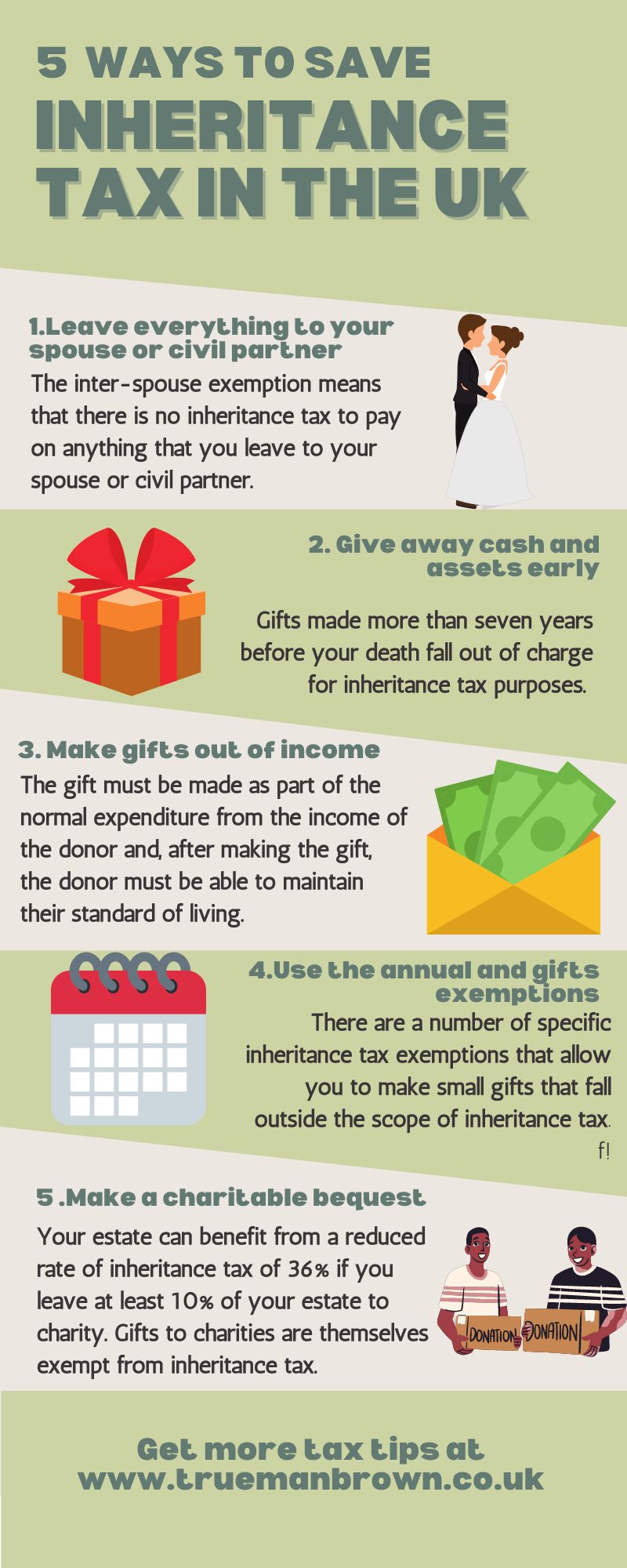

Making use of your inheritance tax allowances

It is often said that inheritance tax is a voluntary tax, and one that can be avoided if you give away sufficient assets at least seven years before you die so the value of your estate is sheltered by your available inheritance tax allowances.

This is not always practical – people do not generally know when they are going to die and they need somewhere to live and the ability to fund their life in the meantime.

However, there are various inheritance tax allowances and exemptions that allow lifetime gifts to be made free of tax even if you die within seven years of making the gift.

Regular payments from income

Gifts that you make from your income do not count as part of your estate for inheritance tax (IHT) purposes as long as you can afford to make the payments after meeting your living costs and the payments are made out of your regular income.

For example, if you have surplus income each month, you could help a child with their rent, pay school fees for a grandchild or provide financial assistance for a relative.

You can give away as much of your surplus regular income as you like, and also take advantage of various inheritance tax allowances and exemptions to make gifts from your capital free of IHT.

Annual exemption (a key inheritance tax allowance)

The annual exemption allows you to make gifts of up to £3,000 a year without them being included in your estate for IHT purposes.

If you did not use your full annual allowance in the previous tax year you can carry forward the unused amount to the next tax year. This form of inheritance tax allowance is a simple way to reduce your estate value tax-efficiently.

Small gift allowance – a smaller but useful inheritance tax allowance

The small gift allowance means that you can make gifts of up to £250 a year to as many people as you like without those gifts counting as part of your estate. However, gifts to the same person cannot benefit from both the small gift allowance and another allowance or exemption. This allowance can be counted among your inheritance tax allowances strategies.

Wedding and civil partnership gifts – an additional inheritance tax allowance

The value of this exemption depends on the relationship between you and the recipient. For gifts to a child: £5,000, for a grandchild: £2,500, for a wedding or civil partnership gift to any other person: £1,000.

The same person can benefit from a wedding/civil partnership gift and other exemptions (but not the small gift allowance).

