Director’s Loan Accounts – The 30-Day Rule Explained

A director’s loan can provide short-term flexibility for directors, participators, or their associates who borrow funds from their company.

With HMRC’s official rate of interest (ORI) set at 3.75% per annum from 6 April 2025, and average mortgage rates at 4.74% as of 29 August 2025, some directors may find it cheaper to use company funds than personal borrowing. However, strict rules apply to director’s loans, particularly around repayment and the 30-day anti-avoidance provisions.

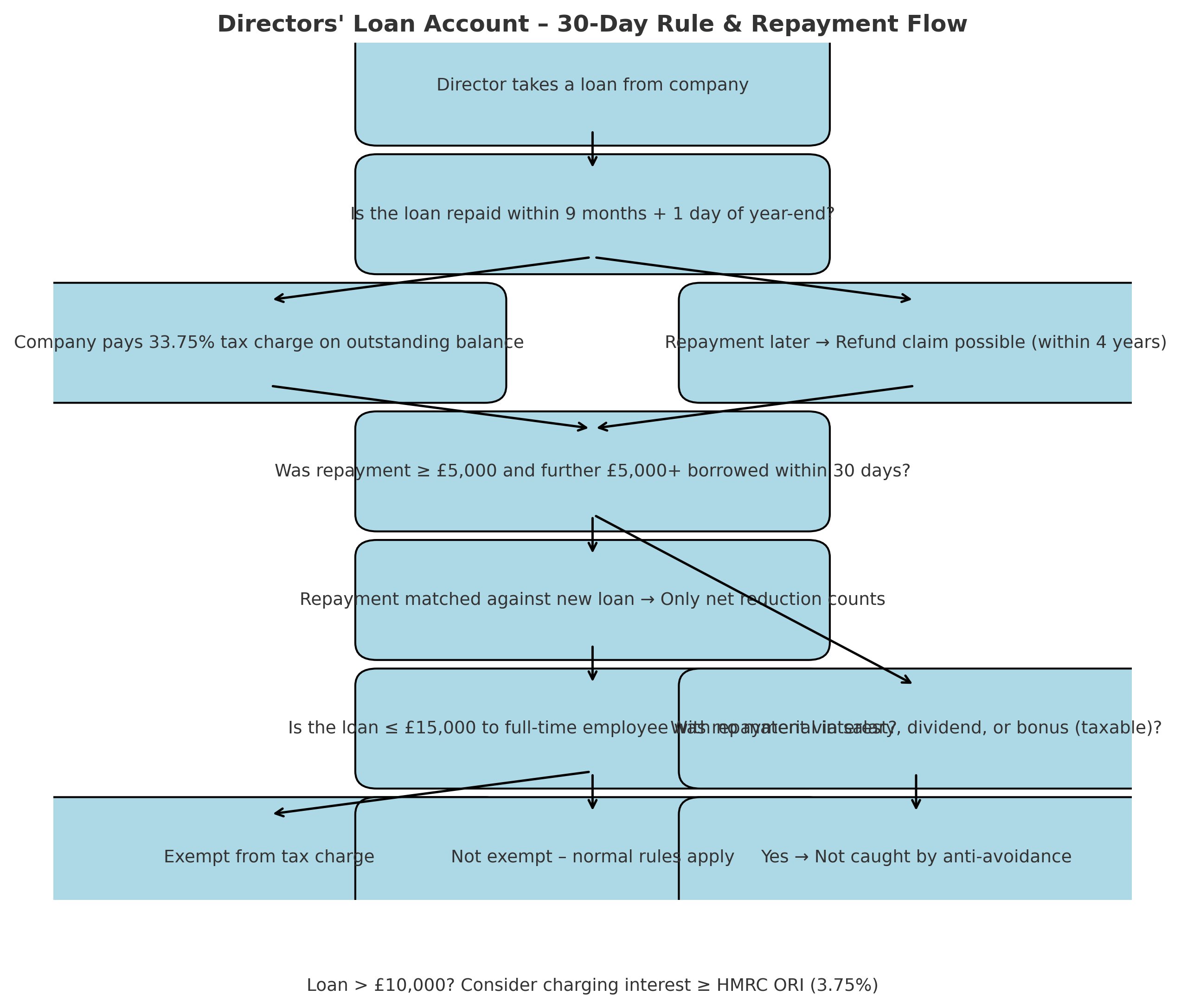

Repaying a Director’s Loan Within Nine Months

The golden rule for any director’s loan is that it must be repaid within nine months and one day of the company’s accounting period end. If not, the company will face a temporary tax charge of 33.75% of the outstanding balance.

Although this charge can be reclaimed once the loan is repaid, HMRC refunds are often slow. In addition, the claim must be made within four years of the accounting period in which the loan was cleared, or the relief will be lost.

The 30-Day Rule and Director’s Loan “Bed and Breakfasting”

HMRC introduced anti-avoidance legislation to stop directors from repaying and re-borrowing funds purely to avoid tax.

If a repayment of £5,000 or more is made, and within 30 days another borrowing of £5,000 or more occurs (by the same person or their associate), the repayment is matched to the new borrowing, not the original director’s loan.

This “bed and breakfasting” rule ensures that only genuine repayments reduce the outstanding balance.

Further tightening announced in the 2024 Autumn Statement prevents companies from using related businesses to cycle loans and avoid the nine-month repayment trigger.

Exemptions from Director’s Loan Tax Charges

Some smaller loans are exempt from the charge. For example, if the director’s loan is £15,000 or less, made to a full-time employee who does not hold a material interest in the company, it is usually exempt.

However, the ‘intention and arrangements’ rule applies if the balance before repayment is £15,000 or more and there are plans to borrow at least £5,000 again, even outside the 30-day period. In such cases, the exemption will not apply.

Practical Points on Managing a Director’s Loan

-

Repayments made via salary, dividends, or bonuses are generally treated as taxable income and are not caught by the anti-avoidance rules.

-

Where the director’s loan exceeds £10,000, companies should consider charging interest at least equal to HMRC’s ORI to avoid a benefit-in-kind tax charge.

-

Accurate record keeping is essential to avoid falling foul of HMRC’s complex rules.

How Trueman Brown Can Help with Your Director’s Loan

At Trueman Brown, we specialise in helping directors manage their tax planning efficiently. Whether you are looking at taking a director’s loan, managing repayments, or navigating HMRC’s complex anti-avoidance rules, our team can guide you through the process and ensure you remain compliant.

📧 Email: mark@truemanbrown.co.uk

📞 Telephone: 01708 372262

Get in touch today to discuss how we can help you make the most of your company funds without falling into tax traps.

Director’s Loan – FAQs

1. What is a director’s loan?

A director’s loan is money taken from a company by a director or participator that is not salary, dividend, or expense repayment.

2. What happens if I don’t repay my director’s loan?

If the loan is not repaid within nine months and one day of the year-end, the company will face a temporary tax charge of 33.75%.

3. Can I avoid the 30-day rule?

No. HMRC rules automatically apply if you repay £5,000+ and re-borrow £5,000+ within 30 days. The repayment will only count against the new borrowing.

4. Are small director’s loans exempt?

Yes, if the loan is £15,000 or less, given to a full-time employee without a material interest in the company.

5. Do I need to charge interest on a director’s loan?

If the loan is over £10,000, interest should normally be charged at least at HMRC’s official rate of interest to avoid a benefit-in-kind charge.

Recent Comments