Understanding the risk of business property relief problems

When it comes to succession planning for a business or unquoted company, business property relief problems can arise if you assume that relief will always be available unchecked.

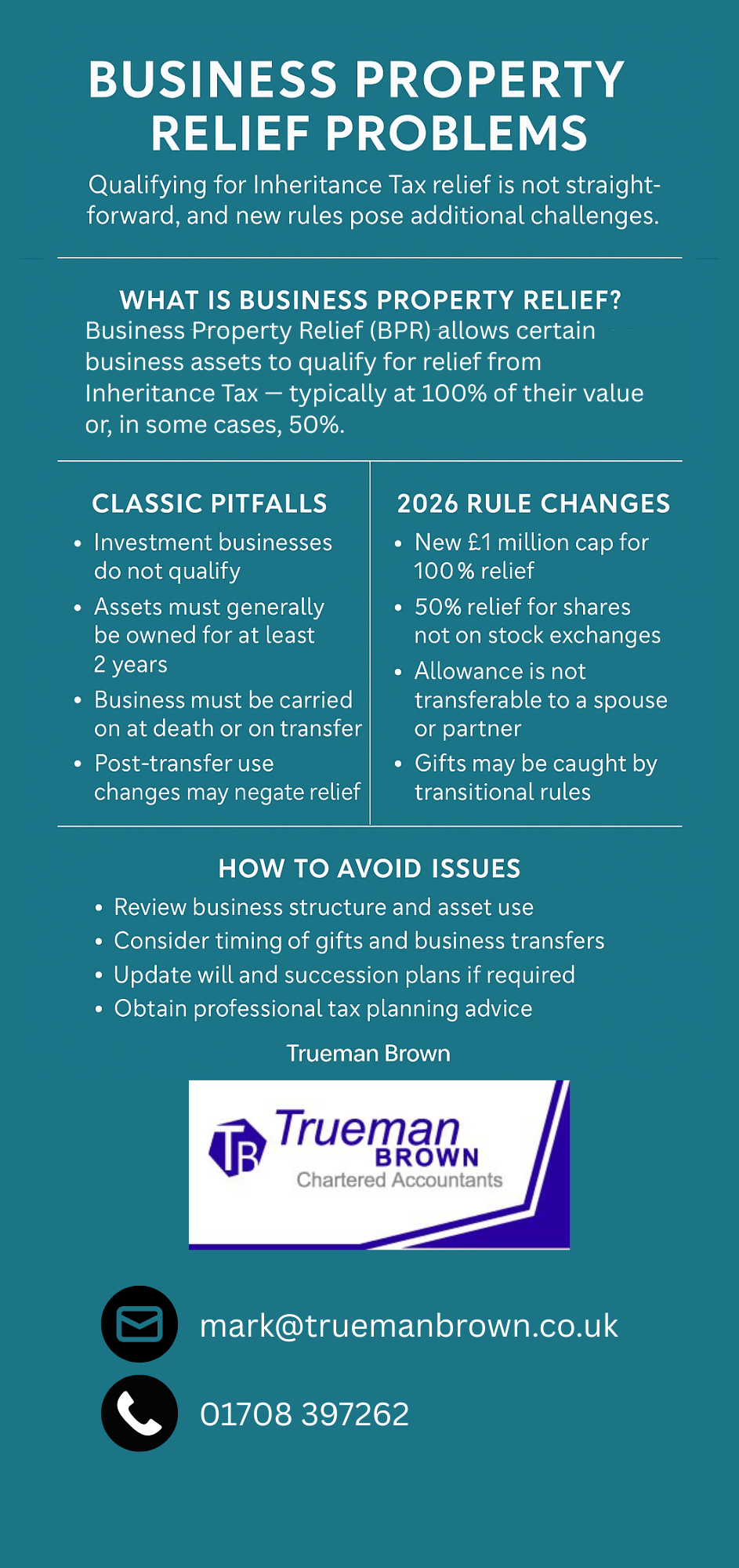

The relief commonly known as Business Property Relief (BPR) can save substantial Inheritance Tax (IHT) on death or lifetime gift of qualifying business assets — but the rules have become more complex and the planning window tighter. If you don’t address key issues proactively, you may find yourself facing significant tax charges or having to restructure your business or estate under stress.

What is business property relief and why problems occur

Business Property Relief (BPR) allows certain business assets to qualify for relief from IHT — typically at 100% of their value or, in some cases, 50%.

