Payrolling Benefits: A Smarter Way to Manage Employee Perks

Employers across the UK are increasingly turning to payrolling benefits as a streamlined alternative to traditional P11D reporting.

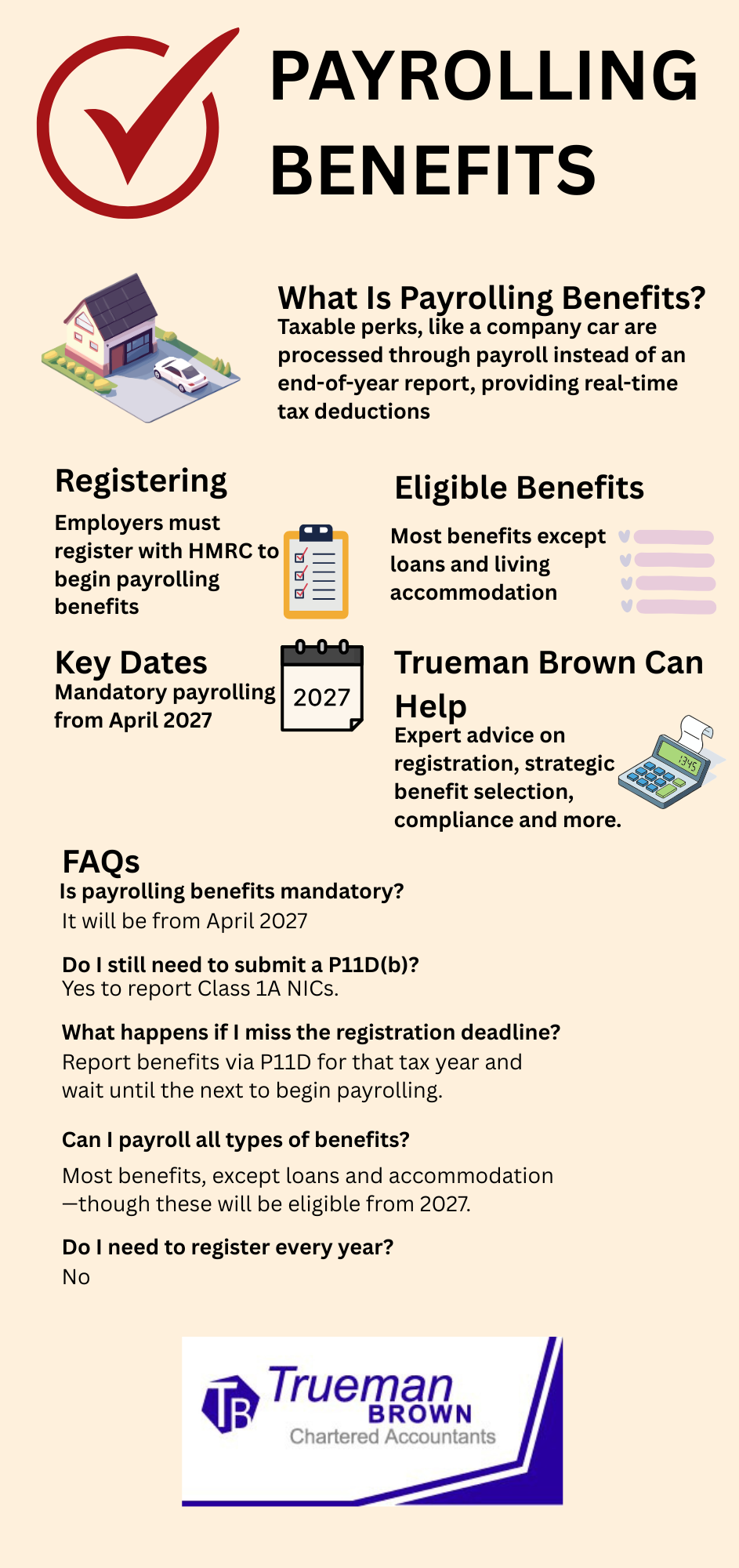

This method allows taxable benefits in kind to be processed through payroll, ensuring real-time tax deductions and simplifying compliance with HMRC regulations.

With mandatory payrolling set to take effect from April 2027, now is the time to understand how this system works and prepare accordingly.

What Is Payrolling Benefits?

Payrolling benefits refers to the process of including the taxable value of employee perks—such as company cars, private medical insurance, or mobile phones—within the payroll system. Instead of reporting these benefits at the end of the tax year via Form P11D, employers deduct Income Tax in real time, treating the benefit as part of the employee’s gross pay.

For example, if an employee receives a company car valued at £4,800 annually, £400 is added to their monthly gross pay for tax purposes.

However, this amount is excluded from National Insurance calculations, as most benefits attract Class 1A NICs rather than Class 1.

Registering for Payrolling Benefits

To begin payrolling benefits, employers must register with HMRC before the start of the relevant tax year—typically by 6 April.

Once registered, the benefits remain active for payrolling until the employer chooses to deregister, which also must be done before the start of the tax year.

Registration is completed via HMRC’s online service: Payrolling Employees’ Taxable Benefits.

Which Benefits Can Be Payrolled?

Currently, most benefits in kind can be payrolled, with the exception of:

- Employment-related loans

- Living accommodation

However, from April 2027, HMRC will allow voluntary payrolling of these previously excluded benefits, aligning with the broader mandate for real-time reporting of all BiKs (Benefits in Kind).

Payrolling Benefits vs. P11D Reporting

While payrolling benefits simplifies tax reporting, employers must still submit Form P11D(b) to declare their Class 1A NIC liability.

This form is due by 6 July following the end of the tax year.

Employers who continue using P11Ds for benefit reporting should consider transitioning early to payrolling, especially with the upcoming 2027 mandate.

Early adoption reduces administrative burden and improves payroll accuracy.

Recent Updates to Payrolling Rules (2025–2026)

HMRC has extended the deadline for mandatory payrolling benefits to April 2027, giving employers more time to prepare. Key updates include:

- Real-Time Reporting: From 2027, all BiKs must be reported via Full Payment Submission (FPS).

- Expanded Eligibility: Employment-related loans and accommodation can be voluntarily payrolled from 2027.

- National Insurance Changes: Employer NIC rates increased to 15% from April 2025, with a lower threshold of £5,000.

These changes make it even more important for businesses to review their payroll systems and ensure they’re ready for the shift.

How Trueman Brown Can Help with Payrolling Benefits

At Trueman Brown Chartered Accountants, we specialise in helping businesses transition smoothly to payrolling benefits. Whether you’re registering for the first time or reviewing your existing setup, our team offers:

- Expert guidance on HMRC registration

- Strategic advice on which benefits to payroll

- Support with Class 1A NIC calculations and P11D(b) submissions

- Ongoing compliance monitoring and deadline management

📧 Email: mark@truemanbrown.co.uk

📞 Call: 01708 397262

Let us help you simplify your payroll and stay ahead of regulatory changes.

FAQs on Payrolling Benefits

Q: Is payrolling benefits mandatory?

Not yet. It becomes mandatory from April 2027, but early adoption is encouraged.

Q: Do I need to register every year?

No. Once registered, benefits remain active until you deregister.

Q: Can I payroll all types of benefits?

Most benefits can be payrolled, except loans and accommodation—though these will be eligible from 2027.

Q: Do I still need to submit a P11D(b)?

Yes. Even if you payroll benefits, you must submit P11D(b) to report Class 1A NICs.

Q: What happens if I miss the registration deadline?

You’ll need to report benefits via P11D for that tax year and wait until the next to begin payrolling.

Recent Comments