What was home responsibilities protection?

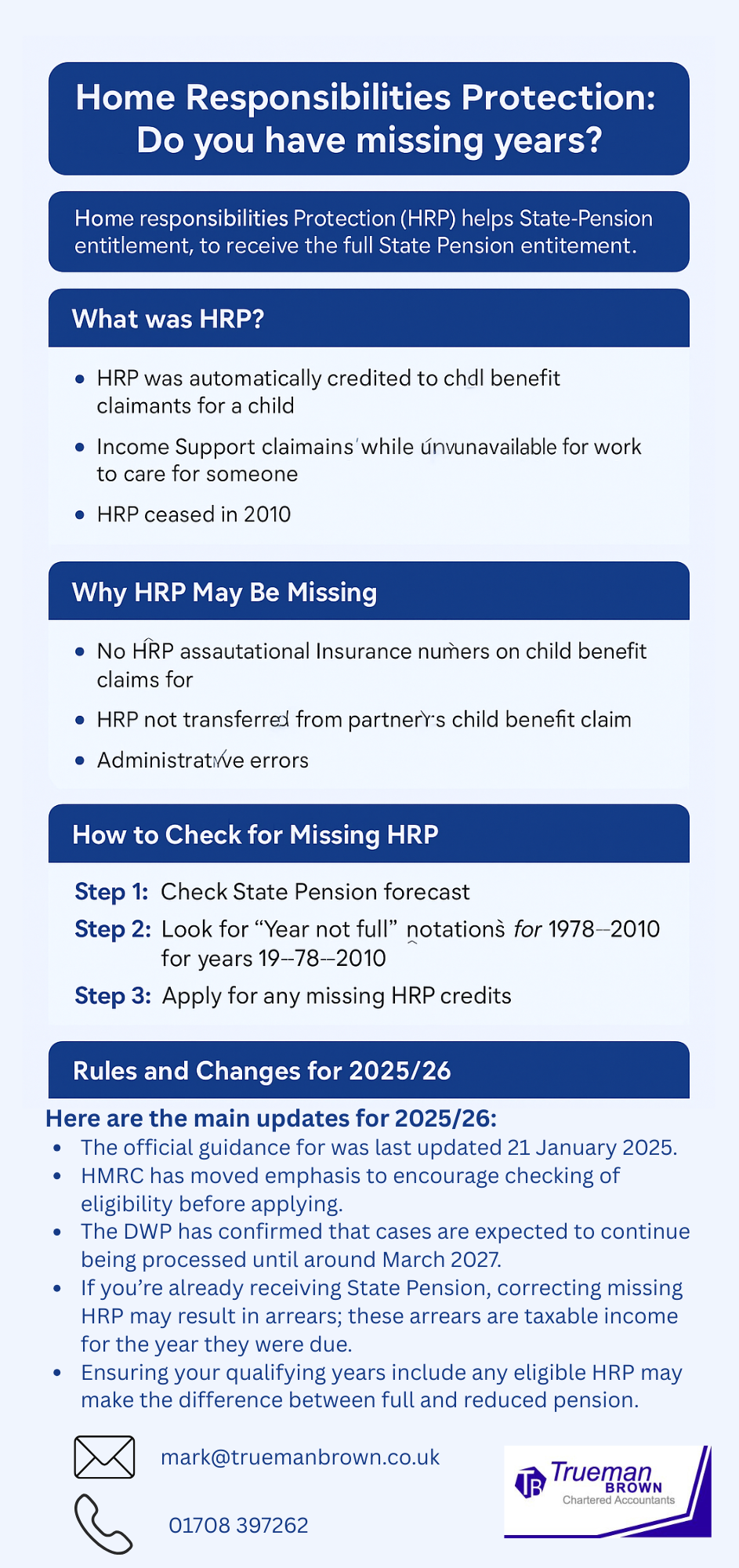

From 6 April 1978 to 5 April 2010, the HRP scheme existed to help parents and carers build up entitlement to the state pension even if their paid work (and corresponding National Insurance contributions) was limited.

Specifically:

-

If you claimed child benefit for a child under 16 between 1978 and 2010, you should have automatically been credited with HRP for full tax years.

-

If you were caring for a sick or disabled person and claimed Income Support while unavailable for work, you may also have been eligible.

-

From 6 April 2010, HRP was replaced by National Insurance credits for caring – the HRP scheme itself ceased after that date

The purpose of the scheme was to reduce the number of qualifying years required, recognising that caring responsibilities may have prevented gainful employment. HRP was designed to ease that impact.

Why you might still be missing home responsibilities protection

Even though the scheme ended in 2010, many people remain unaware that they may not have received all the HRP they were due — meaning their National Insurance record contains gaps, which in turn may reduce their state pension entitlement. Recent investigations reveal significant under-payments linked to missing HRP.

Key reasons include:

-

If your first claim for child benefit was made before May 2000, you may not have provided your National

Insurance number at that time; this means your HRP may not have been recorded.

-

If your partner claimed child benefit and you were the carer, HRP may not have transferred to you unless correctly applied.

