Dividend Traps for Directors – What Company Directors Must Know

As a company director, understanding dividend traps for directors is crucial.

Drawing a dividend sounds straightforward, but mis-timing it, mis-calculating it or ignoring the legal and tax rules can expose you to unpleasant surprises. In the 2025/26 UK tax year new thresholds and rules mean the landscape is changing — so directors who don’t keep up risk falling into dividend traps for directors.

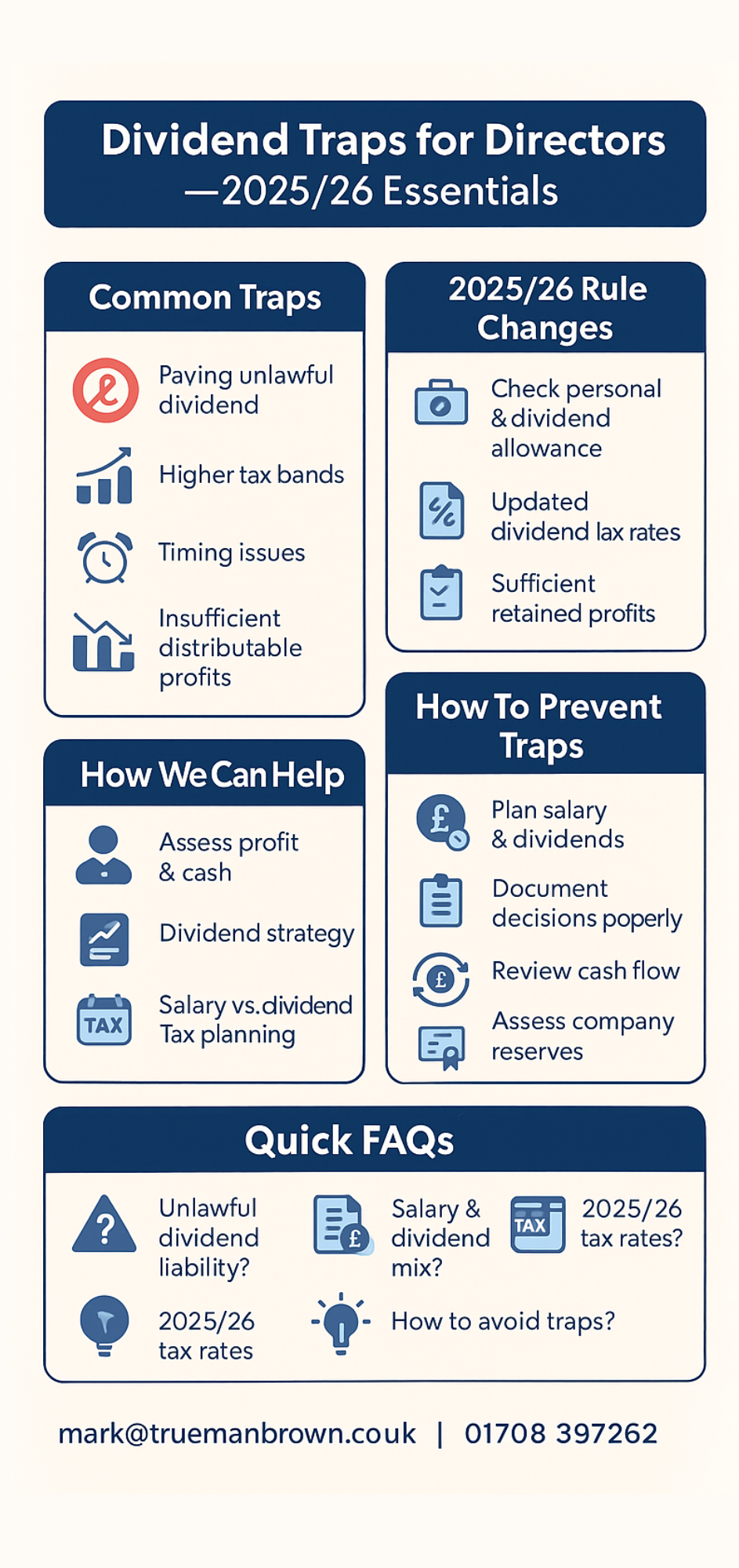

1. What exactly are the dividend traps for directors?

There are several common pitfalls that form the core of dividend traps for directors:

-

Paying a dividend when the company doesn’t have sufficient distributable profits. This can make the dividend unlawful and lead to personal liability.

-

Drawing a dividend that pushes you into a higher tax band, without proper planning, thereby reducing the net benefit.

-

Failing to consider the interaction with salary, national insurance, pension contributions and other company taxes.

-

Ignoring the timing of the dividend: for example, drawing it at a time when the company has cash flow constraints or anticipating profit that doesn’t materialise.

These are key examples of dividend traps for directors that catch many small-company owners off guard.

2. How the 2025/26 tax year changes affect dividend traps for directors

With the tax year 2025/26 upon us, directors must be aware of updated rules which can exacerbate dividend traps for directors if not handled correctly. Some of the key changes:

-

The personal allowance and dividend allowance remain subject to indexation; make sure you check the latest figure before paying a dividend.

-

The dividend tax rates continue to be linked to the individual’s income tax band: for the 2025/26 year the rates for dividend income above the allowance are: 8.75% (basic rate), 33.75% (higher rate) and 39.35% (additional rate). [Note: check HMRC updates].

