Calculating a Director’s National Insurance Contributions (2025/26)

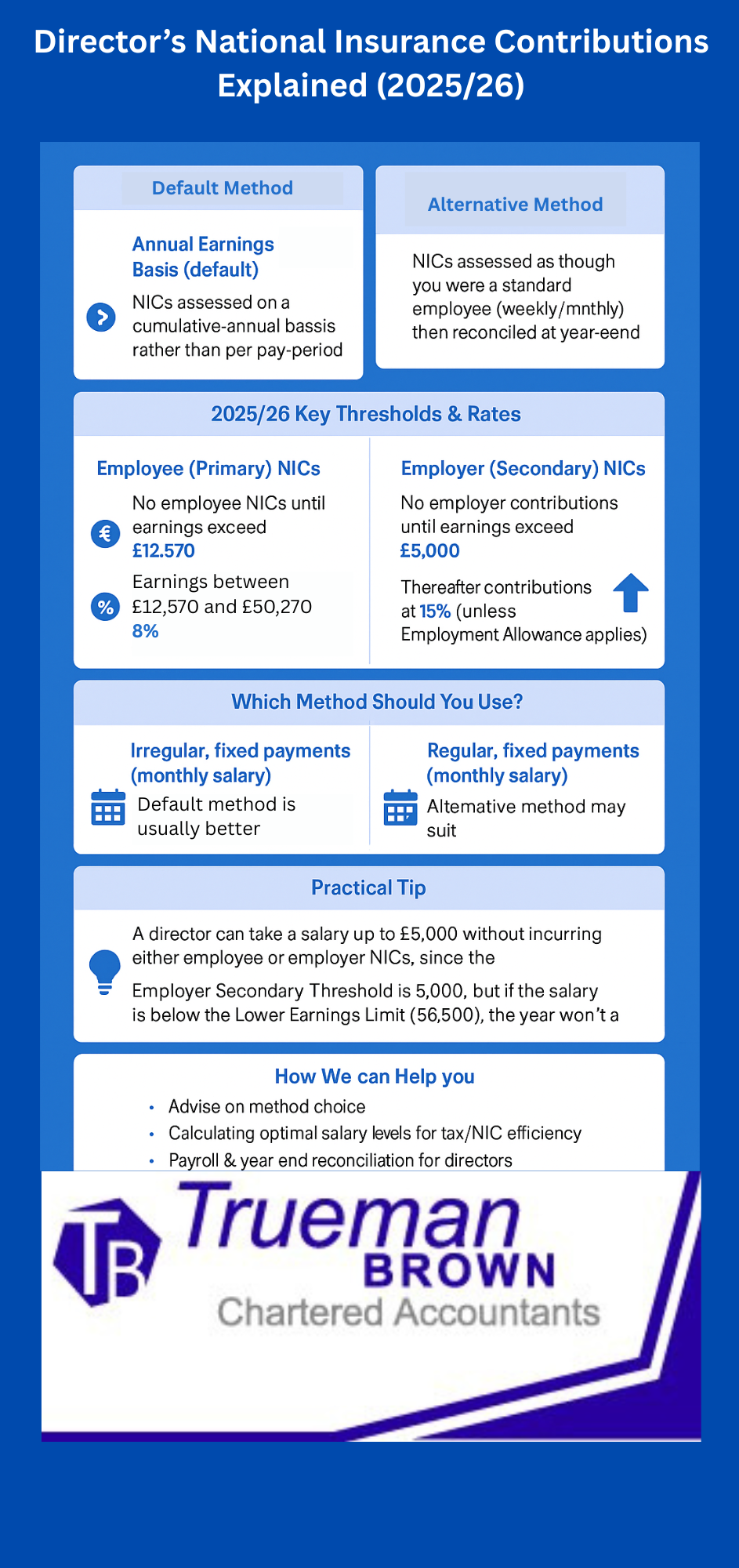

When it comes to director’s National Insurance contributions, the rules differ from those for regular employees. While employees’ NICs are calculated based on their pay intervals (weekly or monthly), directors have an annual earnings period, meaning their NICs are assessed against annual thresholds regardless of how often they are paid.

