Business Rate Relief for FHL: What Furnished Holiday Let Owners Need to Know

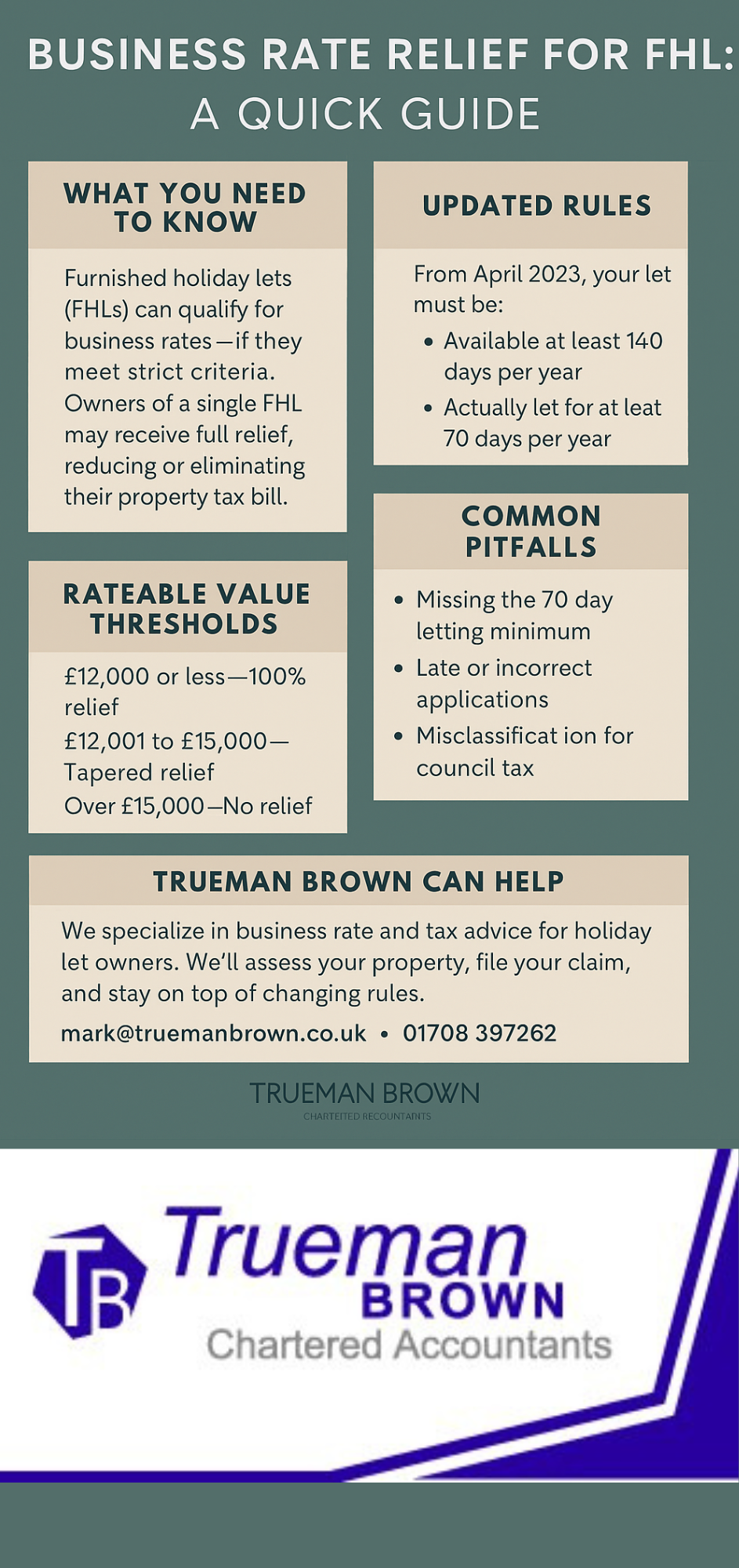

If you own a furnished holiday let (FHL), understanding your eligibility for business rate relief for FHL could significantly reduce your property costs.

With updated rules now in effect, only properties genuinely let as holiday accommodation qualify for business rates instead of council tax.

This distinction opens the door to valuable reliefs—especially for small business owners operating a single FHL.

Understanding Business Rates for Holiday Lets

Business rates apply to non-domestic properties, including FHLs that are commercially let.

These rates are calculated by multiplying the property’s rateable value by the applicable multiplier. For 2025/26:

- Standard multiplier: 52.6p per £1 of rateable value (53.8p in London)

- Small business multiplier: 50.1p per £1 (51.3p in London)

Properties with a rateable value under £15,000 may qualify for business rate relief for FHL, potentially eliminating your business rates bill entirely.

Who Qualifies for Business Rate Relief for FHL?

To benefit from business rate relief for FHL, your property must meet specific conditions:

-

- Rateable value under £15,000: Full relief is available for properties valued at £12,000 or less.

- Tapered relief: Applies to properties between £12,001 and £15,000.

- Single property rule: Relief is typically available if you own only one business property.

- Multiple properties: You may still qualify if additional properties have a combined rateable value under £20,000 (£28,000 in London), and none exceed £2,899 individually.

Relief is not automatic—you must apply through your local authority.

If you’ve missed out previously, retrospective claims may be possible.

Updated Eligibility Rules from April 2023

Since April 2023, HMRC has tightened the criteria for FHLs to qualify for business rates. Your property must be:

- Available for letting: At least 140 days per year

- Actually let: For a minimum of 70 days annually

These thresholds are less stringent than the tax definition of an FHL, which requires 105 days of actual letting.

If your property meets the business rates test, you may still qualify for business rate relief for FHL, even if it doesn’t meet the tax definition.

Claiming Business Rate Relief for FHL: Step-by-Step

- Check your rateable value: Use the VOA website or contact your local council.

- Confirm letting activity: Ensure your FHL meets the 70-day actual letting threshold.

- Submit your claim: Write to your local authority with supporting evidence.

- Review past bills: You may be eligible for backdated relief.

How Trueman Brown Can Help You Maximise Relief

Navigating the rules around business rate relief for FHL can be complex—but Trueman Brown Chartered Accountants are here to simplify the process. We offer:

- ✅ Tailored advice for FHL owners

- ✅ Rateable value assessments and relief eligibility checks

- ✅ Support with retrospective claims and appeals

- ✅ Full compliance with HMRC and local authority requirements

📧 Email: 📞 Call: 01708 397262

Let us help you reduce your property costs and stay compliant.

FAQ: Business Rate Relief for FHL

Q: What’s the difference between council tax and business rates for holiday lets?

A: Council tax applies to second homes not commercially let. FHLs that meet letting thresholds are assessed for business rates.

Q: Can I claim relief if I own more than one FHL?

A: Possibly—if the combined rateable value is under £20,000 (£28,000 in London) and no single property exceeds £2,899.

Q: Is business rate relief for FHL automatic?

A: No. You must apply through your local authority and provide evidence of letting activity.

Q: What if I missed claiming in previous years?

A: You may be able to claim retrospectively. Trueman Brown can assist with the process.

Q: Does the relief apply to Airbnb properties?

A: Yes, if the property qualifies as an FHL and meets the commercial letting criteria.

Recent Comments