However, business property relief problems often arise because relief is only available if the business and the assets meet very specific conditions.

If any of those conditions are breached — for example because the business becomes “wholly or mainly” an investment business, or there is a binding contract for sale, or the assets haven’t been held for the minimum period — then relief may be restricted or lost.

Furthermore, with new changes planned for April 2026, owners need to plan now to avoid being caught unawares.

Understanding the risk of business property relief problems

When it comes to succession planning for a business or unquoted company, business property relief problems can arise if you assume that relief will always be available unchecked. The relief commonly known as Business Property Relief (BPR) (BPR) can save substantial Inheritance Tax (IHT) on death or lifetime gift of qualifying business assets — but the rules have become more complex and the planning window tighter. If you don’t address key issues proactively, you may find yourself facing significant tax charges or having to restructure your business or estate under stress.

What is business property relief and why problems occur

Business Property Relief (BPR) allows certain business assets to qualify for relief from IHT — typically at 100% of their value or, in some cases, 50%.

However, business property relief problems often arise because relief is only available if the business and the assets meet very specific conditions.

If any of those conditions are breached — for example because the business becomes “wholly or mainly” an investment business, or there is a binding contract for sale, or the assets haven’t been held for the minimum period — then relief may be restricted or lost.

Furthermore, with new changes planned for April 2026, owners need to plan now to avoid being caught unawares.

Qualifying criteria — classic triggers for business property relief problems

The rules for BPR are strict and the subtleties give rise to many of the business property relief problems we see in practice:

-

The business must be trading, not predominantly investing (i.e., it must not consist “wholly or mainly” of making or holding investments).

-

The donor or deceased must have owned the relevant asset for at least two years (in many cases) before the transfer.

-

The business must be carried on up to the date of death (or lifetime gift) and not subject to a binding contract for sale at that date.

-

The asset must qualify — e.g., a sole trader business, a partnership interest, or shares in an unquoted trading company. Some types of assets (e.g., pure investment properties or shares in quoted companies) may only qualify for 50% relief or none at all.

-

Post-transfer usage must not change in such a way as to break the qualifying conditions soon after the transfer. Otherwise, relief may be clawed back.

Because these conditions are complex and intertwined, overlooking even one element can lead to business property relief problems.

For example, a business owner may assume that because the company is trading now it will always qualify — but if the company begins letting property or investing in shares such that more than 50 % of its business becomes investment, then relief may be lost or reduced.

Common pitfalls and how business property relief problems emerge

Below are some of the frequent pitfalls which trigger business property relief problems:

1. Mixed trading and investment operations

A business that partially trades and partially invests (for example, property letting or shareholding investments) may fail the “trading” test. If more than 50% is investment rather than trading, relief may be denied entirely.

2. Ownership period and timing issues

If the business asset has not been held for the required period (often two years) at the relevant time (gift or death), relief may be refused. Similarly, if a binding sale contract is in place, relief may be excluded because the business is effectively disposing of the asset.

3. Change in business use or structure

If after the gift (or before death) the business changes purpose, ceases to trade, or is wound down, then relief may be clawed back. Also, splitting trading and non-trading activities into different companies may inadvertently exclude the non-trading company from relief.

4. Reluctance to review succession planning ahead of rule changes

With the upcoming reforms to BPR (see below) many business owners are failing to act early and risk being caught by business property relief problems simply because they left things too late. The proposed changes will impose a new cap, change the rate of relief for certain shares, and affect trust arrangements.

5. Trusts and lifetime gifts — compounded complexity

When business assets are held via trusts or gifted during lifetime, additional rules apply. The interplay of trust exit charges, the timing of gifts (within seven years of death), and the relief conditions means that business property relief problems can be significantly greater in complexity for trusts than for simple inheritance on death.

The 2026 rule changes: avoid escalating business property relief problems

From 6 April 2026 the rules for BPR will change materially. Understanding these is essential to avoid major business property relief problems:

-

A new combined £1 million allowance applies for 100% relief for individuals and similarly for trusts. Qualifying assets (for BPR and for the related Agricultural Property Relief (APR)) over this limit will only receive 50% relief, resulting in an effective 20% IHT rate on the excess.

-

Shares in companies that are not listed on a recognised stock exchange (e.g., companies listed only on AIM or other alternative markets) will in all cases qualify only for 50% relief (not the 100% relief previously available in certain circumstances).

