Understanding National Insurance Deferment When You Have Multiple Jobs

When you work more than one job, you may find yourself paying more National Insurance contributions than necessary. HMRC has rules in place to allow employees to apply for a National Insurance deferment so they do not exceed the annual maximum contributions. This can save money and prevent the need to claim a refund at the end of the tax year.

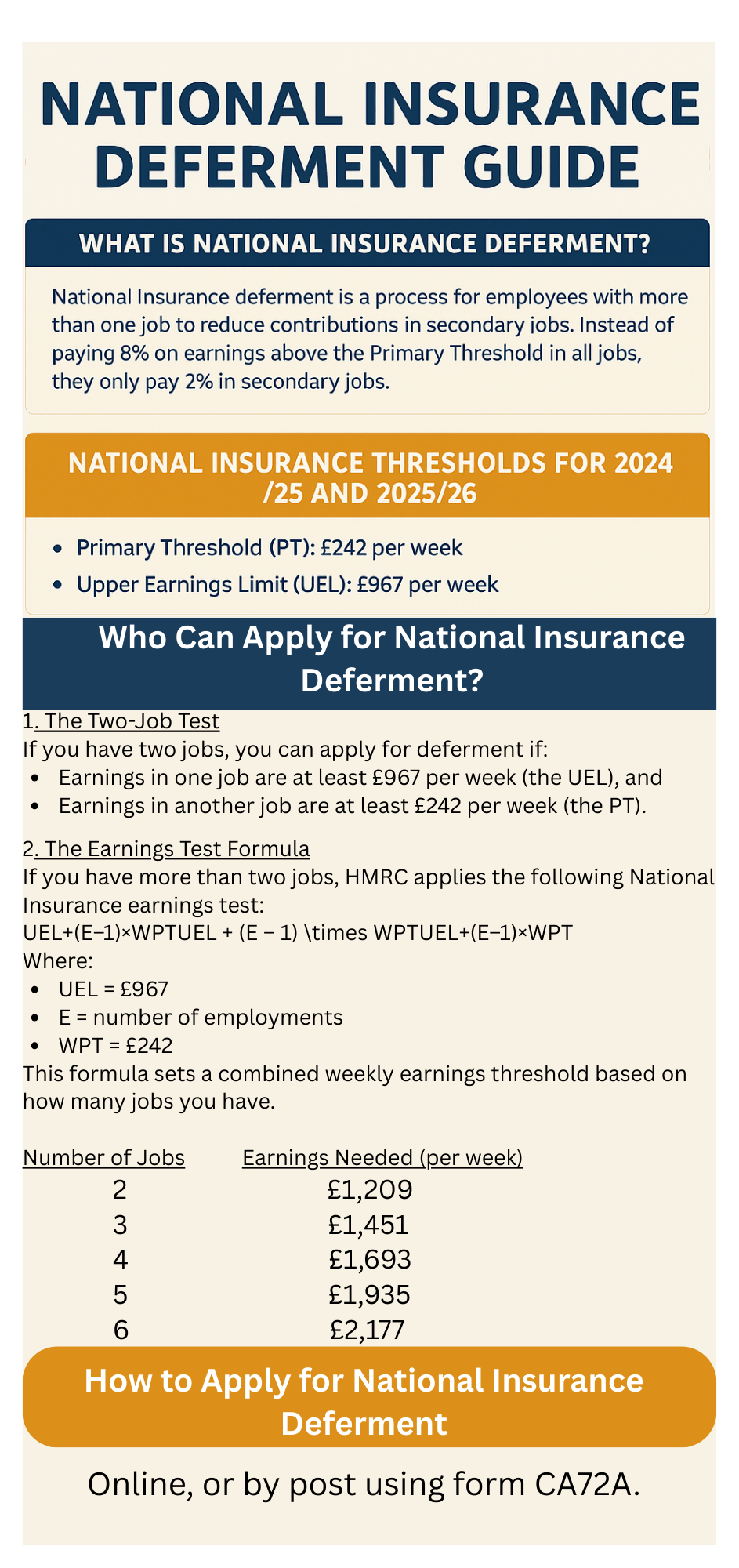

What Is National Insurance Deferment?

