Capital Allowances Small Pool Write Off – Updated for 2025/26

Businesses that don’t use the cash basis can claim capital allowances for qualifying purchases such as machinery, equipment, or tools.

The capital allowances small pool write off allows a business to deduct the remaining balance in its main pool if it falls below £1,000 at the year-end — offering a simple way to claim relief in full.

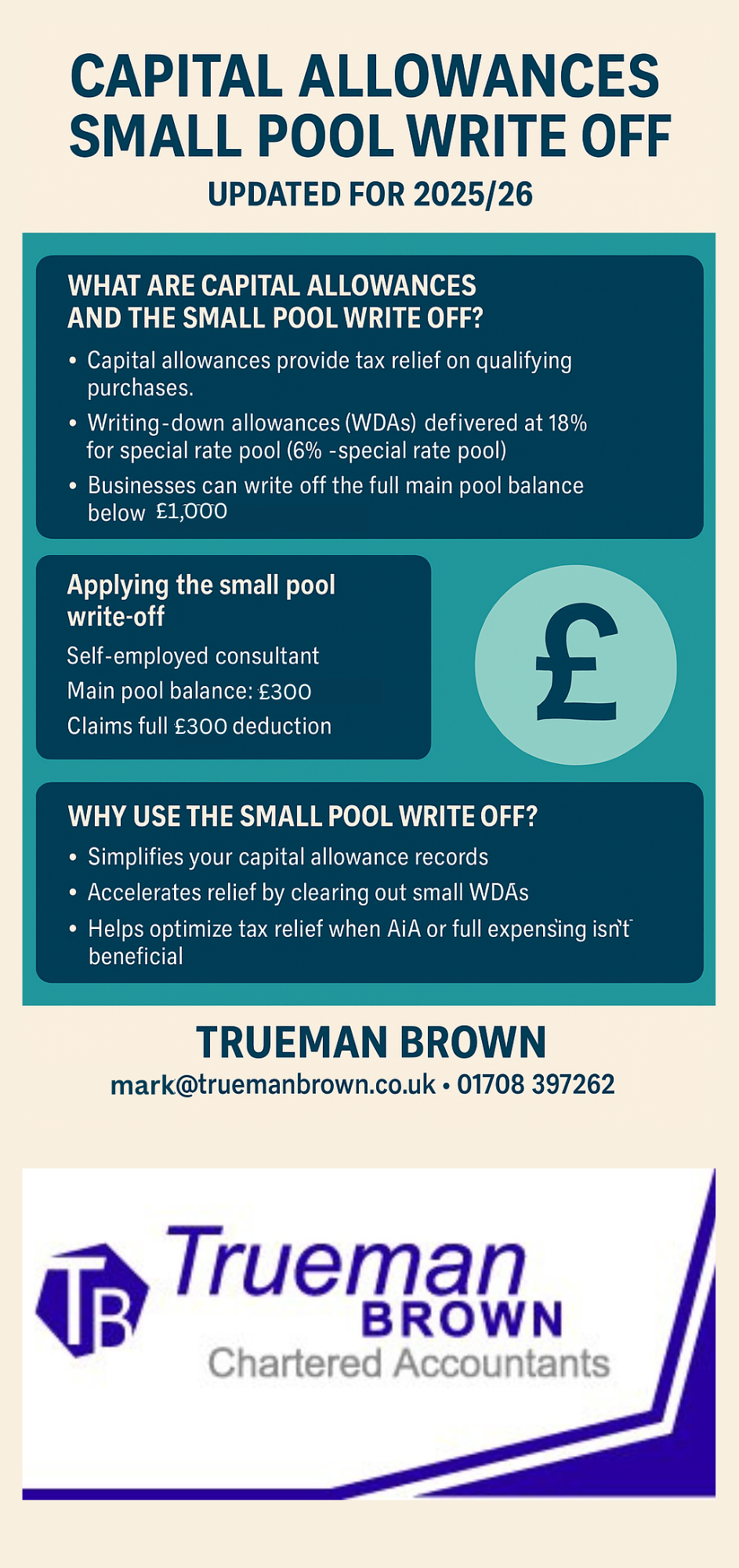

What Are Capital Allowances and the Small Pool Write Off?

Capital allowances provide tax relief on qualifying capital expenditure.

Normally, a writing-down allowance (WDA) of 18% applies to the main pool, and 6% to the special rate pool (for example, integral features or high-emission vehicles).

However, if the balance of the main pool is less than £1,000, businesses can claim the capital allowances small pool write off, writing off the entire balance instead of continuing to claim WDAs annually.

2025/26 Updates to Capital Allowances

For the 2025/26 tax year, the Annual Investment Allowance (AIA) remains at £1 million, continuing to give 100% immediate relief for qualifying assets.

The capital allowances small pool write off threshold remains £1,000, adjusted proportionally for accounting periods shorter or longer than 12 months.

Additionally, full expensing continues for companies investing in new main-pool plant and machinery.

However, the small pool write off remains valuable for unincorporated businesses and where AIA or full expensing are not applicable.

Example – Applying the Small Pool Write Off

Let’s consider a self-employed consultant with a main pool balance of £800 after claiming WDAs in previous years.

Instead of carrying this balance forward, they can use the capital allowances small pool write off to deduct the full £800 in the current accounting period, reducing taxable profits and simplifying record-keeping.

Why Use the Capital Allowances Small Pool Write Off?

-

Simplifies your capital allowance records.

-

Accelerates relief by clearing out small residual balances.

-

Avoids unnecessary small WDAs in future years.

-

Helps optimise tax relief when the AIA or full expensing isn’t beneficial.

How Trueman Brown Can Help You With The Capital Allowances Small Pool Write Off

At Trueman Brown, we specialise in ensuring businesses maximise all available tax reliefs — including the capital allowances small pool write off.

Our expert tax accountants in Dagenham can help you identify qualifying expenditure, prepare claims, and plan efficiently for future asset purchases.

📧 Email: mark@truemanbrown.co.uk

📞 Call: 01708 397262

We provide practical advice and ongoing support to help your business stay tax-efficient and compliant with the latest HMRC rules.

Frequently Asked Questions About The Capital Allowances Small Pool Write Off

1. What qualifies as a small pool for the write off?

If your main pool balance is under £1,000 (pro-rated for non-12-month periods), you can claim the full amount as a deduction.

2. Does the small pool write off apply to the special rate pool?

No, it only applies to the main pool. Special rate pool assets continue to attract WDAs at 6%.

3. Can companies using full expensing still claim the small pool write off?

Yes, but it’s mainly relevant when full expensing isn’t claimed or available — for example, for older assets.

4. Is the £1,000 limit changing in 2025/26?

No, it remains unchanged for the 2025/26 tax year.

5. Do I need to make an election to claim the small pool write off?

Yes, you must make the claim in your tax computation or return for the relevant accounting period.

Recent Comments