Register for Self-Assessment: What You Need to Know for 2024/25

If you need to register for Self-Assessment and need to submit a tax return for the 2024/25 tax year, it’s vital to act early.

You must register before 5 October 2025 to avoid penalties and to ensure HMRC issues your Unique Taxpayer Reference (UTR) and Notice to File in time.

Failing to register on time could result in a failure to notify penalty, so preparation is key.

Do You Need to Register for Self-Assessment?

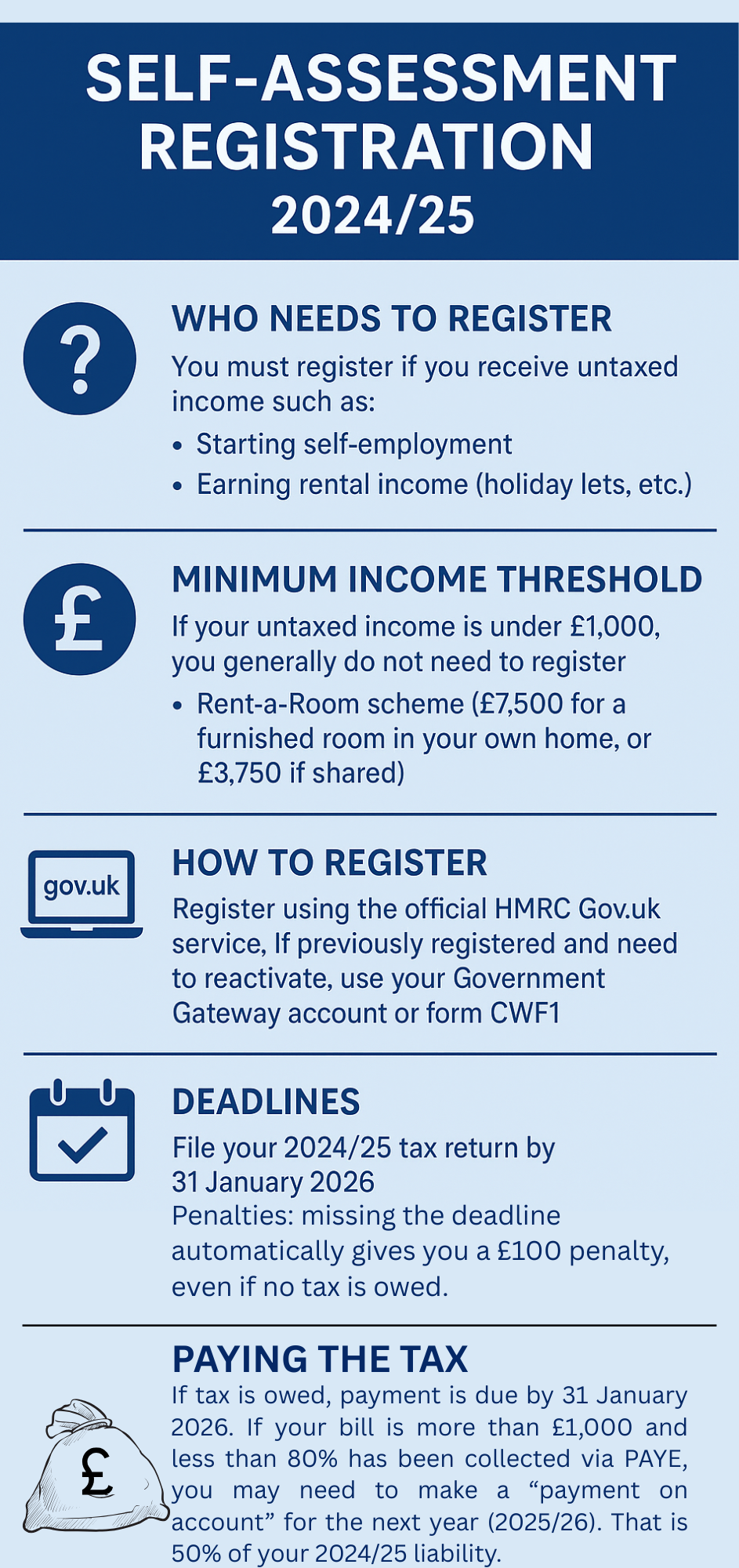

You may need to register for Self-Assessment if you have a new source of untaxed income during the 2024/25 tax year. This can include:

-

Starting a trade or business, even as a side hustle alongside employment.

-

Earning money from property rentals, whether long-term lets or holiday accommodation.

However, not everyone with additional income needs to register. For example:

-

If your self-employment income (before deductions) is under £1,000, you don’t need to register.

-

If your property rental income is under £1,000, you’re also exempt.

-

If you let a furnished room in your home, you can earn up to £7,500 (or £3,750 each if shared) under the rent-a-room scheme before registration is required.

For certainty, HMRC provides a useful tool: Check if you need a tax return.

Already Registered for Self-Assessment Before?

If you’ve previously register for SELF-ASSESSMENT but didn’t file a return for 2023/24, you may need to reactivate your account.

Simply log into your Government Gateway account. If you cannot, complete form CWF1 and submit it to HMRC to re-establish your registration.

How to Register For SELF-ASSESSMENT Online

Registering online is simple and secure via the official Gov.uk service:

-

Allow up to 21 working days for HMRC to process your registration.

-

Once complete, you will be able to access your account and file your return online.

Filing Your Self Assessment Return

After you have registered for SELF-ASSESSMENT you will need to submit your 2024/25 return online by 31 January 2026.

-

You don’t have to wait until January – you can file as soon as you’re ready.

-

Missing the deadline results in an automatic £100 penalty, regardless of whether tax is owed.

If your Notice to File is issued after 31 October 2025 (but you registered by 5 October), you will have three months from the issue date to file.

Paying Your Tax Bill

Once your have registered for SELF-ASSESSMENT and your return filed, you must pay any tax owed by 31 January 2026.

-

If your bill exceeds £1,000, and less than 80% of your tax has already been collected through PAYE, you’ll also need to make a first payment on account for 2025/26.

-

This advance payment is equal to 50% of your 2024/25 liability.

How Trueman Brown Can Help You To Register for Self-Assessment

Navigating SELF-ASSESSMENT REGISTRATION and filing deadlines can feel overwhelming, especially if it’s your first time or if your income streams are complex.

At Trueman Brown, we provide expert advice and hands-on support to ensure you stay compliant, avoid penalties, and make the most of available allowances.

📧 Contact us today at mark@truemanbrown.co.uk

📞 Or call us directly on 01708 397262

Our team will handle the process so you can focus on running your business or managing your property with peace of mind.

FAQs About How To Register For SELF-ASSESSMENT

1. What happens if I register late?

If you register after 5 October 2025, HMRC may issue a penalty for failure to notify.

2. Do I need to register if I earn less than £1,000 from side income?

No – if your total self-employment or property income is under £1,000, you’re covered by the trading or property allowance.

3. How long does registration take?

It can take up to 21 working days for HMRC to confirm your registration and issue your UTR.

4. Can Trueman Brown register for me?

Yes – we can manage your registration and filing on your behalf to save you time and stress.

5. When is the tax return filing deadline?

The online filing deadline for the 2024/25 tax year is 31 January 2026.

Recent Comments