Understanding the Employer National Insurance Rise 2025

The Employer National Insurance rise 2025 announced in the Autumn Budget will take effect from 6 April 2025, significantly impacting payroll costs across the UK.

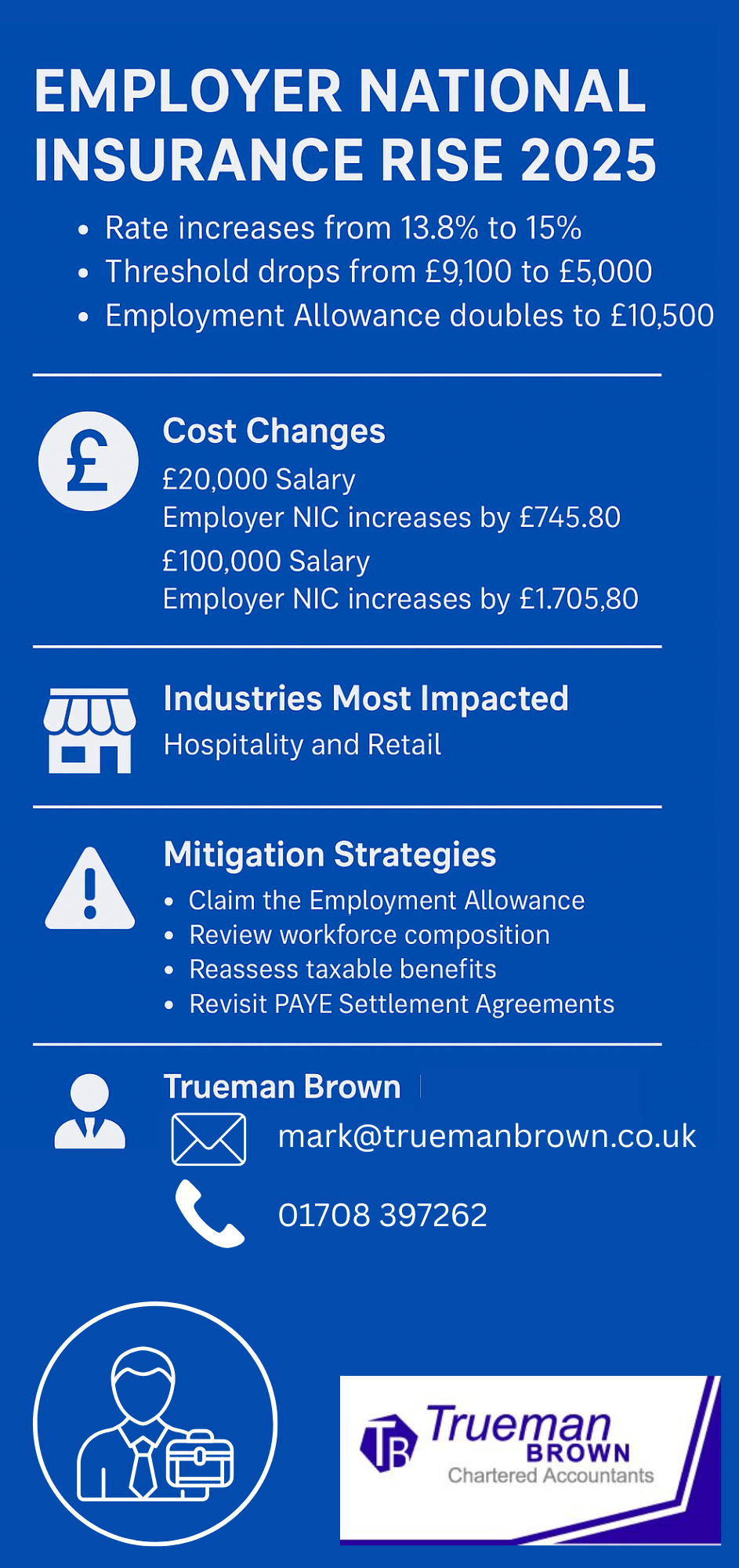

From that date, the secondary Class 1 National Insurance rate increases from 13.8% to 15%, while the secondary threshold will drop from £9,100 to £5,000 — meaning more of your employees’ earnings will attract contributions.

Fortunately, the Employment Allowance will double to £10,500, softening the blow for smaller employers.

What Does the Employer National Insurance Rise 2025 Mean?

For 2025/26, employers will face a 1.2 percentage point increase on most employee earnings above £5,000.

This change also affects Class 1A (benefits in kind) and Class 1B (PAYE Settlement Agreement) contributions, both rising to 15%.

The new rates apply broadly, but exemptions remain for employees under 21, apprentices under 25, armed forces veterans, and staff at special tax sites.

Example Cost Changes Under the Employer National Insurance Rise 2025

-

Employee earning £20,000:

Employer NIC increases from £1,504.20 (2024/25) to £2,250 (2025/26) — up by £745.80. -

Employee earning £100,000:

Employer NIC increases from £12,544.20 (2024/25) to £14,250 (2025/26) — up by £1,705.80.

For small employers using the expanded Employment Allowance, the total bill could even fall if payroll costs remain moderate.

Who Will Feel the Impact Most?

Industries with large numbers of part-time or lower-paid workers — particularly hospitality and retail — will feel the biggest impact.

Since contributions now start from £5,000, many more employees will generate NIC liability for their employers.

How to Mitigate the Employer National Insurance Rise 2025

-

Claim the Employment Allowance – it’s not automatic and can save up to £10,500 per year.

-

Review workforce composition – employing workers under 21 or veterans can reduce liability.

-

Reassess taxable benefits – switching to exempt perks (e.g. cycle-to-work schemes) can cut Class 1A NIC.

-

Revisit PAYE Settlement Agreements – ensure these remain affordable at the new 15% rate.

How Trueman Brown Can Help

At Trueman Brown Chartered Accountants, we understand how the Employer National Insurance rise 2025 affects your business.

Our experts can:

-

Analyse your payroll structure to identify savings.

-

Ensure you’re claiming the full Employment Allowance.

-

Optimise your workforce tax planning for 2025/26 and beyond.

Get in touch today at mark@truemanbrown.co.uk or call 01708 397262 to discuss how we can help your business adapt confidently to the new rules.

FAQs: Employer National Insurance Rise 2025

Q1: When does the new rate take effect?

A: From 6 April 2025, for the 2025/26 tax year.

Q2: What is the new Employer NIC rate?

A: The rate increases from 13.8% to 15%.

Q3: What is the new secondary threshold?

A: It drops from £9,100 to £5,000, meaning more pay is subject to NIC.

Q4: Who is exempt?

A: Employees under 21, apprentices under 25, veterans, and certain special-site workers.

Q5: Can small businesses offset the increase?

A: Yes — the Employment Allowance doubles to £10,500 in 2025/26.

Recent Comments