Tax treatment when a partner dies: what you need to know

When a partner in a business passes away, the tax treatment when a partner dies becomes a critical issue for the remaining partners, their estate and the business itself.

Whether you operate a general partnership or a limited liability partnership (LLP), there are important income tax, inheritance tax (IHT) and capital gains tax (CGT) considerations triggered by the death of a partner — especially looking ahead to the 2025/26 tax year.

1. Nature of the partnership and automatic dissolution

If a business is structured as a partnership (where two or more persons carry on business with a view to profit), then unless there is a partnership agreement stating otherwise, the default law (Partnership Act 1890) applies. Under that law, the tax treatment when a partner dies often begins with the partnership automatically dissolving on the date of death of a partner.

Because the partnership is not treated as a separate legal entity (for income tax purposes) the deceased’s share of profits and losses is taxed as though the partner had ceased trading.

2. Income tax implications: cessation of trade

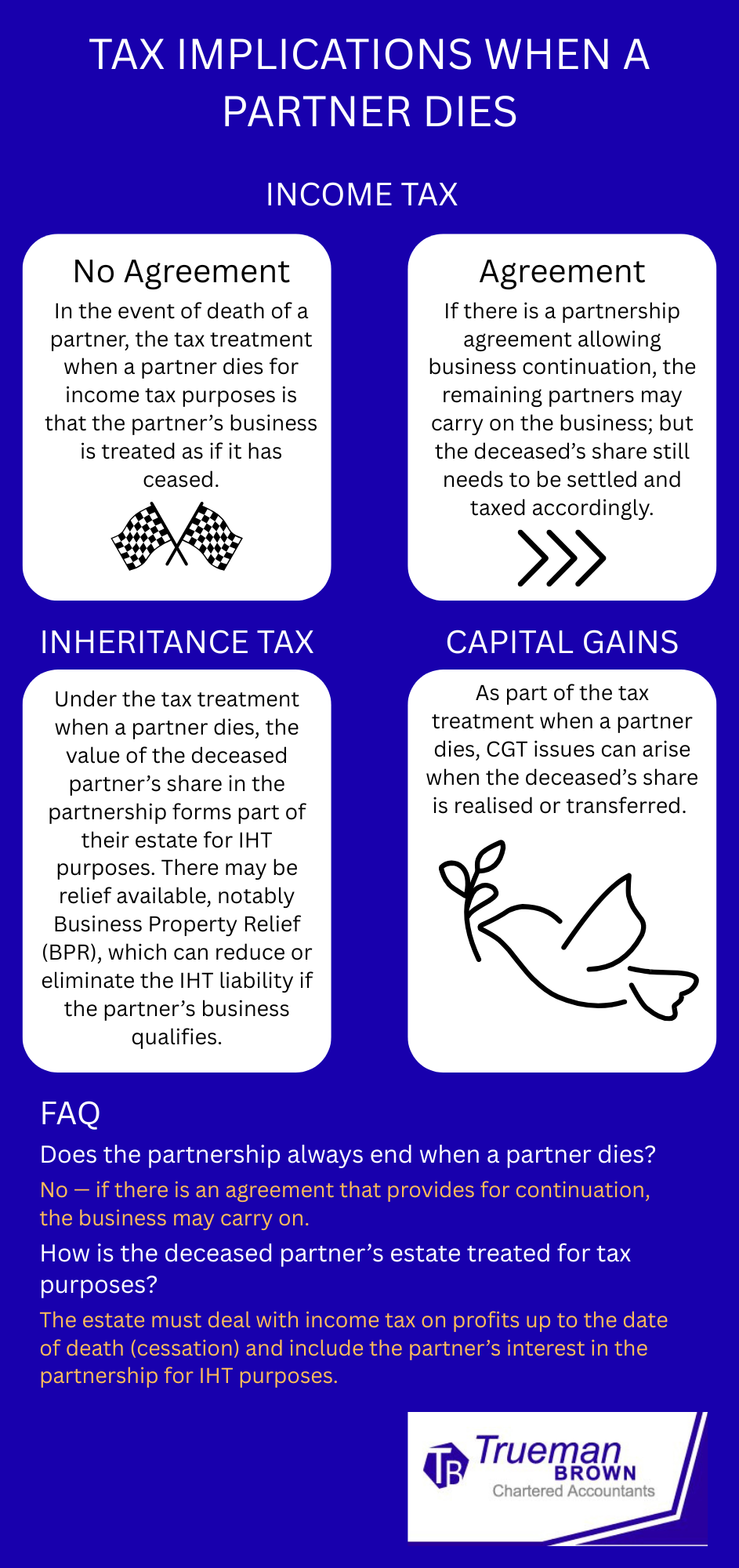

In the event of death of a partner, the tax treatment when a partner dies for income tax purposes is that the partner’s business is treated as if it has ceased — akin to a sole trader stopping trading.

