VAT Bonanza for Member-Owned Clubs: How to Make a Not-For-Profit VAT Claim

If your sports club is a member-owned, non-profit entity, you may be entitled to a not-for-profit VAT claim for VAT overpaid on visitor fees.

The landmark ruling by the European Court of Justice (ECJ) in the Bridport & West Dorset Golf Club case established that member clubs should not have charged VAT on green fees to non-members.

This opens up potential for significant refunds to genuine not-for-profit sports clubs across the UK.

HMRC could be liable for repaying tens of millions to clubs that wrongly charged VAT on sporting fees.

Under subsequent tribunal decisions, many clubs can now pursue a not-for-profit VAT claim of up to 90 % of the overpaid tax.

Background: Why a Not-For-Profit VAT Claim Is Possible

In December 2013, the ECJ ruled in Bridport & West Dorset Golf Club (C-495/12) that the green fees charged by a member-owned golf club to non-members should be treated the same as for members, meaning they may be exempt from VAT under Article 132(1)(m) of the VAT Directive.

Later, the First-Tier Tribunal in Berkshire Golf Club & others v HMRC held that clubs were unjustly charged VAT and should be repaid 90 % of that overpaid VAT, rather than HMRC’s earlier position applying stricter restrictions.

As a result, HMRC issued Brief 10/2016, revising its stance on unjust enrichment and instructing clubs to resubmit previously rejected claims (so long as within the allowed time window).

Because of these developments, many member-owned clubs can now legitimately make a not-for-profit VAT claim for overpaid VAT on non-member green fees, after recalculating partial exemption and capital goods scheme adjustments.

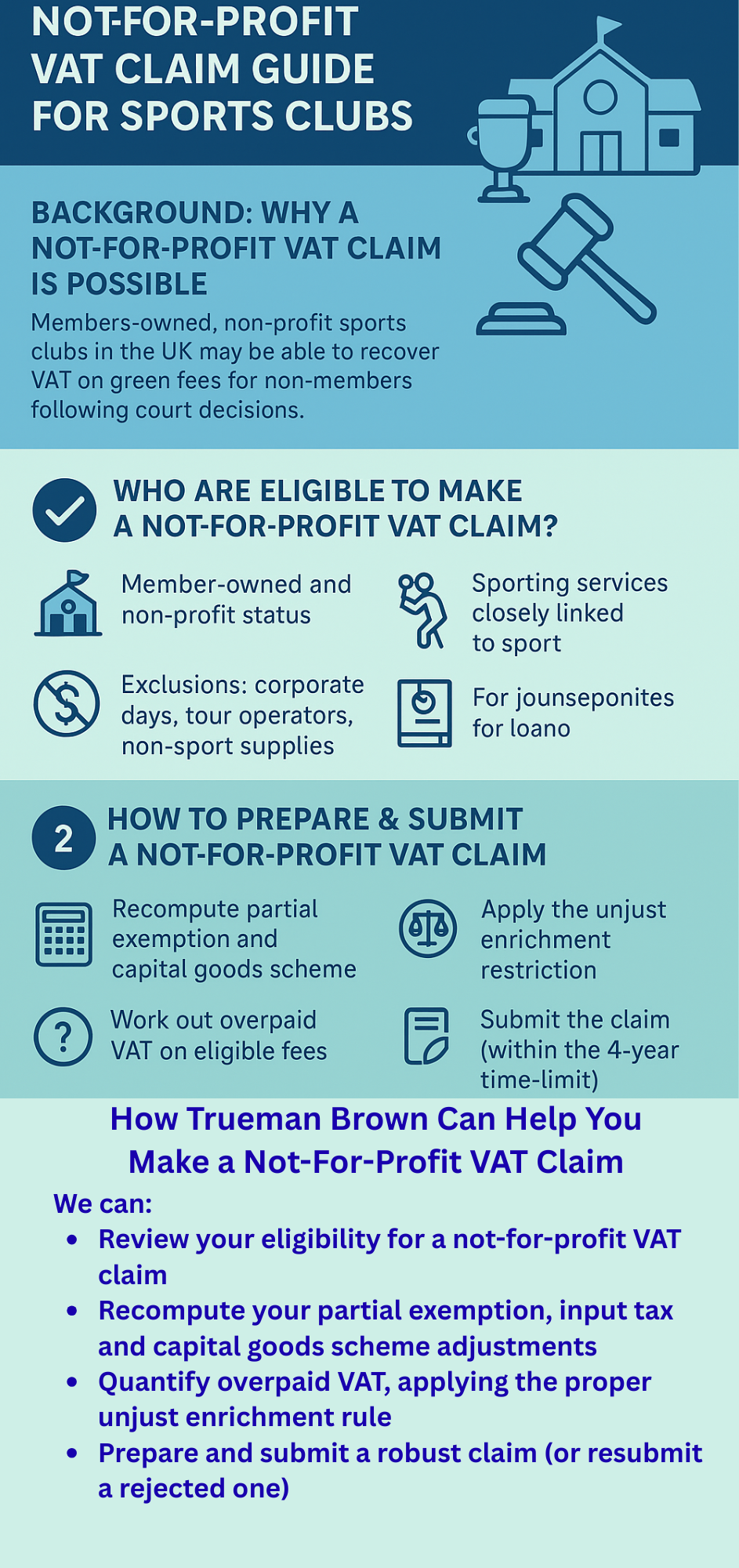

Who Qualifies to Make a Not-For-Profit VAT Claim?

Member-owned and non-profit status

Only clubs that are genuinely non-profit / not-for-profit and member-owned can rely on the ECJ and tribunal rulings to base a valid not-for-profit VAT claim. HMRC’s guidance and case law do not extend this relief to commercial or proprietary clubs.

