Company Cash Management and Tax Planning: How to Make the Most of Surplus Business Funds

In today’s uncertain economy, some businesses have managed to build up healthy cash reserves — often more than they need for day-to-day operations.

While this is a good position to be in, company cash management and tax planning are essential to ensure these funds are used wisely and tax-efficiently.

Leaving cash idle can lead to reduced value through inflation and unnecessary tax exposure when it’s eventually withdrawn.

Below, we explore how directors can manage surplus company cash effectively while staying compliant with HMRC rules.

💡 Why company cash management and tax planning matters

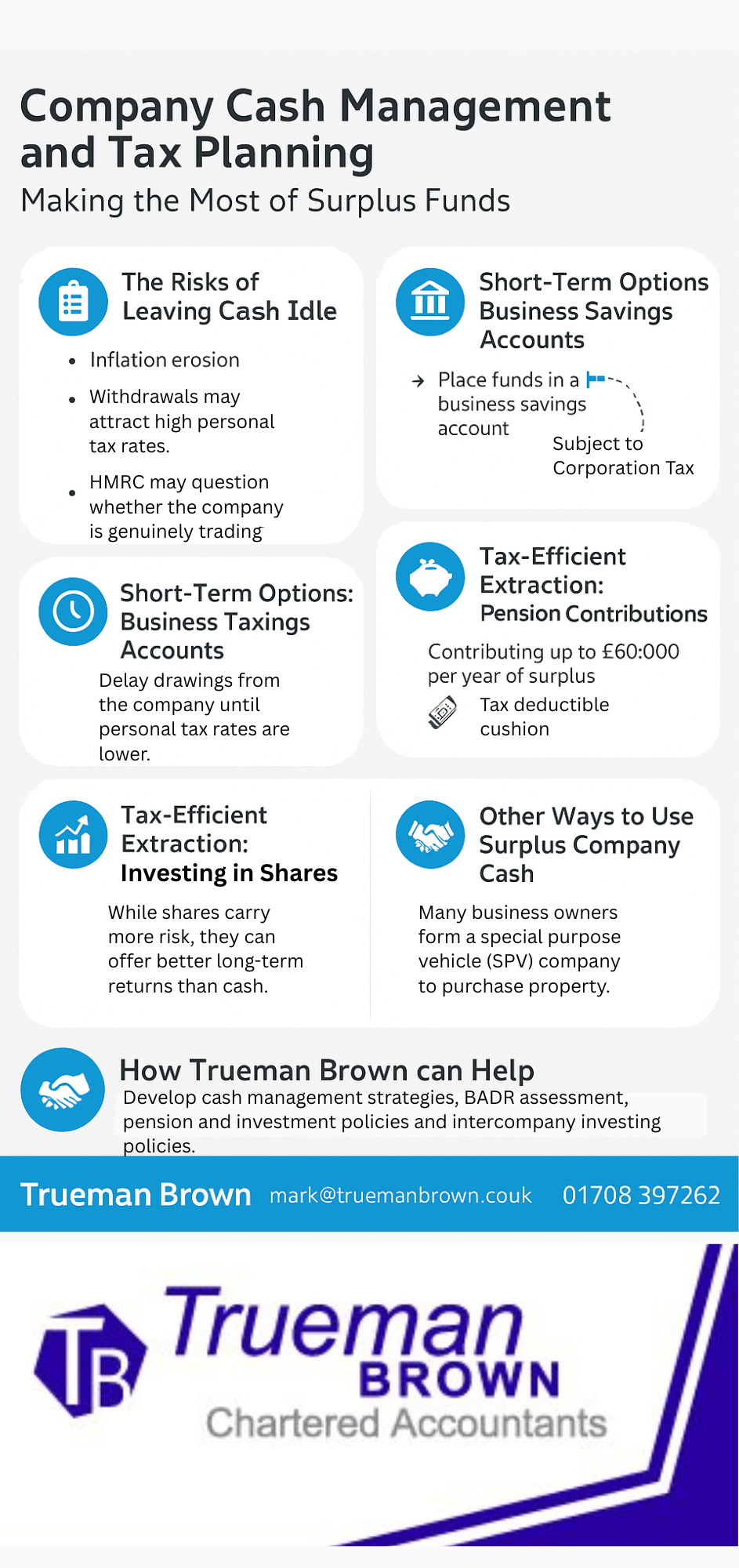

Retaining too much cash in a business current account can create several risks:

-

Inflation erosion: The real value of cash declines over time.

