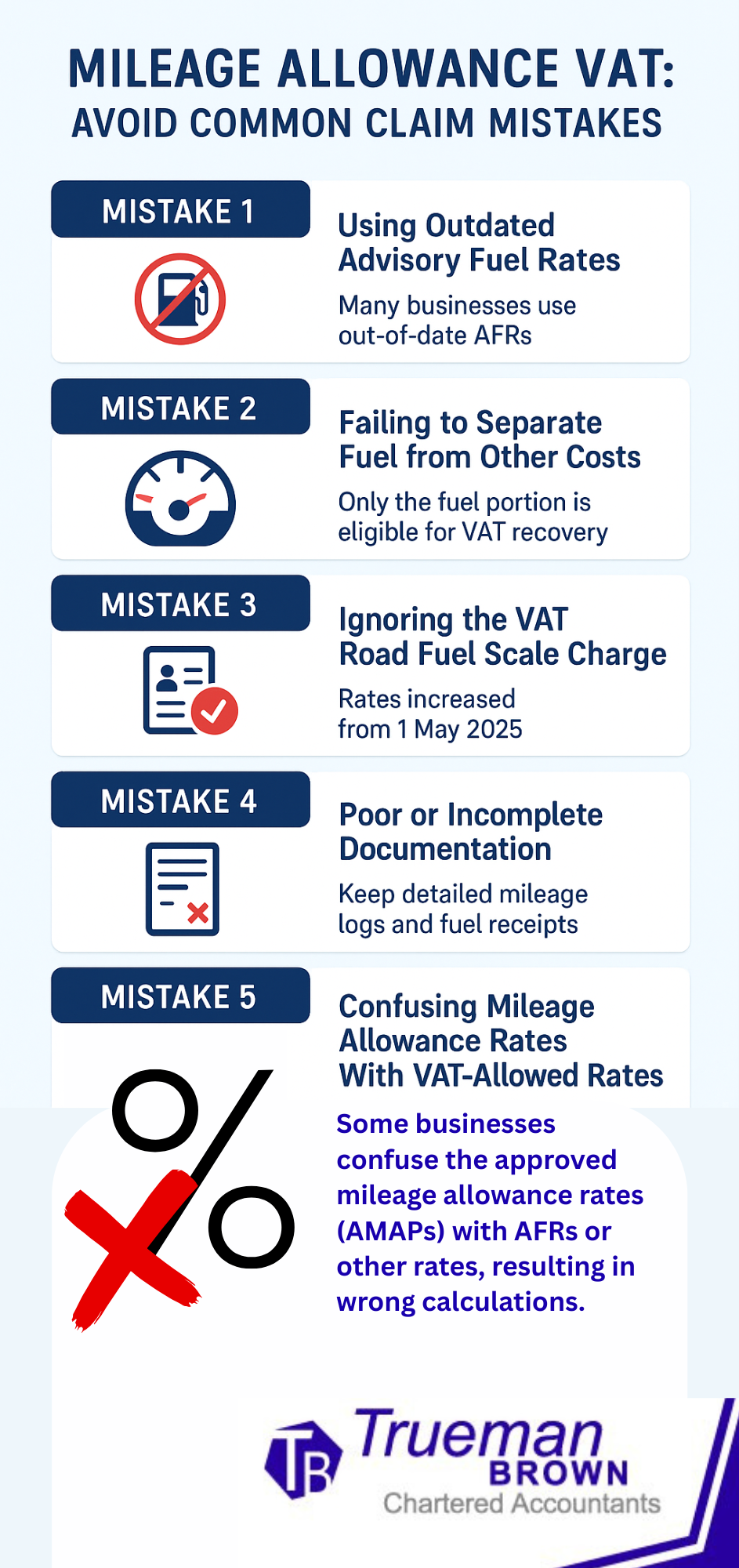

Failing to keep adequate records, using outdated advisory fuel rates (AFRs), or mixing up allowance rates and fuel rates are among the top mistakes that result in under- or over-claiming on mileage allowance.

Below we outline key common errors and how to avoid them.