The estate will need to assess profits from the end of the last accounting period up to the date of death (and any necessary adjustments such as overlap relief or terminal loss relief may apply).

If there is a partnership agreement allowing business continuation, the remaining partners may carry on the business; but the deceased’s share still needs to be settled and taxed accordingly.

3. Inheritance Tax — partnership interest as part of the estate

Under the tax treatment when a partner dies, the value of the deceased partner’s share in the partnership forms part of their estate for IHT purposes.

There may be relief available, notably Business Property Relief (BPR), which can reduce or eliminate the IHT liability if the partner’s business qualifies.

Valuation is critical — the interest is generally valued at market value unless the agreement states otherwise. The estate may also have the right to share profits since death or interest at 5% per annum until payment is made.

Update for 2025/26: While the core IHT rules remain as above, it is wise to check that the business qualifies for BPR in the light of any recent HMRC guidance. Also, keep in mind that IHT thresholds and residence nil-rate bands remain frozen (so pressure on estates remains).

4. Tax treatment when a partner dies – Capital gains and valuation issues

As part of the tax treatment when a partner dies, CGT issues can arise when the deceased’s share is realised or transferred. For example, beneficiaries benefit from a market value uplift on death in many cases.

However, with partnerships, complications may arise because if the interest passes under a partnership agreement (rather than via a will) then the uplift may not apply — due to the rules in Statement of Practice D12.

Practical things to check: asset valuations, balancing allowances for assets held in the partnership, and whether the transfer to remaining partners is treated as a disposal for CGT or not.

5. The importance of a robust partnership agreement

To mitigate the risks of how the tax treatment when a partner dies plays out, a clear partnership (or LLP members’) agreement is vital. The agreement should include:

-

-

a “death of partner” clause that specifies whether the business continues or is wound up;

-

how the deceased partner’s interest will be valued;

-

mechanism for buy-out by remaining partners or admission of new partners;

-

timing and payment terms for the estate;

-

the removal of the deceased partner’s name from materials and contracts.

-

Having these provisions gives certainty to the business, the estate and the surviving partners.

6. How Trueman Brown can help you with the tax treatment when a partner dies

If you’re dealing with a situation of the tax treatment when a partner dies, Trueman Brown is well placed to support you through every step.

We can:

-

Review or draft partnership or LLP agreements with appropriate death-of-partner and buy-out clauses.

-

Assist in valuing the deceased partner’s share, advising on fair mechanisms and settlement terms.

-

Guide the estate and remaining partners on income tax cessation, IHT planning (including Business Property Relief) and CGT/asset transfer issues.

-

Provide business continuity advice so the remaining partners can operate smoothly and minimise disruption.

For tailored assistance, please contact us at mark@truemanbrown.co.uk or call 01708 397262.

We are here to help you navigate the tax, legal and commercial issues confidently.

FAQ About The Tax Treatment When A Partner Dies— Frequently Asked Questions

Q1: Does the partnership always end when a partner dies?

A1: No — but as part of the tax treatment when a partner dies, in an ordinary partnership without an agreement the business will automatically dissolve on the partner’s death under the default law. If there is an agreement that provides for continuation, the business may carry on.

Q2: How is the deceased partner’s estate treated for tax purposes?

A2: The estate must deal with income tax on profits up to the date of death (cessation) and include the partner’s interest in the partnership for IHT purposes. The estate may also claim either the partner’s share of profits since death or interest on their share until settlement.

Q3: Will Business Property Relief always apply?

A3: Not automatically. The conditions for BPR must be met (for example, the business must be trading, not investment, and the interest must be held for the required period). It forms part of the tax treatment when a partner dies in reducing IHT, but specialist advice is needed.

Q4: What about CGT when a partner dies?

A4: Generally, assets passing on death benefit from a market value uplift for CGT. But in partnership transfer situations where the interest passes under a partnership agreement rather than via a will, the uplift may not apply — affecting the tax treatment when a partner dies.

Q5: What should surviving partners do immediately?

A5: They should review the partnership agreement to identify death-clauses, secure business assets, notify HMRC, agree valuation/payment mechanisms for the estate and consider business continuity steps. All of these form part of managing the tax treatment when a partner dies.

Recent Comments