Cycle to Work SCHEME – a smart benefit for employers and employees alike

At Trueman Brown, we believe that a properly structured cycle to work SCHEME can deliver meaningful tax, health and sustainability benefits for your business.

By introducing a scheme that allows employees to access bikes and equipment via salary-sacrifice, you not only encourage active commuting, but also unlock corporation tax and national insurance savings while helping your workforce to enjoy greener, fitter journeys.

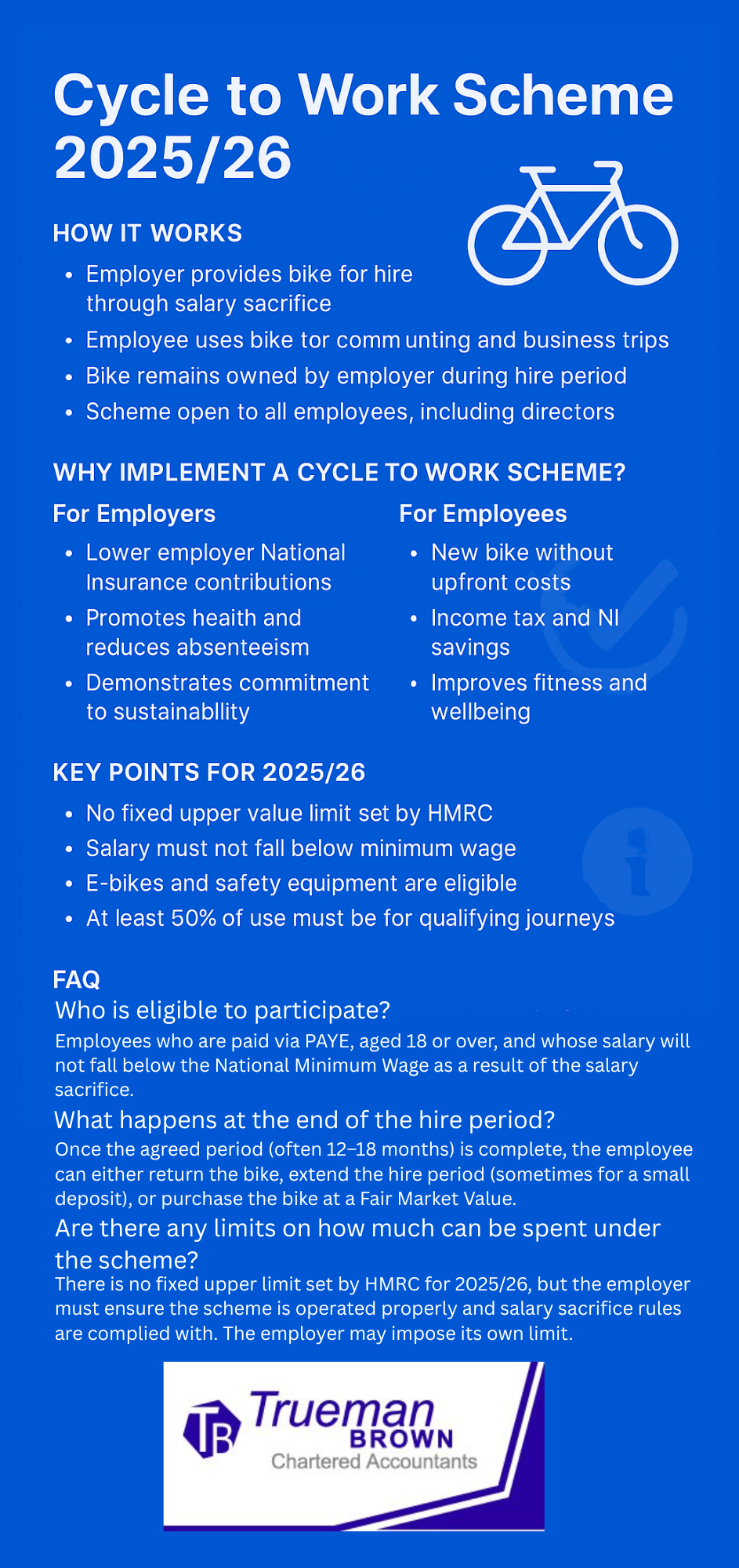

What is a cycle to work SCHEME and how does it work?