Sporting services “closely linked”

The services (e.g. green fees, pay-as-you-play access) must be “closely linked to sport or physical education” and provided to individuals participating in sport. VAT Update+3Curia+3Croneri Library+3

Exclusions: corporate days, tour operators, non-sport supplies

Not all supplies are eligible. For example:

-

Green fees charged to a company or corporate body are generally taxable (i.e. not exempt) because the customer is corporate, not an individual. GCMA+2Tax Journal+2

-

Green fees sold via tour operators or wholesale (i.e., the club sells blocks of tee times) are taxed at the standard rate. GCMA+2Tax Journal+2

-

Costs or activities that do not directly relate to sport (e.g. non-sporting commercial supplies) must be excluded from the claim. Croneri Library+1

Thus, when making a not-for-profit VAT claim, clubs must carefully segregate exempt sporting supplies from taxable supplies.

How to Prepare & Submit a Not-For-Profit VAT Claim

Step 1: Recompute your partial exemption and capital goods scheme

Because non-member green fees now fall within VAT exempt status (from 1 January 2015), past input tax treatment must be adjusted. You’ll need to revisit your partial exemption methodology and the capital goods scheme to restate what your “input tax” position would have been had you treated those green fees as exempt. Tax Journal+2Croneri Library+2

Step 2: Work out overpaid VAT on eligible fees

You must identify the amounts of VAT that were incorrectly charged on non-member access, and adjust for any excluded supplies (corporate days, tour operator sales). Use HMRC’s VAT Information Sheet 01/15 as your procedural guide. Croneri Library+3Croneri Library+3Tax Journal+3

Step 3: Apply the unjust enrichment restriction

The tribunal in Berkshire (and related decisions) found that clubs had effectively borne about 90 % of the VAT cost, so only a 10 % “unjust enrichment” restriction is applied. So your not-for-profit VAT claim should reflect repayment of 90 % of the eligible VAT. Tax Journal+3GCMA+3Casemine+3

Step 4: Submit the claim (within the time-limit)

-

The time limit is 4 years (section 80(4) VAT Act 1994). GOV.UK+2Tax Journal+2

-

Claims previously rejected (and not appealed) may be resubmitted under the revised HMRC brief. Tax Journal+1

-

Address your claim to “VAT Bridport Claims, SO483, PO Box 200, Bootle, L69 9AH” (as per HMRC guidance) referencing “Bridport claims” in submissions. GOV.UK+2Tax Journal+2

Clubs should also consider requesting compound interest on the overpaid VAT, although this depends on future ECJ and domestic decisions regarding interest entitlement. Tax Journal+1

Key Dates and Policy Changes You Should Note

-

From 1 January 2015, clubs should treat non-member green fees as exempt (i.e. no VAT). Tax Journal+2Tax Journal+2

-

HMRC now accepts the tribunal’s approach to unjust enrichment (i.e. 90 % repayment) via Brief 10/2016. Tax Journal+1

-

Previously rejected claims must be resubmitted as fresh claims within the 4-year limit. Tax Journal+1

-

You may need to revise and restate your past VAT returns, particularly partial exemption and CGS entries, to align with the new treatment. Tax Journal+2Croneri Library+2

-

The position on compound interest remains unsettled; claimants may benefit in future if courts rule in favour of interest awards. Tax Journal+1

Thus, many clubs have only a limited window to act, and doing so promptly and properly is essential.

How Trueman Brown Can Help You Make a Not-For-Profit VAT Claim

If you want professional assistance with a not-for-profit VAT claim, Trueman Brown can help you through every step, from planning and computation to submission and HMRC correspondence.

We can:

-

Review your eligibility for a not-for-profit VAT claim

-

Recompute your partial exemption, input tax and capital goods scheme adjustments

-

Quantify overpaid VAT, applying the proper unjust enrichment rule

-

Prepare and submit a robust claim (or resubmit a rejected one)

-

Liaise with HMRC on your behalf, including interest requests

To discuss your club’s situation, contact Mark at mark@truemanbrown.co.uk or call 01708 397262.

We’ve supported many member-owned clubs to recover VAT that was never properly due. We’d be pleased to help you navigate this complex area.

Frequently Asked Questions (FAQ)

Q1: What is a not-for-profit VAT claim?

A not-for-profit VAT claim is a claim made by a non-profit, member-owned sports club to recover VAT wrongly charged on green fees to non-members — based on ECJ and tribunal rulings that those fees should have been VAT exempt.

Q2: Who can make such a claim?

Only genuine non-profit, member-owned clubs offering sporting services “closely linked” to sport qualify. Commercial clubs cannot benefit.

Q3: How far back can we claim?

Generally, you can claim for up to 4 years prior to the current period (under section 80(4) VATA 1994).

Q4: Will HMRC pay 100 % of the VAT I overpaid?

No. Under current tribunal decisions, claims are restricted by the principle of unjust enrichment. The accepted restriction means clubs typically recover 90 % of overpaid VAT.

Q5: Can we include interest?

Yes, you can request compound interest, but whether HMRC or the courts will allow it depends on future litigation and rulings.

Q6: What if HMRC already rejected a similar claim?

You can resubmit it as a fresh claim under the revised HMRC guidance (e.g. Brief 10/2016), if still within the 4-year limit.

Q7: Do we need expert help?

It’s advisable, since claims require careful apportionment, adjustments to past VAT returns, and robust evidence. Trueman Brown can support every step.

If you have more questions or want to check your club’s eligibility, just say the word — I can help tailor this further for your club.