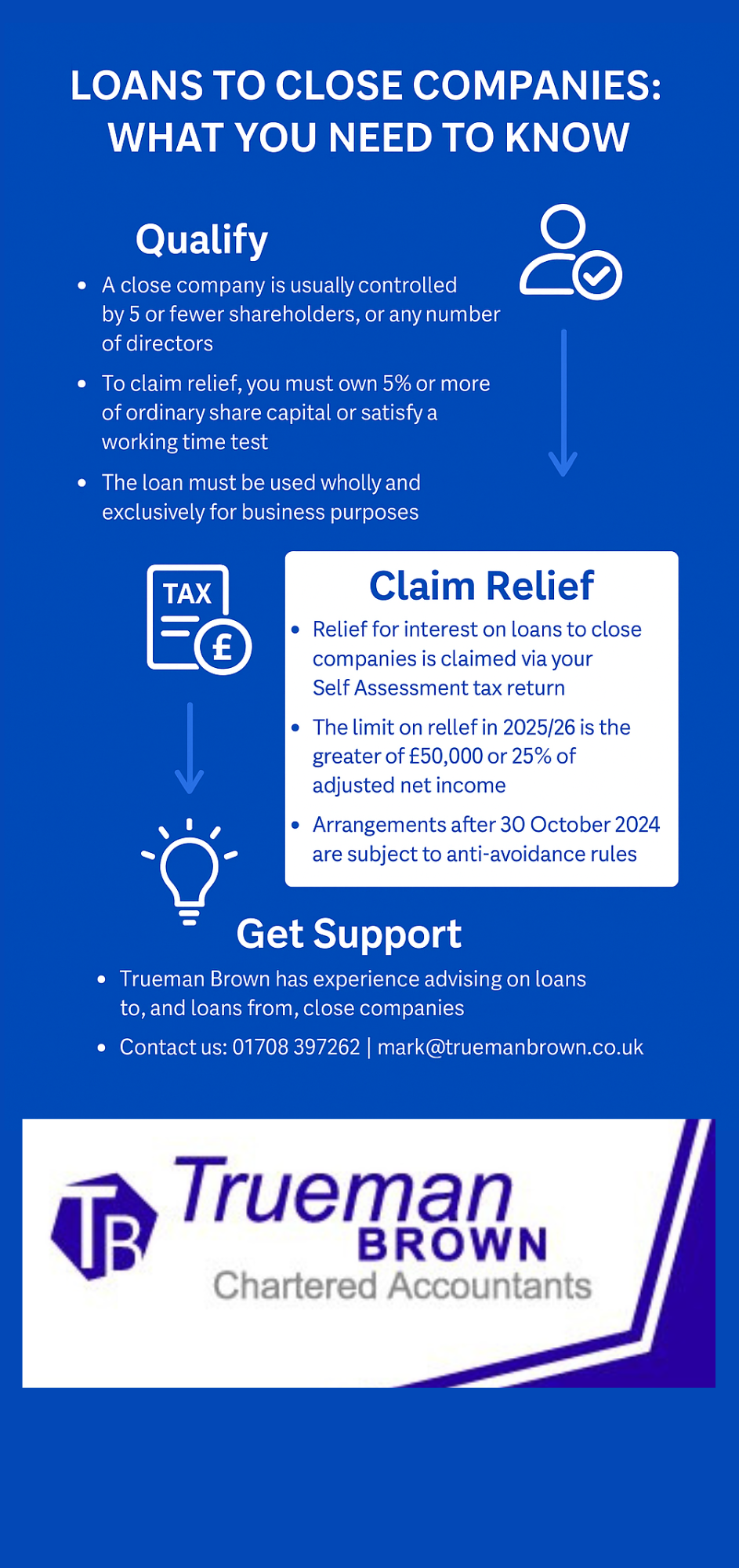

Loans to Close Companies – What You Need to Know

If you’re considering making loans to close companies, it’s important to understand the tax relief rules and changes for the 2025/26 tax year.

At Trueman Brown our local Basildon accountants specialise in helping directors and shareholders navigate the complexities of such arrangements.