This is another of the inheritance tax allowances you may apply when planning.

Gifts to spouses and civil partners – unlimited inheritance tax allowance

Gifts to spouses or civil partners can be made free of IHT without limit (provided both are domiciled in the UK). This represents a significant inheritance tax allowance, as it allows for inter-spousal transfers without triggering an IHT charge on those assets.

Nil rate band and residence nil-rate band – core inheritance tax allowances for estates

For 2025/26 the main standard IHT nil rate band remains at £325,000.

In addition, if you pass on your home to your children (including adopted, foster or step-children) or grandchildren, you may benefit from the residence nil-rate band, giving an additional allowance of £175,000.

Thus, if applicable, your estate’s tax-free threshold could be up to £500,000 (for an individual) under the available inheritance tax allowances. For married couples or civil partners, the unused allowances of the first to die can be transferred to the survivor, meaning a combined potential exemption of £1 million.

It is important to note that the residence nil-rate band tapers away for estates with a total value over £2 million (reducing by £1 for every £2 above that threshold).

Also, the government has confirmed that the nil-rate band and residence nil-rate band will remain frozen at these levels until at least 2030.

Other exemptions and lifetime use of inheritance tax allowances

Exemptions also apply for certain gifts to charities, registered clubs, political parties, housing associations and to gifts for national purposes or public benefit.

Beyond these, there are further ways to use your lifetime inheritance tax allowances such as making gifts more than seven years before death (the “7-year rule”), using trust structures, leaving at least 10% to charity (which can reduce the tax rate from 40% to 36%) and applying business property or agricultural reliefs.

Be aware that upcoming reform means that from April 2026 the agricultural property relief and business property relief will be limited (first £1 m exempt, thereafter taxed at half the standard rate).

Also, from April 2027, pension pots will begin to count within your estate for IHT, meaning current unused allowances could reduce in future – so using your inheritance tax allowances now is prudent.

Lifetime gifting and use of inheritance tax allowances

If you make gifts while you are alive, and you die within seven years of making the gift, that gift may still be subject to IHT.

However if you survive seven years the gift falls outside your estate and the relevant inheritance tax allowance has effectively been applied.

The sooner you make use of your allowances, the more effective the planning can be.

Gifts that fall within the annual exemption, small gift allowance, or are made under the regular income rule, will not count towards IHT.

Larger lifetime gifts may utilise the nil-rate band or residence nil-rate band allowances indirectly by reducing the value of your estate.

With freeze of thresholds until at least 2030, using these allowances now makes sense.

How Trueman Brown Chartered Accountants can help – including inheritance tax allowances guidance

At Trueman Brown we understand that inheritance tax allowances are a key part of estate-planning and tax efficiency. We can help you assess and optimise your position — whether you are making lifetime gifts, considering how to pass your home to children or grandchildren, or simply reviewing your current estate strategy.

For personalised advice, please contact Mark at mark@truemanbrown.co.uk or call us on 01708 397262.

We’ll work through your situation, clarify how to use your inheritance tax allowances, help you navigate upcoming changes, and craft a plan that aims to minimise tax exposure while ensuring your wishes are met.

FAQ – inheritance tax allowances

Q1: What are the nil-rate band and residence nil-rate band?

A: The nil-rate band (NRB) is the value of your estate up to which IHT is not charged – for 2025/26 it is £325,000. The residence nil-rate band (RNRB) is an additional allowance of £175,000 if you pass your main residence to direct descendants. Both together are part of your available inheritance tax allowances.

Q2: Can I carry forward unused allowances?

A: You cannot carry forward the nil-rate band or residence nil-rate band themselves, but you can carry forward the annual exemption (up to £3,000) for one year if unused. Small gift allowance and other rules apply each tax year.

Q3: What if I’n married or in a civil partnership – can we combine allowances?

A: Yes. If the first to die doesn’t use all their nil-rate band and/or residence nil-rate band, the unused percentage can be transferred to the surviving spouse or civil partner. This means between you you could potentially pass on up to around £1 million tax-free under current allowances.

Q4: What happens if my estate is worth more than £2 million?

A: The residence nil-rate band starts to reduce (taper) if your estate exceeds £2 million – it falls by £1 for every £2 above the threshold. So if your estate is £2.35 million or more, you may lose the full RNRB. The nil-rate band itself remains at £325,000.

Q5: Do pensions and business assets count towards my estate and inheritance tax allowances?

A: Pensions will start to count towards your estate for IHT from April 2027 – so for now they are excluded, but this upcoming change should encourage earlier planning. Business property relief and agricultural property relief remain, but from April 2026 the relief for farms/business assets will be limited (first £1 m exempt, then taxable at half rate). All these affect how you can best use your inheritance tax allowances.

Q6: How can I make best use of my inheritance tax allowances now?

A: Consider using your annual exemption each year (£3,000), make small gifts (£250 to many individuals), make use of the spousal exemption, put surplus income gifts in place, and review the value of your estate and your home to see whether the residence nil-rate band applies. Gifts made more than seven years before death are also fully outside the estate. Speak to a specialist to ensure you comply with rules and retain access to necessary capital or income.

Recent Comments