Tax Implications of a Directors Loan Write Off

If your company is considering a directors loan write off, it’s crucial to understand the tax consequences from the outset.

A directors loan write off is not just an internal bookkeeping decision — HMRC treats it as a distribution, and there can be significant tax and National Insurance ramifications for both the company and the director.

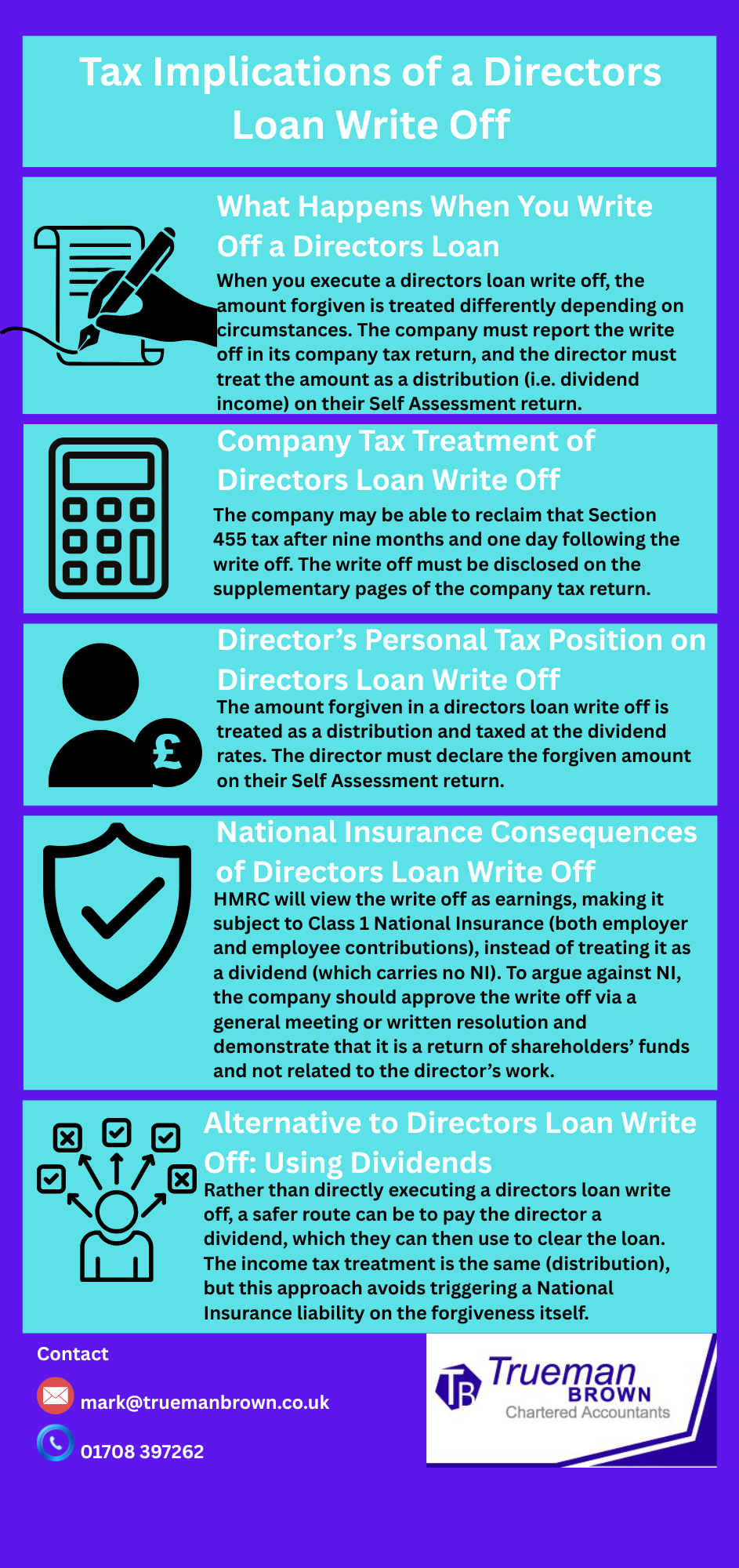

What Happens When You Write Off a Directors Loan

When you execute a directors loan write off, the amount forgiven is treated differently depending on circumstances.