-

Administrative errors mean that some eligible years were never captured, and the result is missing qualifying years on your record.

For example, the Department for Work and Pensions (DWP) identified 12,379 under-payments between 8 January 2024 and 31 March 2025 totalling around £104 million.

How to check if you have missing home responsibilities protection

Step 1 – Check your state pension forecast

Your first move should be to log into your personal tax account on the HM Revenue & Customs (HMRC) site and get your State Pension forecast. This will tell you how many qualifying years you have, how many you still need for the full amount, and whether there are gaps in your National Insurance record.

Step 2 – Look for gaps in your NI record for the years 1978-2010

If you see a “Year not full” or similar notation for tax years during which you:

-

were claiming child benefit for a child under 16; or

-

were caring for someone sick or disabled and not available for work;

…then you may have missing HRP credits. This step is particularly important if your child benefit claim began before May 2000.

Step 3 – Apply for missing HRP if eligible

If you believe you’re eligible, you can apply either online or by post.

The guidance on HRP shows that the evidence you may need includes foster-carer letters, local authority confirmations, or allowances/benefits paid to the person you cared for (covering at least 48 weeks of each year claimed).

Processing times vary (some are over 3 months), so the sooner you make your application the better.

Important rules and changes for 2025/26 around home responsibilities protection

While the HRP scheme itself ended in 2010, the rules around missing HRP, applications, and arrears continue to evolve — so it’s key to be up to date. Here are the main updates for 2025/26:

-

The official guidance for “Apply for Home Responsibilities Protection” was last updated 21 January 2025.

-

HMRC has moved emphasis to encourage checking of eligibility before applying, and emphasises that first you must check for gaps and eligibility.

-

The DWP has confirmed that cases are expected to continue being processed until around March 2027.

-

For back-payments, if you’re already receiving State Pension, correcting missing HRP may result in arrears; these arrears are taxable income for the year they were due, not necessarily the year paid.

-

While the full new State Pension still requires 35 years of qualifying years (for those reaching SPA on or after 6 April 2016), ensuring your qualifying years include any eligible HRP may make the difference between full and reduced pension.

So, if you left work to care for children or others between 1978-2010, and especially if you claimed Child Benefit (or your partner did) before May 2000, you should treat this matter as still live for 2025/26 — the application window remains open, and missing HRP could materially affect your pension.

How we at Trueman Brown can help you

If you suspect you might have missing home responsibilities protection, the team at Trueman Brown Chartered Accountants is ready to assist.

We can:

-

Check your National Insurance record and State Pension forecast to identify any potential gaps linked to HRP.

-

Help you assess whether you qualify for HRP and assist in collecting the evidence required (child benefit records, caring-allowance documentation, etc.).

-

Guide you through the online or postal application process for HRP, including tracking your claim and liaising with HMRC if necessary.

-

Advise on the implications of any back-payments (including tax considerations) and how this fits with your broader retirement planning.

If you’d like us to take a look, please contact us at mark@truemanbrown.co.uk or call 01708 397262.

We’d be happy to arrange an initial discussion and see how we can help you maximise your state pension entitlement.

Frequently Asked Questions (FAQ)

Q: What is home responsibilities protection (HRP)?

A: HRP was a scheme running from 6 April 1978 to 5 April 2010 which allowed parents or carers who were not working (or working minimally) to accumulate qualifying years toward the state pension by claiming Child Benefit or certain caring benefits. It effectively reduced the number of paid contribution years needed for those specific circumstances.

Q: Who is eligible to claim missing HRP?

A: If you had full tax years between 1978 and 2010 during which you claimed Child Benefit for a child under 16, or you claimed Income Support while caring for a sick/disabled person, and you have gaps in your NI record for those years — you may be eligible. Also, if you were a foster or kinship carer (in certain years) you might apply.

Q: What happens if I apply and am successful?

A: If your application for missing HRP is accepted, HMRC will update your National Insurance record. If you’re already receiving State Pension, the Department for Work and Pensions (DWP) will be notified and your pension may be increased going forward. If you were underpaid, you might also receive back-payments (arrears).

Q: Will I be taxed on back-payments for missing HRP?

A: Yes — any back-payments are treated as part of your taxable income for the year the pension was meant to be paid, not necessarily the year you receive it. It’s wise to check with a tax adviser or your accountant (such as us at Trueman Brown).

Q: Is there a deadline for applying for missing HRP?

A: While there’s no strict statutory deadline for many claims, the DWP expects the bulk of these cases to be processed by around March 2027. Given the age profile of many affected, acting sooner rather than later is recommended.

Q: I didn’t receive a letter from HMRC — can I still apply?

A: Yes. Even if you did not receive a letter, if you believe you may be missing HRP, you can check your NI record and apply. HMRC’s guidance confirms you should not assume you are unaffected simply because you didn’t get a letter.

If you’d like us to review your specific situation in more detail or help you prepare an application, just drop us a line at mark@truemanbrown.co.uk or call 01708 397262. We’d be glad to assist.

Recent Comments