Claiming Business Travel Expenses on Holiday

For many business owners, the warm weather brings thoughts of holidays.

But what if you also meet a client, visit a supplier, or attend an event while you’re away?

Claiming business travel expenses on holiday is a common question — and the answer depends on how HMRC’s rules apply to your trip.

Understanding the difference between business vs personal travel expenses is essential to avoid claiming incorrectly and attracting unwanted HMRC scrutiny.

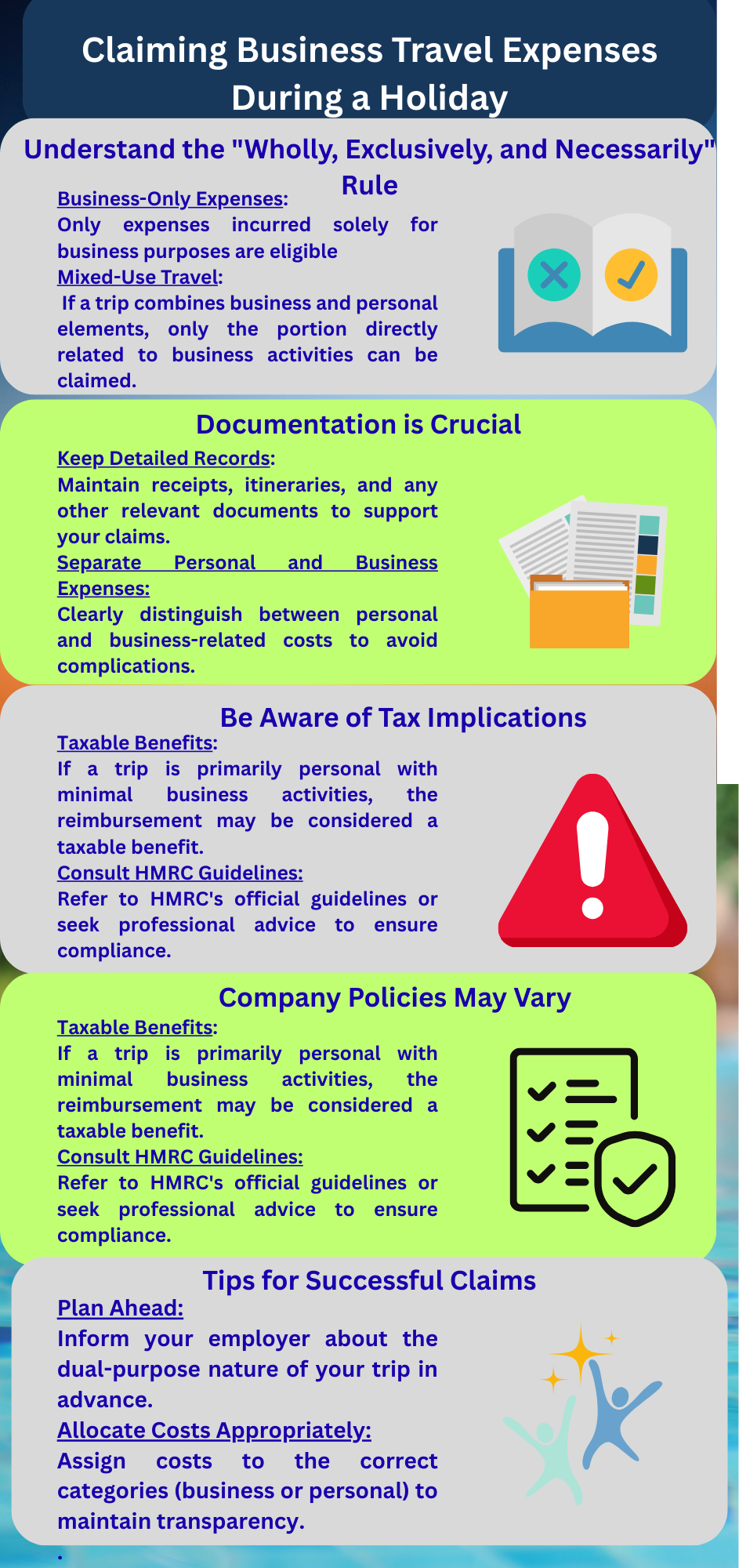

HMRC’s “Wholly and Exclusively” Rule

HMRC allows you to claim expenses that are wholly and exclusively for the purposes of your trade.

