New Evidence Requirements for PERSONAL PENSION RELIEF

From 1 September 2025, HMRC introduced new rules that affect how individuals claim PERSONAL PENSION RELIEF.

Previously, higher or additional rate taxpayers could secure relief through their tax code without providing proof.

Now, evidence must be provided to support every claim.

At the same time, HMRC stopped accepting claims by telephone—applications must be made either online or by letter.

Taxpayers who submit a Self Assessment tax return must continue to claim their relief directly through their return rather than using this new process.

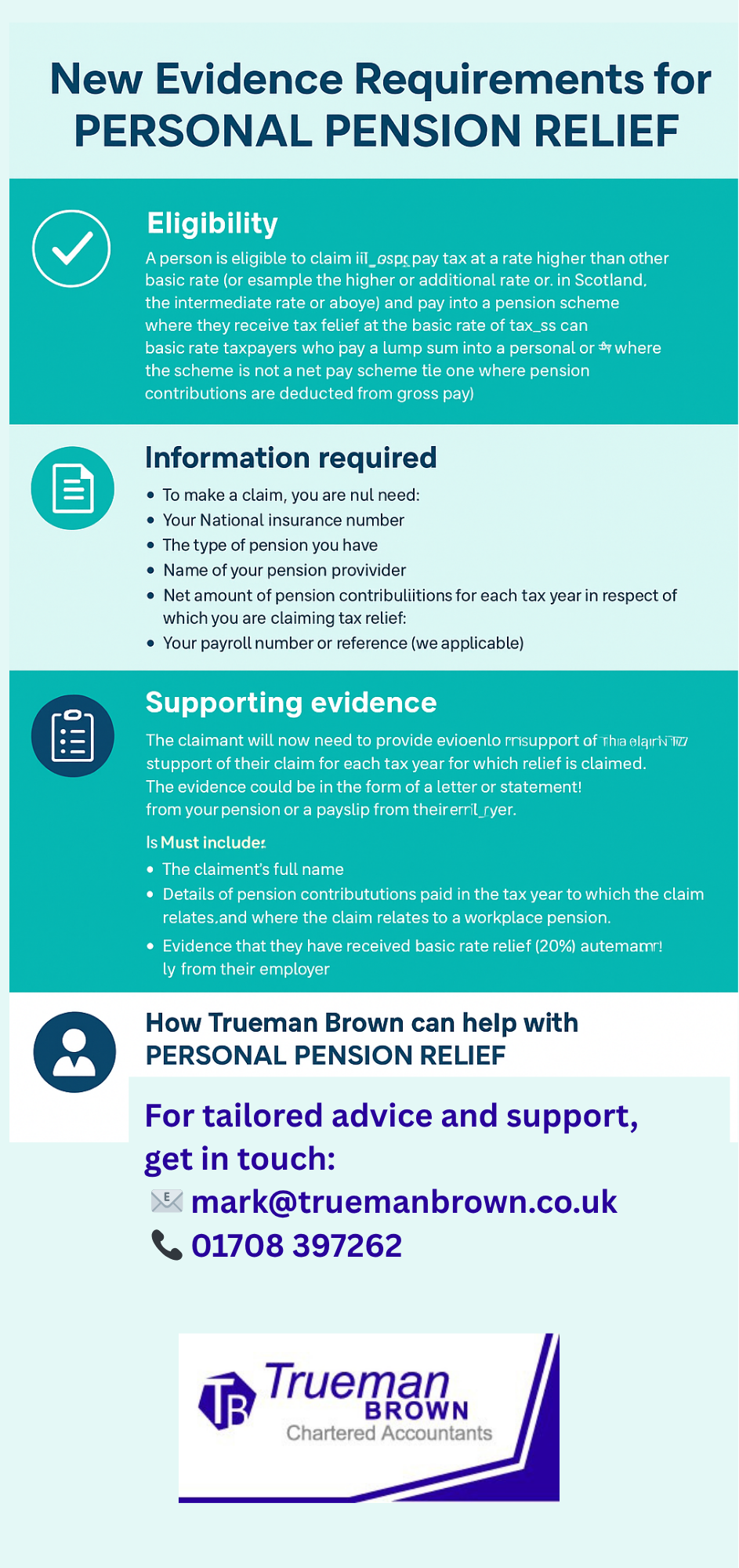

Eligibility for PERSONAL PENSION RELIEF

You may be eligible to claim PERSONAL PENSION RELIEF if you:

-

Pay tax above the basic rate (higher or additional rate taxpayers, or intermediate rate and above in Scotland).

-

Contribute to a pension scheme that only provides basic rate relief at source.

-

Are a basic rate taxpayer paying into a scheme where the employer does not, or will no longer, claim tax relief.

-

Make lump-sum payments into a pension that is not a net pay scheme.

In short, if you are paying more into your pension than you are receiving in tax relief at source, you could be entitled to additional relief.

Information Needed to Claim

When applying for PERSONAL PENSION RELIEF, you must provide the following details:

-

National Insurance number.

-

Type of pension scheme.

-

Pension provider’s name.

-

Net contributions for each tax year.

-

Payroll number or reference (if applicable).

Having these details prepared will make the claim process smoother and faster.

Supporting Evidence for PERSONAL PENSION RELIEF

A significant change is that HMRC now requires evidence for each tax year in which you claim relief. Accepted evidence includes:

-

A statement or letter from your pension provider.

-

A payslip showing contributions.

Evidence must confirm:

-

Your full name.

-

Contributions paid in the relevant tax year.

-

That basic rate relief (20%) has already been applied if the claim relates to a workplace pension

How to Make a Claim

HMRC prefers claims for PERSONAL PENSION RELIEF to be made online via the Gov.uk website.

if you cannot apply online—or an agent applies for you—the claim can instead be submitted by letter. Remember to include all required details and evidence.

HMRC usually responds within 28 working days.

You can also amend a claim after it has been submitted, either online (for online claims) or by sending a follow-up letter (for postal claims).

How Trueman Brown Can Help with PERSONAL PENSION RELIEF

At Trueman Brown, we understand that navigating HMRC’s updated rules on PERSONAL PENSION RELIEF can be daunting. Our team can guide you through the eligibility checks, evidence gathering, and claim submission process, ensuring you receive the full relief you are entitled to.

For tailored advice and support, get in touch:

📧 mark@truemanbrown.co.uk

📞 01708 397262

FAQs on PERSONAL PENSION RELIEF

1. Do I still need to claim if I already complete a Self Assessment tax return?

Yes. You must claim your PERSONAL PENSION RELIEF directly through your return rather than via the new online or letter process.

2. Can I claim by phone?

No. HMRC no longer accepts telephone claims.

3. How long will HMRC take to process my claim?

Typically within 28 working days, though delays are possible during busy periods.

4. What if I forget to include some contributions in my claim?

You can amend your claim later—online if you claimed digitally, or by sending a follow-up letter if you claimed by post.

5. Do basic rate taxpayers ever qualify for PERSONAL PENSION RELIEF?

Yes, if their scheme does not automatically claim relief or if they make lump-sum payments into a non-net pay scheme.

Recent Comments