There are two recognised calculation methods:

- The Annual Earnings Period Basis (the default method)

- The Alternative (Regular Earnings) Method

Both methods result in the same total contributions over the course of the tax year, but the timing of deductions varies significantly between them.

1. The Annual Earnings Period Basis – Default Method

Under this default method, director’s National Insurance contributions are worked out on a cumulative basis for the entire tax year.

Instead of calculating NICs each month or week, this approach looks at the director’s total earnings to date and applies the annual thresholds.

For 2025/26:

-

No employee NICs are due until earnings exceed the Primary Threshold of £12,570.

-

Earnings between £12,570 and £50,270 are charged at 8%.

-

Earnings above £50,270 are charged at 2%.

Employer (secondary) NICs are calculated separately:

-

No contributions are due until the Secondary Threshold of £5,000 is reached.

-

Thereafter, contributions are charged at 15% (unless the Employment Allowance applies).

-

For directors under 21, an upper secondary threshold may apply, delaying employer NICs further.

This annual approach is particularly beneficial where directors receive irregular or variable payments.

It allows contributions to “smooth out” over time and avoids overpaying NICs early in the year.

2. Alternative (Regular Earnings) Method

The alternative method—also known as the regular earnings method—is optional and often chosen by directors receiving consistent, regular payments.

Here, NICs are calculated as though the director were a standard employee, using weekly or monthly thresholds.

However, at the end of the tax year, there’s a reconciliation using the annual thresholds to ensure the correct overall amount has been paid.

If this year-end calculation reveals any shortfall, it is deducted from the final salary payment. Should the final payment be insufficient, the employer must pay the balance.

This approach produces consistent NIC deductions throughout the year, making it easier for budgeting and cash flow management.

Which Method Should You Choose?

Choosing the right method for calculating director’s National Insurance contributions depends on your payment structure and the company’s preferences.

-

Irregular or infrequent payments: The annual method usually works best, as it reflects the true cumulative earnings and can help manage cash flow more flexibly.

-

Regular, fixed payments: The alternative method provides smoother, predictable deductions each pay period.

Practical Tip for 2025/26

For the 2025/26 tax year, the key thresholds are:

-

Personal Allowance: £12,570

-

Employee’s NI Primary Threshold: £12,570

-

Lower Earnings Limit: £6,500

-

Employer’s NI Secondary Threshold: £5,000

This means a director can take a salary up to £5,000 without incurring any director’s National Insurance contributions—either as employee or employer.

However, be aware that if your salary is below the Lower Earnings Limit (£6,500), the year will not count as a qualifying year for your state pension.

How Trueman Brown Can Help You With Director’s National Insurance Contributions

Understanding and managing director’s National Insurance contributions can be complex—especially when balancing salary and dividends for maximum tax efficiency.

At Trueman Brown, we specialise in helping company directors and business owners structure their pay in the most tax-efficient way, while ensuring full compliance with HMRC rules.

Our team can:

-

Advise on whether to use the annual or alternative NIC method

-

Calculate optimal salary levels to minimise tax and NIC liabilities

-

Handle payroll and year-end reconciliations for directors

-

Ensure your business remains compliant with current HMRC thresholds and legislation

For tailored advice, contact Mark at Trueman Brown today:

📧 mark@truemanbrown.co.uk

📞 01708 397262

We’ll help you make informed decisions and ensure your company runs as efficiently and compliantly as possible.

FAQs – Director’s National Insurance Contributions

1. Do company directors pay National Insurance?

Yes. Directors pay both employee (primary) and employer (secondary) National Insurance contributions, just like other employees—but their NICs are calculated on an annual basis.

2. Can a director avoid paying National Insurance?

A director can legally avoid paying NICs by keeping their annual salary below the Primary Threshold (£12,570). However, doing so may affect their entitlement to state benefits such as the state pension.

3. What’s the difference between the annual and alternative NIC methods?

The annual method calculates NICs cumulatively across the tax year, while the alternative method calculates them each pay period and then reconciles at year-end.

4. Which NIC method should I use as a director?

It depends on your pay pattern. Use the annual method if you pay yourself irregularly; use the alternative method if you have a regular monthly salary.

5. Do dividends attract National Insurance contributions?

No. Dividends are not subject to National Insurance. This is why many directors choose a low salary plus dividends structure for tax efficiency.

Recent Comments