Restarting Child Benefit: What Parents Need to Know in 2025

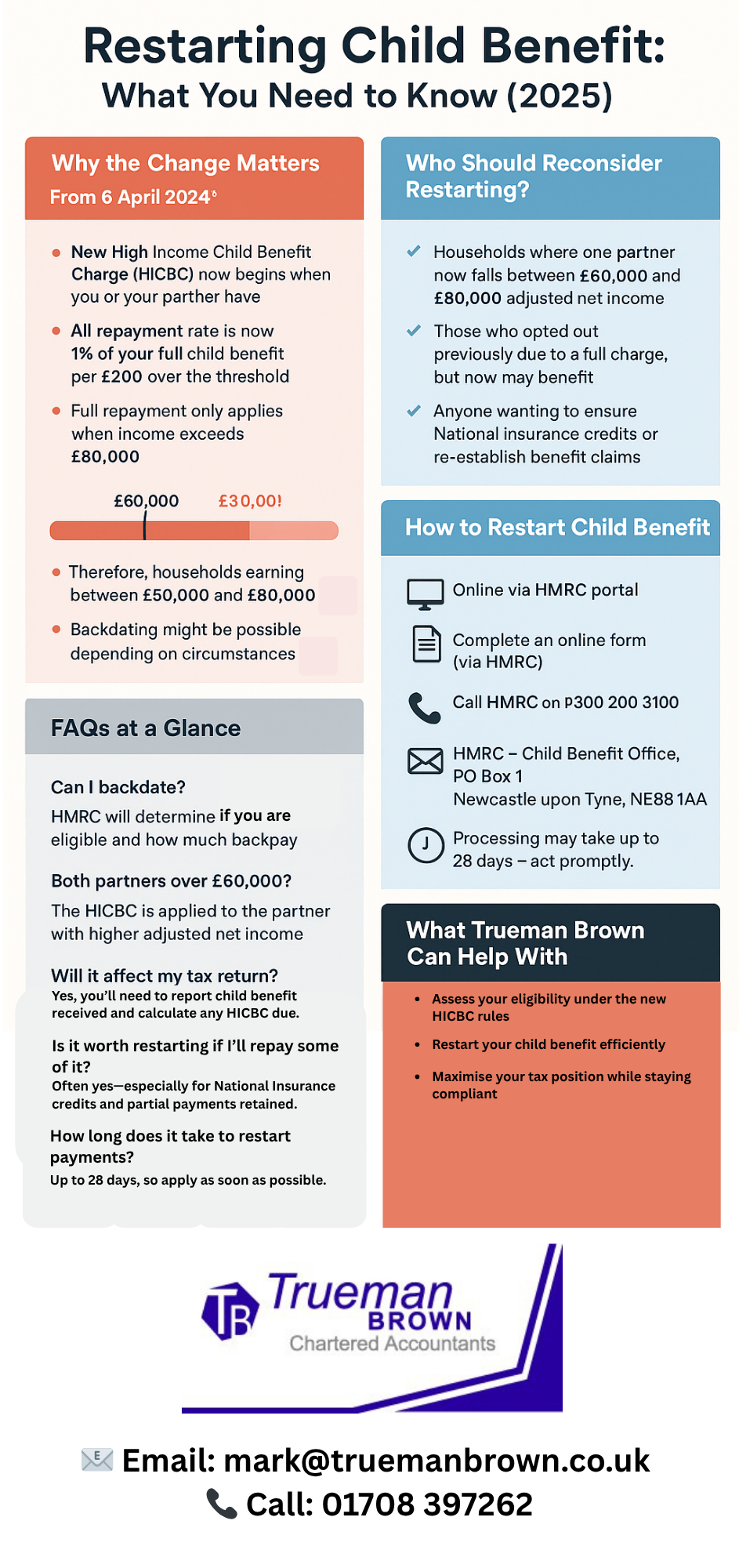

Restarting Child Benefit has become a timely topic for many UK families following the recent changes to the High Income Child Benefit Charge (HICBC).

If you previously opted out of receiving child benefit due to the full repayment requirement, now is the moment to reconsider.

With new thresholds in place from April 2024, thousands of parents may now be eligible to retain some or all of their payments.

Understanding the New HICBC Thresholds

From 6 April 2024, the HICBC applies when either the claimant or their partner has an adjusted net income exceeding £60,000.

The charge is now calculated at 1% of the child benefit for every £200 over the threshold.

This is a significant shift from the previous £50,000 trigger point and £100 increments.

- Full repayment now only applies when income exceeds £80,000.

- Families earning between £60,000 and £80,000 may now retain partial benefit.

- This change makes Restarting Child Benefit a financially worthwhile move for many.

Why Restarting Child Benefit Matters

Even if you’re not eligible for full payments, claiming child benefit ensures you receive National Insurance credits—vital for your future State Pension.

Restarting Child Benefit also helps maintain your child’s eligibility record and can be backdated depending on your circumstances.

Who Should Consider Restarting Child Benefit?

If you or your partner earn between £60,000 and £80,000, and you previously opted out, you may now benefit from restarting payments.

HMRC will assess your eligibility and inform you about any backdated amounts.

Restarting Child Benefit is especially important if:

-

You’re no longer subject to the full HICBC.

-

You want to secure NI credits.

-

You’re unsure about your current entitlement under the new rules.

How to Restart Child Benefit Payments

You can restart payments through:

-

The

-

Completing the online form

-

Calling HMRC at 0300 200 3100

-

Writing to: HMRC – Child Benefit Office, PO Box 1, Newcastle upon Tyne, NE88 1AA

Processing can take up to 28 days, so act promptly to avoid delays.

Trueman Brown: Your Partner in Restarting Child Benefit

Navigating tax changes can be daunting, but Trueman Brown Chartered Accountants are here to help.

Whether you’re unsure about your eligibility or need assistance with restarting your claim, our team offers expert guidance tailored to your situation.

📧 Email: 📞 Call: 01708 397262

We’ll help you:

-

Assess your eligibility under the new HICBC rules

-

Restart your child benefit efficiently

-

Maximise your tax position while staying compliant

FAQs About Restarting Child Benefit

Q: Can I backdate my child benefit if I restart now?

A: HMRC will confirm if you’re eligible for backdated payments and how much you’ll receive.

Q: What if both partners earn over £60,000?

A: The HICBC is charged to the partner with the higher adjusted net income.

Q: Will restarting affect my tax return?

A: Yes, you’ll need to report child benefit received and calculate any HICBC due.

Q: Is it worth restarting if I’ll repay some of it?

A: Often yes—especially for National Insurance credits and partial payments retained.

Q: How long does it take to restart payments?

A: Up to 28 days, so apply as soon as possible.

Recent Comments