Is an Alphabet Share Structure Still Worthwhile in 2025/26?

Alphabet shares remain a powerful tool for small business owners and family-run companies seeking flexibility in dividend distribution.

With the 2025/26 dividend allowance frozen at just £500 and tax rates unchanged, understanding how such shares work—and whether they’re still beneficial—is more important than ever.

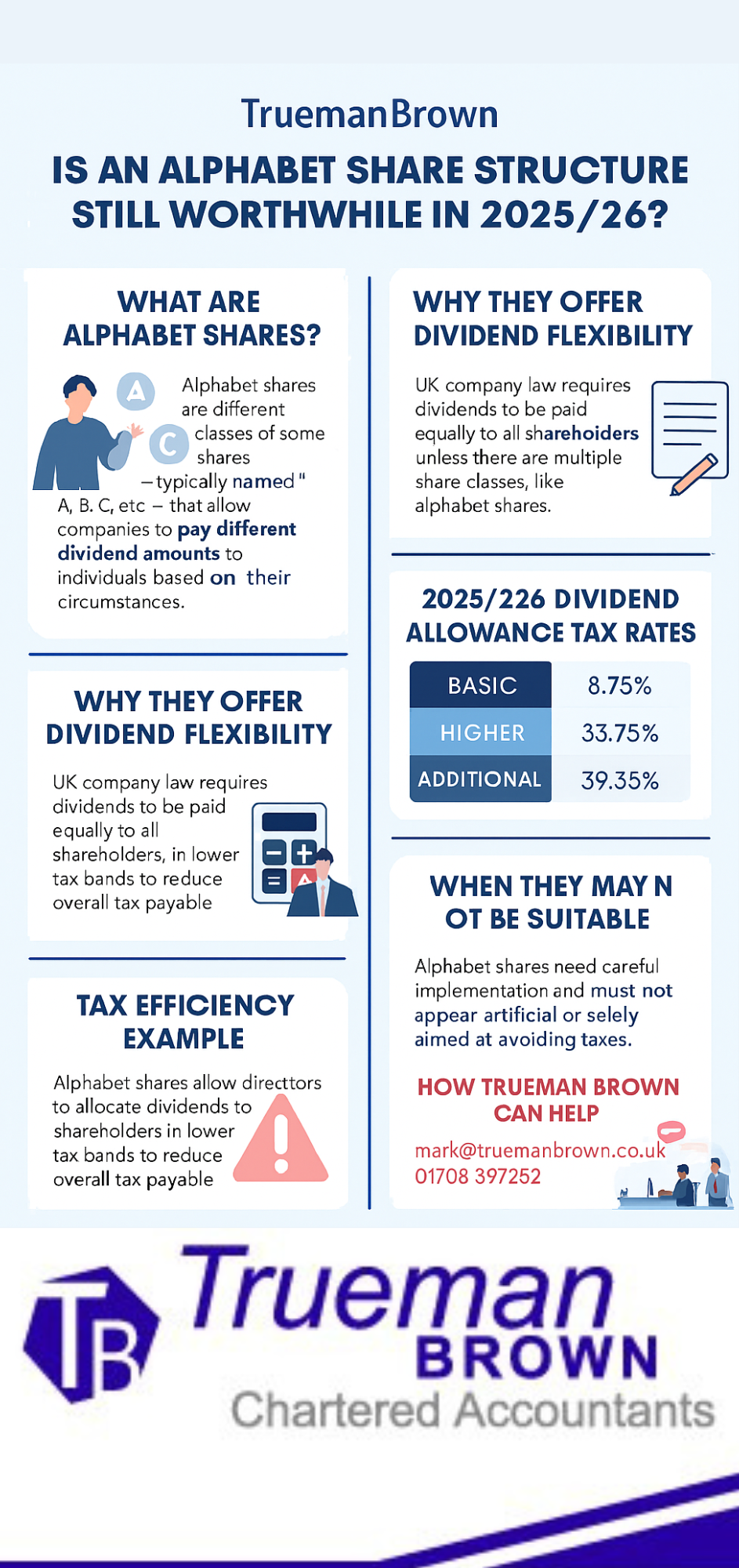

What Are Alphabet Shares?

Each class can receive different dividend amounts, allowing directors to tailor payouts based on individual shareholder circumstances.

This flexibility is especially useful in family businesses or companies with shareholders in varying tax bands.

Why Alphabet Shares Offer Dividend Flexibility

Under UK company law, dividends must be paid in proportion to shareholdings unless different share classes exist.

Alphabet shares bypass this restriction, enabling directors to allocate dividends in a tax-efficient manner.

For example, one shareholder may receive a higher dividend than another, depending on their income level and tax band.

2025/26 Dividend Allowance and Tax Rates

The dividend allowance for 2025/26 remains at £500.

This means only the first £500 of dividend income is tax-free, regardless of other income.

Beyond this, dividends are taxed as follows:

| Tax Band | Dividend Tax Rate |

|---|---|

| Basic Rate | 8.75% |

| Higher Rate | 33.75% |

| Additional Rate | 39.35% |

These rates apply after using the £12,570 personal allowance, which is also frozen for 2025/26.

Alphabet Shares and Tax Planning

Alphabet shares allow directors to allocate dividends to shareholders in lower tax bands, reducing the overall tax burden.

For instance, if one shareholder is an additional rate taxpayer and another is within the basic rate band, dividends can be weighted toward the latter to minimise tax.

Example: Tax Efficiency with Alphabet Shares

Consider ABC Ltd with three shareholders:

- Albert (A shares): Additional rate taxpayer

- Betty (B shares): Property income of £35,270

- Charlotte (C shares): Part-time income of £20,270

ABC Ltd has £45,000 in profits to distribute. Using alphabet shares, the company declares:

- £10 per A share → Albert receives £1,000 (tax-free via dividend allowance)

- £150 per B share → Betty receives £15,000 (£1,000 tax-free, £14,000 taxed at 8.75%)

- £290 per C share → Charlotte receives £29,000 (£1,000 tax-free, £28,000 taxed at 8.75%)

Total tax payable: £3,675. Without alphabet shares, equal dividends would result in a tax bill of £7,959. The tailored approach saves £4,284.

When Alphabet Shares May Not Be Suitable

Such shares require careful documentation and board approval.

HMRC may scrutinise arrangements that appear artificial or designed solely for tax avoidance.

It’s essential to have robust legal and accounting support when implementing such structures.

Recent Comments