-

Tax inefficiency: Withdrawals may attract high personal tax rates.

-

HMRC scrutiny: Significant reserves might cause HMRC to question whether the company is genuinely trading, especially if Business Asset Disposal Relief (BADR) is later claimed.

🏦 Short-Term Strategy: Business Savings Accounts

For funds not immediately required, moving money into a company savings account can be a simple and low-risk step.

Many business accounts currently offer around 4.5% interest.

Keep in mind that interest income is subject to corporation tax — at a 25% rate, the effective return is approximately 3.38%.

This still beats holding cash in a non-interest current account while keeping liquidity available.

👴 Retaining Cash for Future Withdrawals or Sale

If a director-shareholder is approaching retirement, holding on to cash within the company may be part of an effective tax planning approach.

The idea is to delay withdrawals until personal tax rates are lower.

In cases where the company might be sold or liquidated, Business Asset Disposal Relief (BADR) can significantly reduce tax on the gain:

-

10% rate up to April 2026

-

18% thereafter (for qualifying disposals)

To qualify, the company must remain a trading company. HMRC allows some non-trading activities, provided they are not “substantial” — typically less than 20% of the company’s assets or income.

In Potter v HMRC [2019] UKFTT 554 (TC), a business that held £800,000 in bonds during a trading lull was still found to be trading.

HMRC looks closely at intent and overall business activity rather than cash balances alone.

💼 Tax-Efficient Extraction: Pension Contributions

One of the most effective company cash management and tax planning tools is contributing to a pension.

The company can make contributions directly on behalf of the director, and these payments are deductible from taxable profits.

Key facts:

-

Up to £60,000 per tax year can be contributed, depending on the director’s allowance.

-

The director can withdraw 25% tax-free upon retirement.

-

Excess contributions may trigger a pension recovery charge, so planning is important.

This strategy provides both long-term financial security and immediate corporation tax relief.

📈 Other Ways to Use Surplus Company Cash

1. Investing in Shares

While shares carry more risk, they can offer better long-term returns than cash.

However, excessive investment activity could affect the company’s trading status for BADR purposes, so it’s best done with professional guidance.

2. Property Investment via an SPV

Many business owners form a special purpose vehicle (SPV) company to purchase property.

The trading company can lend funds to the SPV, which acquires the property.

Benefits include:

-

Earning interest income on the intercompany loan

-

Keeping trading and investment activities separate

-

Building long-term capital growth

Ensure the loan terms, rate, and repayment schedule are clearly documented to satisfy HMRC’s “commercial arrangement” requirements.

🤝 How Trueman Brown Can Help You With Company Cash Management And Tax Planning

At Trueman Brown, we specialise in helping business owners navigate the complex world of company cash management and tax planning.

Whether you’re considering how to invest surplus funds, planning for retirement, or preparing your company for sale, our experienced team can guide you toward the most tax-efficient and compliant solutions.

We work with directors to:

-

Develop cash deployment strategies aligned with business goals

-

Assess BADR eligibility before a sale or liquidation

-

Implement pension and investment planning tailored to your circumstances

-

Manage intercompany lending and property investment structures safely

📧 Email: mark@truemanbrown.co.uk

📞 Call: 01708 397262

Our team is ready to help you make informed decisions that protect and grow your company’s wealth.

❓ Frequently Asked Questions About Company Cash Management And Tax Planning(FAQ)

1. What’s the best way to hold company cash short term?

A high-interest business savings account provides flexibility and modest returns while keeping funds accessible.

2. Does keeping too much cash risk losing BADR eligibility?

It can, but only if the non-trading activity (such as investments) becomes substantial. HMRC generally uses a 20% threshold as a guideline.

3. How much can my company contribute to my pension?

Typically up to £60,000 per tax year, depending on your annual and carry-forward allowances.

4. Can I invest company cash in property?

Yes, many directors set up an SPV for property purchases. Ensure all transactions are commercial and well-documented for tax purposes.

5. When should I seek professional advice?

Always seek guidance before making major withdrawals, pension contributions, or investments — small changes can have significant tax implications.

🧭 Final Thoughts

Thoughtful company cash management and tax planning can protect your business’s hard-earned profits from inflation and tax inefficiencies.

Whether your goal is to reinvest, plan for retirement, or prepare for an eventual sale, taking action now ensures your money continues to work for you — not against you.

Recent Comments