National Insurance deferment is a process that allows employees with more than one job to reduce the contributions they pay in secondary jobs. Normally, National Insurance contributions are calculated separately for each job. This can lead to overpayments if your total income across employments exceeds the Upper Earnings Limit (UEL).

By applying for deferment, you ensure that you only pay National Insurance at the main rate in one job, and at the reduced rate of 2% in your other jobs, rather than the standard 8%.

National Insurance Thresholds for 2024/25 and 2025/26

Before considering deferment, it’s important to understand the key National Insurance thresholds for 2024/25 and 2025/26:

-

Primary Threshold (PT): £242 per week

-

Upper Earnings Limit (UEL): £967 per week

These thresholds are used to assess whether you qualify for deferment and how much National Insurance you should be paying.

Who Can Apply for National Insurance Deferment?

There are two main ways to qualify for National Insurance deferment:

1. The Two-Job Test

If you have two jobs, you can apply for deferment if:

-

Earnings in one job are at least £967 per week (the UEL), and

-

Earnings in another job are at least £242 per week (the PT).

In this case, you pay National Insurance at the standard rate in your main job, and only 2% in your secondary job.

2. The Earnings Test Formula

If you have more than two jobs, HMRC applies the following National Insurance earnings test:

UEL+(E–1)×WPTUEL + (E – 1) \times WPT

Where:

-

UEL = £967

-

E = number of employments

-

WPT = £242

This formula sets a combined weekly earnings threshold based on how many jobs you have.

| Number of Jobs | Earnings Needed (per week) |

|---|---|

| 2 | £1,209 |

| 3 | £1,451 |

| 4 | £1,693 |

| 5 | £1,935 |

| 6 | £2,177 |

Once this test is satisfied, you can apply for deferment on jobs not included in meeting the earnings test.

National Insurance Deferment Example

Jack has three jobs:

-

Job 1: £800/week

-

Job 2: £750/week

-

Job 3: £400/week

Jack’s combined earnings from Job 1 and Job 2 are £1,550 per week. This exceeds the three-job threshold of £1,451.

✅ Therefore, Jack can apply for National Insurance deferment on Job 3. This means he will only pay 2% National Insurance on Job 3 earnings above £242 per week, rather than 8%.

How to Apply for National Insurance Deferment

Applications can be made:

-

Online, or

-

By post using form CA72A.

Key deadlines:

-

Apply before the start of the tax year for smooth processing.

-

Postal applications must be received by 14 February of the tax year.

-

Applications after 14 February will only be accepted with the agreement of the employers involved.

-

If you miss the deadline, you can still claim a refund from HMRC after the tax year ends.

How Trueman Brown Helps with National Insurance Deferment

At Trueman Brown, we understand how complex National Insurance rules can be—especially if you work multiple jobs. Our expert tax team helps you:

-

Review your employment income to see if you meet the National Insurance deferment criteria.

-

Complete and submit your deferment application (online or by post).

-

Liaise with employers and HMRC to ensure deferments are correctly applied.

-

Claim back any overpaid National Insurance at the end of the tax year if required.

With Trueman Brown managing the process, you can be confident you won’t pay more National Insurance than necessary.

National Insurance Deferment – FAQs

Q1: Can anyone apply for National Insurance deferment?

No. You must meet the earnings criteria, either under the two-job rule or using the earnings test formula.

Q2: What happens if I miss the deferment deadline?

If your application is late, you can still request a refund after the tax year by contacting HMRC.

Q3: Does deferment reduce the amount of National Insurance I pay overall?

Yes. Instead of paying 8% on earnings above the Primary Threshold in all jobs, you will only pay 2% on secondary jobs.

Q4: Do employers handle deferment automatically?

No. You must apply directly using form CA72A, although your employers will need to apply the deferment once approved.

Q5: Can Trueman Brown apply on my behalf?

Yes. We can manage the entire National Insurance deferment process for you, ensuring compliance and maximising your savings.

Recent Comments