The company must report the write off in its company tax return, and the director must treat the amount as a distribution (i.e. dividend income) on their Self Assessment return.

Company Tax Treatment of Directors Loan Write Off

If the company had already paid Section 455 tax because the loan remained outstanding beyond nine months and one day after the year end, a directors loan write off is treated akin to a repayment for the company’s purposes.

In that case, the company may be able to reclaim that Section 455 tax after nine months and one day following the write off.

The write off must be disclosed on the supplementary pages of the company tax return.

Director’s Personal Tax Position on Directors Loan Write Off

From the director’s perspective, the amount forgiven in a directors loan write off is treated as a distribution and taxed at the dividend rates.

The director must declare the forgiven amount on their Self Assessment return. If the director is also an employee, HMRC may consider applying an employment income charge, but dividend treatment usually takes precedence, preventing a double taxation scenario.

National Insurance Consequences of Directors Loan Write Off

The National Insurance (NI) implications of a directors loan write off are more complex.

In many cases, HMRC will view the write off as earnings, making it subject to Class 1 National Insurance (both employer and employee contributions), instead of treating it as a dividend (which carries no NI).

To argue against NI, the company should approve the write off via a general meeting or written resolution and demonstrate that it is a return of shareholders’ funds and not related to the director’s work. HMRC may still challenge this view.

Alternative to Directors Loan Write Off: Using Dividends

Rather than directly executing a directors loan write off, a safer route can be to pay the director a dividend, which they can then use to clear the loan.

The income tax treatment is the same (distribution), but this approach avoids triggering a National Insurance liability on the forgiveness itself.

How Trueman Brown Can Help You With Directors Loan Write Off

If you’re considering a directors loan write off, Trueman Brown can guide you through every step to ensure it’s handled correctly and to minimise your tax exposure.

Whether you need help assessing whether a write off is appropriate, calculating the tax impact, or preparing the necessary company and individual returns, we’re here to help.

You can contact Mark at mark@truemanbrown.co.uk or call us on 01708 397262 for a confidential discussion. We’ll explain your options and tailor a strategy suited to your company’s circumstances.

Frequently Asked Questions (FAQ)

Q: What is a directors loan write off?

A directors loan write off is the forgiveness of a loan made by the company to a director — essentially cancelling the debt so the director no longer owes it.

Q: Is a directors loan write off always taxable?

Generally yes — the forgiven amount is viewed as a distribution (dividend) for personal tax, and the company must report it in its tax return. In many cases, there may also be Section 455 tax considerations or National Insurance implications.

Q: Can I avoid National Insurance on a directors loan write off?

Possibly, if you can successfully argue that the write off is a return of shareholders’ funds unrelated to the director’s employment duties and that it was properly approved. But HMRC may challenge that position.

Q: When can a company reclaim Section 455 tax after a directors loan write off?

If the company had previously paid Section 455 tax on a loan outstanding beyond the required period, and then you execute a directors loan write off, the company may reclaim that Section 455 tax after nine months and one day following the end of the accounting period in which the write off occurs.

Q: Can I simply amend my Self Assessment return for the write-off?

Yes — if a directors loan write off occurred after 5 April 2023 and was not declared, you can usually amend the return rather than using HMRC’s online disclosure service (which is typically for earlier periods).

Q: How can Trueman Brown assist in relation to a directors loan write off?

We can assess whether a write off is appropriate, advise on tax and NI implications, help with claims for Section 455 tax repayments, ensure correct reporting in company and personal returns, and liaise with HMRC on your behalf. Contact Mark at mark@truemanbrown.co.uk or call 01708 397262 to discuss your situation in detail.

Recent Comments