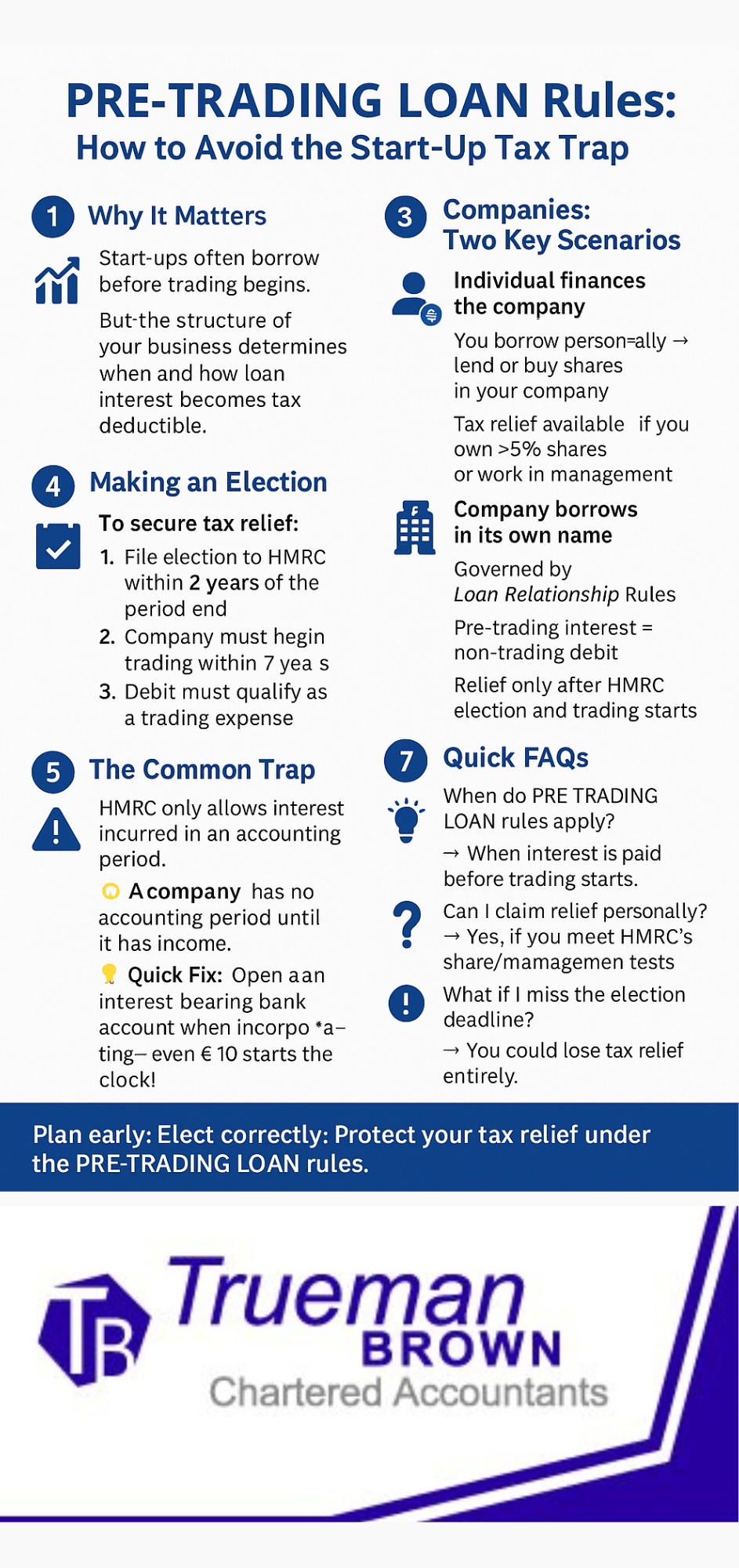

Understanding PRE-TRADING LOAN Rules – Sole Trader vs Company Tax Relief

When starting a new business, it’s common to take out a loan to cover early expenses — perhaps to buy initial stock, pay rent or secure a deposit.