-

The company must have sufficient retained profits (distributable reserves) at the date the dividend is declared. Drawing a dividend without this remains a core dividend trap for directors.

-

Confirm that the dividend is correctly documented (board minutes or resolution) and that the tax treatment is properly recorded in the company accounts — failing to do so can become a dividend trap for directors if challenged.

-

The interaction with other tax reliefs (e.g., pension contributions, salary versus dividend optimisation) is still highly important in 2025/26 — neglecting this can turn into one of the major dividend traps for directors.

3. Salary vs Dividend – avoiding the wrong move and sidestepping dividend traps for directors

One of the most common scenarios where directors fall into dividend traps for directors is when they choose the wrong mix of salary and dividend. Key points to consider:

-

Paying yourself a modest salary allows you to build NIC (national insurance) qualifying years and may be more tax-efficient up to the primary threshold.

-

Drawing dividends on top only if the company has retained profits and you remain within a comfortable tax band.

-

Avoid using dividends simply to clear retained profits when the company might need those funds for investment or tax liabilities. Over-drawing dividends could force the company into cash shortfall or trigger a recovery of tax reliefs. That becomes a dividend trap for directors.

-

Ensure the timing of dividends makes sense: drawing all profits at year-end without considering future cash flow, tax bills or pension strategy can lead to regret. That’s another form of dividend trap for directors.

4. Legal obligations and company duties – the governance side of dividend traps for directors

Ensuring you meet your legal duties within the company is central to avoiding dividend traps for directors. Important obligations include:

-

Confirming distributable profits exist (i.e., retained earnings less accumulated losses) at the date the dividend is declared. If not, the dividend could be unlawful and you may be personally liable.

-

Making a proper directors’ decision (minute or written resolution) approving the dividend. Poor record-keeping can turn into a dividend trap for directors if HMRC or auditors query it.

-

Updating company accounts, ensuring your reserves position is clear, and that dividend payments are properly recorded. A lurking dividend trap for directors is failure to reflect it correctly.

-

Being mindful of future company liabilities: e.g., tax, pension obligations, possible trading losses — drawing large dividends without leaving sufficient buffer can leave the company exposed. That exposure is another dividend trap for directors.

5. Cash flow, retained profits and avoiding hidden dividend traps for directors

Even when profits exist, cash flow can betray you. Here’s how this aspect drives dividend traps for directors:

-

Retained profits may technically exist, but the company might not have the liquid cash required to pay the dividend without jeopardising other obligations (tax, payroll, supplier payments). Drawing a dividend in that scenario = hidden dividend trap for directors.

-

Consider the timing: if the company has seasonal fluctuations, you might declare a dividend at a “high” cash-moment but then run short during a low period. That planning failure is a dividend trap for directors.

-

Also, remember that the company cannot pay a dividend if doing so would render it insolvent — a breach of company law and a major dividend trap for directors.

-

Retaining some profits in the business may be prudent for future investment or contingency — being too aggressive with dividends can backfire.

6. How Trueman Brown can help you steer clear of dividend traps for directors

When you’re navigating the risks of dividend traps for directors, it’s wise to have experienced advisers in your corner.

At Trueman Brown we offer tailored support to ensure your dividend strategy is sound and aligned with 2025/26 rules.

-

We’ll help you assess whether the company has sufficient distributable profits, review your cash situation and ensure your board minutes and accounting treatment are correct.

-

We’ll model salary vs dividend scenarios for your personal tax position and company tax efficiency, identifying potential dividend traps for directors before they arise.

-

We’ll assist with year-end planning, ensure you’ve considered other tax reliefs (pension, R&D, investment) so your dividend moment is optimised.

-

We’ll help you document everything properly, provide clear advice on timing, and monitor how your dividend strategy interacts with future cash flow and tax liabilities.

Contact us today: mark@truemanbrown.co.uk or phone 01708 397262 and we’ll guide you through avoiding dividend traps for directors.

FAQ – Frequently Asked Questions

Q: What happens if I pay a dividend but the company has no distributable profits?

A: That dividend may be considered unlawful. The company could be required to reverse the payment or you may have personal liability for an unlawful distribution. This is one of the key dividend traps for directors.

Q: Can I draw a dividend and still pay myself a salary?

A: Yes—many company directors choose a modest salary (to maximise NIC and pension benefits) and then draw dividends on top. The key is ensuring you have distributable profits and the timing doesn’t trigger a dividend trap for directors via inadequate cash.

Q: Are dividends taxed differently in 2025/26?

A: Yes. In 2025/26 you must ensure you know the correct dividend tax rates above the allowance. Mistakes here are part of the dividend traps for directors. Ensure you check the latest allowances and rates via HMRC or your adviser.

Q: How can I avoid falling into dividend traps for directors?

A: Review your company’s profit and cash position; ensure you have distributable reserves; plan the salary/dividend mix; ensure documentation is in place; consider company future needs; and engage with a qualified accountant (such as Trueman Brown) to guide you.

Q: If I already drew a dividend and later find out a trap existed, what should I do?

A: Seek professional advice immediately. You may need to rectify the situation (for example repay the dividend, restate accounts or deal with tax/NIC implications). Colouring your mistake as a ‘learning moment’ still means you have to act, because ignoring a dividend trap for directors can worsen the consequences.

Recent Comments