If an expense is entirely for business, it’s deductible.

But if there’s a private element, things get more complicated.

The good news is that HMRC does accept a split where the business element is clearly identifiable.

The challenge is knowing where that split applies — and where it doesn’t.

When You Can Claim

✅ Business-only trips

If the sole purpose of travel is business (e.g. visiting a supplier in Spain), you can normally claim the full cost of flights, hotels, and meals. The fact that you enjoy incidental private benefit — like sunshine or sightseeing — doesn’t matter.

✅ Separately identifiable business costs

If you’re on holiday and make a distinct trip for business (e.g. driving from your holiday base to meet a client), you can claim that cost. For example, business mileage can be deducted if supported by a log.

When You Should Not Be Claiming Business Travel Expenses on Holiday

❌ Holiday costs

If the trip is mainly for leisure and you simply add some business while there, you cannot deduct flights, hotels, or meals related to the holiday. Only incremental business costs are allowed.

❌ Dual-purpose expenses

Where costs serve both personal and business purposes and cannot be split (like a family hotel used for both holiday and work), no deduction is permitted.

Mixed Business and Personal Travel

Some costs can be separated on a reasonable basis. For example:

-

Driving 200 miles for a holiday, but 40 of those miles are to meet a client → claim the 40 miles.

-

Staying an extra two nights after a business meeting for leisure → claim only the business portion of hotel costs.

However, where a split is impossible, HMRC will reject the expense in full.

Incidental Private Benefit

What if a genuine business trip has a side benefit, like leisure time or pleasant weather? HMRC won’t penalise you.

As long as the main purpose is business, you can claim the expense in full, even if you happen to enjoy personal benefits on the side.

Practical Tips for Claiming Business Travel Expenses on Holiday

-

Keep clear documentation (emails, meeting notes, tickets).

-

Record mileage separately when on holiday.

-

Pay for business costs through your company account.

-

Exclude costs for partners, spouses, or family.

-

Always ensure the main purpose of the trip is clear and provable.

How Trueman Brown Can Help

At Trueman Brown, we work with business owners and contractors to ensure their expense claims are both compliant with HMRC and as tax-efficient as possible.

Whether you’re planning overseas meetings, or just want clarity on claiming business travel expenses on holiday, we can guide you.

📧 Email: mark@truemanbrown.co.uk

📞 Phone: 01708 397262

We’ll help you avoid common pitfalls and make sure you only claim what you’re entitled to.

Final Word

When it comes to claiming business travel expenses on holiday, the golden rule is intention.

If your trip is mainly a holiday, you’ll only be able to claim the marginal business costs. If the trip is mainly for business, you can usually claim the full cost.

With the right records and advice, you can enjoy your break without worrying about tax complications.

FAQs: Claiming Business Travel Expenses on Holiday

Can I claim hotel costs when claiming business travel expenses on holiday?

Only if the main purpose of your trip is business. If you’re primarily on holiday, hotel accommodation is treated as a personal expense and cannot be claimed.

Can I claim mileage if I meet a client while on holiday?

Yes. When claiming business travel expenses on holiday, you can deduct the mileage or transport costs for the specific business journey (such as driving to a client meeting). Keep a mileage log for evidence.

What happens if expenses are both business and personal?

If a cost is clearly split (for example, extra mileage or additional nights for business), HMRC allows you to claim the business portion. But if it’s a dual-purpose expense that cannot be separated, it won’t qualify.

Does the “wholly and exclusively” rule apply to holidays?

Yes. The wholly and exclusively rule is central to claiming business travel expenses on holiday. Costs must be incurred solely for business purposes, unless you can identify a distinct business element.

Can I claim flights if I extend a business trip into a holiday?

You can claim the flight if the primary reason for travel was business. However, additional holiday costs (like extra hotel nights or leisure activities) are personal and not deductible.

Recent Comments