Mistake 1: Using Outdated Advisory Fuel Rates in Mileage Allowance Reclaims

When reclaiming VAT on mileage allowance, many businesses use out-of-date AFRs.

But HMRC updates these rates quarterly (March, June, September, December) to reflect changing fuel costs.

If you use a stale AFR, you might under-reclaim (losing money) or over-claim (risking HMRC challenges). Always check the latest AFR relevant to each employee’s vehicle.

Mistake 2: Failing to Separate Fuel from Other Costs

Another frequent error is treating the entire mileage allowance rate as if it were fuel cost. As noted, only the fuel component is eligible for VAT recovery.

You must split the mileage rate into fuel and non-fuel elements, and then only reclaim VAT on the fuel portion (using AFR). For example, if AFR = 14p/mile for a given vehicle, and you pay a 45p/mile allowance, the 14p element is the fuel part (and only that part attracts input tax).

Mistake 3: Ignoring the VAT Road Fuel Scale Charge in Mileage Allowance Claims

Since 1 May 2025, the VAT road fuel scale charge rates have increased. MHA The scale charge applies when a business recovers input VAT on fuels used for vehicles that are used for private purposes.

If you reclaim VAT on fuel via your mileage allowance scheme without ensuring the private use element is accounted for, you could be required to pay output tax under the scale charge mechanism.

There are two main ways to handle this:

-

Use the fuel scale charge: reclaim full fuel VAT and pay output tax via the scale charge.

-

Track and apportion business vs private mileage in detail, then reclaim just the business portion of fuel VAT (and avoid using scale charge).

You must be consistent in your approach across your accounting period.

Mistake 4: Poor or Incomplete Mileage Documentation

One of the easiest ways to be challenged by HMRC is to have weak documentation. With mileage allowance claims, ensure you capture:

-

Date of journey

-

Start and end locations

-

Purpose of the journey (business reason)

-

Miles driven

-

Vehicle type (make, model, engine size)

-

Fuel receipts (VAT invoices)

-

The AFR used and calculation method

Without those details, you will struggle to justify your mileage allowance VAT claim in a compliance review.

Also, carefully record any instance where employees carry passengers (you may be able to include a 5p/mile extra for each passenger, which affects your overall mileage allowance claim).

Mistake 5: Confusing Mileage Allowance Rates With VAT-Allowed Rates

Some businesses confuse the approved mileage allowance rates (AMAPs) with AFRs or other rates, resulting in wrong calculations. The AMAP (mileage allowance) covers all vehicle costs (fuel + non-fuel). AFR is only the fuel part.

Also, the allowable rate for mileage allowance in 2025/26 remains unchanged at 45p for the first 10,000 business miles and 25p thereafter (for cars and vans), and 24p for motorcycles, 20p for bicycles.

If you misapply these rates (for example using a lower rate than HMRC, or mixing up the over-10,000 rate), your mileage allowance claim could be under-paid or challenged.

How to Calculate Correct VAT on Mileage Allowance

Here’s a simplified outline of a compliant process:

-

Determine total business miles driven by an employee in the year (split between first 10,000 and beyond).

-

Apply the mileage allowance rate (AMAPs): e.g. 10,000 × 45p + (excess miles × 25p).

-

Isolate the fuel portion by using AFR (advisory fuel rate) for that vehicle. For instance, if the AFR is 14p/mile, and you did 1,000 business miles, fuel component = 1,000 × 14p = £140.

-

Compute input tax on the fuel portion: divide the fuel amount by 6 (i.e. 20 % VAT fraction) → £140 / 6 = £23.33. That is the VAT you may reclaim.

-

Reconcile the allowable reclaim with your records, and either apply scale charges if appropriate, or exclude private-use proportion.

-

Record all workings and supporting evidence, as HMRC may request them.

If your fuel scale charge (after 1 May 2025) makes output tax liability more than the benefit from reclaiming fuel VAT, you may decide not to reclaim fuel VAT; in that case, you don’t need to apply scale charges either.