-

The £1 million allowance is not transferable to a surviving spouse or civil partner (unlike the nil-rate band) so there is no “spouse top-up” as many may expect.

-

For trusts, the method for calculating exit charges (and the values to which the relief applies) will be standardised — effectively ensuring that values before relief are used for exit charge calculations, which can expose beneficiaries to increased tax if not planned.

-

Transitional rules apply: gifts made on or after 30 October 2024 where the donor dies on or after 6 April 2026 will trigger the new rules. Assets in trusts existing before 30 October 2024 will also be caught under certain conditions when their next 10-year anniversary is on or after 6 April 2026.

In short, unless action is taken ahead of April 2026, business owners risk significant tax exposure — and these changes themselves bring a new dimension to business property relief problems.

How to address and mitigate business property relief problems

Given the complexity and evolving rules, here are key steps to mitigate potential business property relief problems:

-

Review current business structure and activities: ensure your business remains genuinely trading (not investment) to continue to qualify.

-

Confirm ownership periods and the absence of binding sale contracts before the relevant event.

-

Consider timing of gifts and possible crystallisation of relief prior to April 2026 if appropriate.

-

Re-assess trusts and lifetime transfers: ensure the relief allowances and trust arrangements take account of the new rules.

-

Update wills and succession documents to reflect the £1 million allowance cap and non-transferability of that allowance between spouses.

-

Obtain professional valuations and advice — the tax stakes are rising, and business property relief problems can result from errors in valuation or failure to appreciate the new regime.

-

Monitor business use changes after the transfer — as even post-gift changes in business activities can risk relief.

How Trueman Brown can help you avoid business property relief problems

At Trueman Brown, we recognise the growing complexity around BPR and the risk of business property relief problems for business owners, shareholders and trustees. We can support you in several ways:

-

We’ll review your business and estate planning arrangements to identify any red flags for BPR qualification (including mixed trading/investment issues, ownership periods, and gift timing).

-

We’ll help you model the impact of the April 2026 changes (the £1 million allowance cap, 50% relief above that, shares in non-recognised markets, trust exit charges) and identify appropriate succession strategies.

-

We can assist with valuations, gift planning, trust structuring, will review and liaising with tax advisors to ensure your plans remain robust.

-

If you anticipate relief may be lost or reduced, we’ll help explore alternative tax-efficient options to mitigate the exposure.

If you’d like to talk further about how to avoid or manage potential business property relief problems in the 2025/26 tax year and beyond, please get in touch with us at mark@truemanbrown.co.uk or call 01708 397262.

We’d be happy to review your position and help you plan proactively.

Frequently asked questions (FAQ)

Q1. What exactly are “business property relief problems”?

A: The term refers to the various situations where an owner assumes full relief under BPR but, due to structure, timing, business use or rule changes, relief is reduced, denied or clawed back — resulting in unexpected tax liabilities.

Q2. Does the new £1 million cap from April 2026 apply now?

A: Not yet for all transfers — for deaths or trusts before 6 April 2026 the old regime applies. But gifts made on or after 30 October 2024 where the donor dies on or after 6 April 2026 will be subject to the new rules.

It is wise to plan now.

Q3. If I pass the business to my spouse, do we get two lots of the £1 million allowance?

A: No. Under the new rules the £1 million allowance for 100% relief is not transferable to a spouse or civil partner.

This is unlike the nil‐rate band for IHT which can transfer between spouses.

Q4. What about shares in a company listed on AIM (Alternative Investment Market)?

A: From April 2026 BPR for shares in companies that are “not listed on a recognised stock exchange” (which includes AIM) will be limited to 50% relief.

This is a major source of business property relief problems for such shareholdings.

Q5. Can business property relief ever be clawed back after death/gift?

A: Yes — if after the relevant event the business ceases to trade, or is sold, or the assets change use, relief might be withdrawn or reduced. Also, if the business is subject to a binding contract for sale at the time of death/gift the relief may be denied.

Q6. What should I do now?

A: Start reviewing your business structure, ownership, asset use, and succession plan without delay. Make sure you understand whether your assets qualify, whether timing should be brought forward, whether wills/trusts need updating and how the April 2026 reforms will affect you. Help from a professional advisor (such as us at Trueman Brown) is very advisable given the complexity and the stakes.

Recent Comments