In this guide we’ll update you on the most recent rules, eligibility criteria and how we can assist.

What exactly are “loans to close companies”?

A “close company” is typically one controlled by five or fewer shareholders, or by any number of shareholders all of whom are directors.

When an individual lends money to a close company (rather than the company lending to a shareholder), this is one form of loans to close companies.

Provided certain conditions are met, interest paid on those loans may qualify for tax relief.

Equally, when the company lends to shareholders (loans from a close company) there are tax charges.

In short: whether you’re looking at lending to or borrowing from a close company, you need to understand how the rules work and what relief may or may not be available.

Who can qualify for relief on loans to close companies?

In order to claim relief for interest on borrowing used to make loans to close companies, you must satisfy certain tests:

-

You borrow money to lend it to a close company in which you have an interest; or to buy ordinary shares in such a company.

-

You must either own at least 5% of the ordinary share capital (alone or with associates), or you must own some shares and spend the majority of your working time in the management or conduct of the company’s business (or an associated company).

-

The company must be a close company (and not a close investment holding company) and the loan must be used wholly and exclusively for the purposes of the business (or that of an associated company) rather than funding non-business activities.

If all these conditions are met, relief for the interest you pay on the borrowing may be available under the tax rules.

How are loans to close companies treated for tax purposes?

Interest relief on loans to close companies

For tax year 2025/26 the guidance under the HMRC Helpsheet HS340 confirms that interest paid on loans (and alternative finance arrangements) can be relieved where the borrowing is used to lend to a close company in which you have the requisite shareholding or your working involvement.

Importantly:

-

The relief is claimed via your Self Assessment tax return.

-

There are limits: the relief is subject to the limit on income tax reliefs, namely the greater of £50,000 and 25% of adjusted net income.

-

Overdrafts or credit cards are not eligible for this relief.

Loans from a close company (loans to participators)

Be aware: if a close company makes a loan to a shareholder or director (a participator), the company may face a tax charge under s 455 of the Corporation Tax Act 2010.

The rate is currently 33.75% on the outstanding loan amount nine months after the end of the accounting period.

Moreover, from 30 October 2024 (applying for arrangements made on or after that date) the repayment relief under the TAAR (Targeted Anti-Avoidance Rule) within the loans to participators regime has been removed in certain avoidance cases.

So if you are considering loans to close companies, you also need to check if any reverse loan-arrangements (the company lending to you) might trigger a charge.

Key changes for 2025/26 you should know

-

The HS340 guidance (updated April 2025) explicitly lists that relief is available when borrowing is used to buy shares in or lend money to a close company where you own more than 5% (or satisfy the working test).

-

The limit on relief remains: greater of £50,000 and 25% of adjusted net income. Ensure you check your income level accordingly.

-

The anti-avoidance changes under the TAAR for close company loans to participators remain in force for arrangements on/after 30 October 2024. That means more cautious scrutiny around any structure where company money is moving to shareholders or associates.

-

For loans to close companies (i.e. you lending → company) the rules haven’t fundamentally changed, but you must ensure the business purpose is valid, and that it is not accidentally caught as a distribution/advance from the company to you.

-

As ever, records are essential: you’ll need a certificate of interest or alternative finance payments from the lender, and you must retain evidence that the loan was used wholly and exclusively for the business.

Practical considerations for directors and shareholders making loans to close companies

-

Ensure the company is genuinely a trading company (not a close investment holding company) and the money is used exclusively for the business.

-

If you are lending money to your company (i.e. as a shareholder), document the loan, interest terms and ensure you treat it as genuine – otherwise HMRC may challenge relief.

-

Monitor the shareholding and working time tests: if you drop below 5% or cease to perform the majority of work, relief may be lost.

-

Beware the overlap with the loans from a close company rules: don’t inadvertently create a tax charge by mixing up flows of money.

-

For Self Assessment, include the interest relief on your tax return and ensure the limit test is applied.

-

Review structures in place around 30 October 2024 onwards to ensure any arrangements aren’t caught by the TAAR changes.

-

Ask yourself: is the business purpose genuine? HMRC guidance emphasises the “wholly and exclusively for business purposes” test.

Recent Comments