A cycle to work SCHEME is essentially a tax-approved arrangement whereby an employer acquires a cycle (which may include an e-bike) and related safety equipment, then loans it to an employee for qualifying journeys.

The employee repays the cost via salary sacrifice, drawing the repayments from their gross pay, thereby reducing income tax and National Insurance contributions.

Why implement a cycle to work scheme?

For employers:

-

Lower employer National Insurance liability for the payments made via salary sacrifice.

-

Potential for reduced absenteeism and improved employee wellbeing – cycling to work promotes health and fitness.

-

Enhanced green credentials: offering a cycle to work scheme helps your business demonstrate commitment to sustainability.

For employees:

-

Access to a new bike and equipment without large upfront costs.

-

Savings on tax and National Insurance: basic-rate taxpayers may save around 32 % or more, higher-rate even more.

-

Encourages regular cycling and contributes to healthier lifestyles.

Latest updates for 2025/26

When considering a cycle to work scheme for the 2025/26 tax year, make sure you’re aware of the following updates and reminders:

-

There is no fixed upper value limit set by HMRC for the cost of the bike and accessories under the scheme provided the salary sacrifice doesn’t take the employee below minimum wage.

-

E-bikes (electrically assisted pedal cycles) are eligible under the scheme as cycles, so long as they meet the standard definitions.

-

The salary sacrifice arrangement must not bring the employee’s pay below the National Minimum Wage or National Living Wage threshold. This is an important compliance point for 2025/26.

-

Employers must ensure the benefit is offered to all eligible employees, and should avoid favouring directors only, to preserve tax-exemption status.

-

While the guidance around qualifying journeys remains the same (at least 50 % business/commute use), current commentary emphasises that the scheme can accommodate hybrid working patterns – e.g., cycling to a station as part of a longer commute.

-

VAT, Corporation Tax and employer relief rules remain relevant: employers may reclaim VAT on the purchase and claim capital allowances, while the hire repayments reduce taxable profits.

How we can help at Trueman Brown

At Trueman Brown, we can guide you through designing and implementing a compliant cycle to work SCHEME that delivers maximum benefit for your business and employees.

Whether you’re a small limited-company or a growing employer, we’ll help you set up the scheme correctly and ensure you’re aware of the tax, payroll and administrative implications.

If you’d like to speak to us about your specific circumstances, please contact mark@truemanbrown.co.uk or call 01708 397262.

We’ll arrange a consultation to explore how a cycle to work SCHEME could work for your organisation.

FAQ – Common questions about the cycle to work SCHEME

Q: Who is eligible to participate in a cycle to work SCHEME?

A: Typically, employees who are paid via PAYE, aged 18 or over, and whose salary will not fall below the National Minimum Wage as a result of the salary sacrifice. Self-employed persons generally cannot use the scheme unless they receive salary via PAYE.

Q: Can any type of bike be used under the cycle to work SCHEME?

A: Yes — the definition of a cycle includes a bicycle, tricycle or a cycle with four or more wheels (not being a motor vehicle). E-bikes are eligible if they meet the electrically assisted pedal cycle (EAPC) definition.

Q: What happens at the end of the hire period?

A: Once the agreed period (often 12–18 months) is complete, the employee can either return the bike, extend the hire period (sometimes for a small deposit), or purchase the bike at a Fair Market Value. Ensuring a compliant FMV charge is key to avoiding a taxable benefit.

Q: Does the employee have to use the bike only for commuting?

A: The scheme guidance requires that the cycle must be used “mainly” for qualifying journeys – typically meaning at least 50 % of usage is for commuting or business travel. Non-qualifying leisure usage should therefore be kept below 50%.

Q: Are there any limits on how much can be spent under the scheme?

A: There is no fixed upper limit set by HMRC for 2025/26, but the employer must ensure the scheme is operated properly and salary sacrifice rules are complied with. The employer may impose its own limit.

Q: Can a cycle to work SCHEME cover accessories like helmets, panniers, locks?

A: Yes — cyclists’ safety equipment and accessories necessary for the use of the cycle are eligible under the scheme.

Recent Comments