However, how and when interest paid on those loans qualifies for tax relief depends heavily on the business structure.

The PRE-TRADING LOAN rules treat unincorporated and incorporated businesses very differently, and understanding those distinctions can prevent costly mistakes later.

Unincorporated Businesses: The Simple Approach

For a sole trader or partnership, the rules are relatively straightforward.

Any interest incurred before trading begins, but paid personally, is treated as if it were incurred on the first day of trading.

In practice, this means the interest becomes deductible against your first year’s trading profits.

So, for unincorporated businesses, the PRE-TRADING LOAN rules effectively delay tax relief but ensure it is available once trading starts.

Companies: Two Common Scenarios

For limited companies, the picture is more complex. The PRE-TRADING LOAN rules interact with the corporate tax system and the so-called loan relationship rules.

There are two main situations to consider:

1. Individual Finances the Company

If an individual borrows money personally and then lends to or buys shares in their own company, they may be able to claim income tax relief on the interest paid — but only if specific conditions are met.

To qualify:

-

The borrower (and associates) must control more than 5% of the company’s ordinary share capital, or

-

The borrower must work in the company’s management and hold some share capital, however small.

Note: A “close company” is one controlled by five or fewer participators (or by directors who are participators). If the company were to close, more than half of its assets would be distributed to those individuals.

2. Company Borrowing in Its Own Name

When the company itself borrows money, the loan relationship rules govern tax relief.

These rules apply to income and expenses from money debts, such as interest paid or received.

Before the company starts trading, any such interest costs are treated as non-trading debits.

These can’t be immediately deducted against trading profits.

Instead, they’re carried forward to future periods and offset against total profits once available.

Making an Election for Tax Relief

To ensure that pre-trading interest qualifies as a trading expense under the PRE-TRADING LOAN rules, a company must make an election to HMRC.

The conditions are:

-

The election must be made within two years of the end of the accounting period in which the non-trading debit arises;

-

The company must begin to trade within seven years of that period; and

-

The debit would have been a trading expense if incurred once trading had started.

Without this election, tax relief can be delayed or lost entirely.

The Hidden Trap in the PRE-TRADING LOAN Rules

Here’s where many start-ups fall into a “pre-trading loan trap.”

HMRC’s guidance states that interest must be incurred in an accounting period to be allowable. However, an accounting period only begins once the company has a source of income.

Practical Solution:

Open a small, interest-bearing bank account as soon as your company is incorporated. Even a nominal deposit (say £10) will trigger the start of an accounting period.

That small step allows you to submit the election to HMRC and secure tax relief under the PRE-TRADING LOAN rules — provided it’s done within two years of the end of that accounting period.

🤝How Trueman Brown Can Help You With Pre-Trading Loan Rules

Navigating the PRE-TRADING LOAN rules can be tricky, especially for new businesses juggling start-up costs, compliance, and tax planning. The experienced advisers at Trueman Brown can guide you through the process — from determining whether you qualify for relief, to preparing and submitting the correct HMRC elections.

Whether you’re a sole trader or setting up a limited company, we can ensure your pre-trading expenses are structured to maximise tax efficiency and avoid HMRC pitfalls.

📧 Email: mark@truemanbrown.co.uk

📞 Phone: 01708 397262

❓Frequently Asked Questions

Q1: What are the PRE-TRADING LOAN rules?

These are HMRC regulations that determine when and how interest paid before trading starts can be deducted for tax purposes. They differ for individuals and companies.

Q2: When does a company’s accounting period start?

A company’s accounting period begins only when it has a source of income. Opening an interest-bearing bank account is an easy way to trigger this.

Q3: Can I claim tax relief if I lend my own money to my company?

Yes, but only if you meet HMRC’s qualifying conditions — typically owning more than 5% of shares or working in the company’s management.

Q4: What happens if I miss the HMRC election deadline?

If the election isn’t made within two years of the relevant accounting period, the tax relief on pre-trading interest could be lost.

Q5: Who can help me with this process?

Trueman Brown can handle the entire process — from structuring your funding correctly to filing the necessary HMRC elections and ensuring compliance.

Recent Comments