Updated Rule: VAT Fuel Scale Charge from 1 May 2025 & Impact on Mileage Allowance

As of 1 May 2025, VAT road fuel scale charge rates increase. Consequently, businesses using the fuel scale charge method must apply the new rates from the start of the VAT accounting period that begins on or after 1 May 2025.

For vehicles with substantial private use, the scale charge may reduce or eliminate the benefit of reclaiming VAT via mileage allowance claims. If the output tax due on the scale charge exceeds your input VAT reclaim, it might not be worthwhile.

So, for 2025 onward, you should:

-

Review whether using the fuel scale charge is still optimal

-

Consider more precise apportionment of business vs private use instead of relying on scale

-

Ensure your accounting software or VAT systems reflect the new scale rate schedule

Why Many Businesses Fail to Claim Mileage Allowance VAT Correctly

-

Lack of understanding about splitting fuel vs non-fuel elements

-

Failure to use up-to-date AFRs

-

Weak documentation or missing receipts

-

Ignoring the scale charge implications

-

Inconsistent application of method across years

-

Confusing allowance rates vs fuel rates

Because HMRC often scrutinises motoring and travel expenses, errors in mileage allowance VAT claims are a frequent trigger for enquiries. A robust process and accurate recordkeeping can protect you.

How Trueman Brown Can Help You

At Trueman Brown, we regularly assist businesses with optimising their mileage allowance arrangements and ensuring their VAT reclaim is compliant and maximised.

If you’re uncertain whether your current approach is correct, or you want to revisit past claims, we can:

-

Review your existing mileage allowance policy and calculations

-

Check whether your use of AFRs is up to date

-

Assess whether using the fuel scale charge is appropriate for your vehicle mix

-

Help you document and support claims to resist HMRC challenge

-

Advise on whether retrospective adjustments should be made

To discuss your situation, reach out to us at mark@truemanbrown.co.uk or call 01708 397262. We’d be happy to audit your mileage allowance claims and recommend improvements.

Frequently Asked Questions (FAQ)

Q: What is the current approved mileage allowance rate for business travel?

A: For the tax year 2025/26, HMRC retains the same rates: 45p per mile for the first 10,000 business miles in a year, and 25p per mile for miles beyond that (for cars and vans). Motorcycles: 24p/mile; bicycles: 20p/mile.

Q: Can we reclaim VAT on mileage allowance payments we make to employees?

A: You can reclaim VAT on the fuel portion of the mileage allowance (i.e. the part attributable to fuel), not on the full allowance. The fuel portion is determined by applying the AFR for each vehicle.

Q: How do we calculate the fuel portion and VAT reclaim?

A: Calculate business miles × AFR = total fuel cost. Then apply the VAT fraction (i.e. divide by 6 if VAT is 20 %) to find the VAT you can reclaim. Ensure supporting records exist.

Q: What is the VAT road fuel scale charge and how does it affect us?

A: The scale charge is a method HMRC uses to recoup some VAT on fuel where vehicles are used privately. If you reclaim full fuel VAT, you may have to pay output tax via the scale mechanism. Since 1 May 2025, scale charge rates have increased.

Q: Should we always use the fuel scale charge?

A: Not necessarily. If the scale charge is more costly than reclaiming only business fuel VAT by apportionment, you may choose to not reclaim fuel VAT and avoid scale charges. The best option depends on your vehicle mix and private-use proportion.

Q: What records must we keep for a VAT-compliant mileage allowance claim?

A: You should keep full journey logs (date, locations, purpose, miles), vehicle details (make, engine, AFR used), fuel receipts (VAT invoices), and working calculations. These support your claim if HMRC audits.

Q: Can we adjust past mileage allowance VAT claims?

A: Potentially, yes — subject to HMRC’s time limits for VAT error corrections. If past claims were under-claimed or incorrect, a retrospective adjustment or disclosure may be possible. It depends on how old the claim is and whether there are errors exceeding thresholds. (We can advise.)

If you’d like us to review your mileage allowance practice or past claims, drop an email to mark@truemanbrown.co.uk or call 01708 397262 — we’d be glad to help.