Section 455 Tax Refund: Reclaiming the Charge on Director’s Loans

In many personal or family-run companies, company directors borrow money from the company rather than taking out a commercial loan or paying themselves additional salary or dividends.

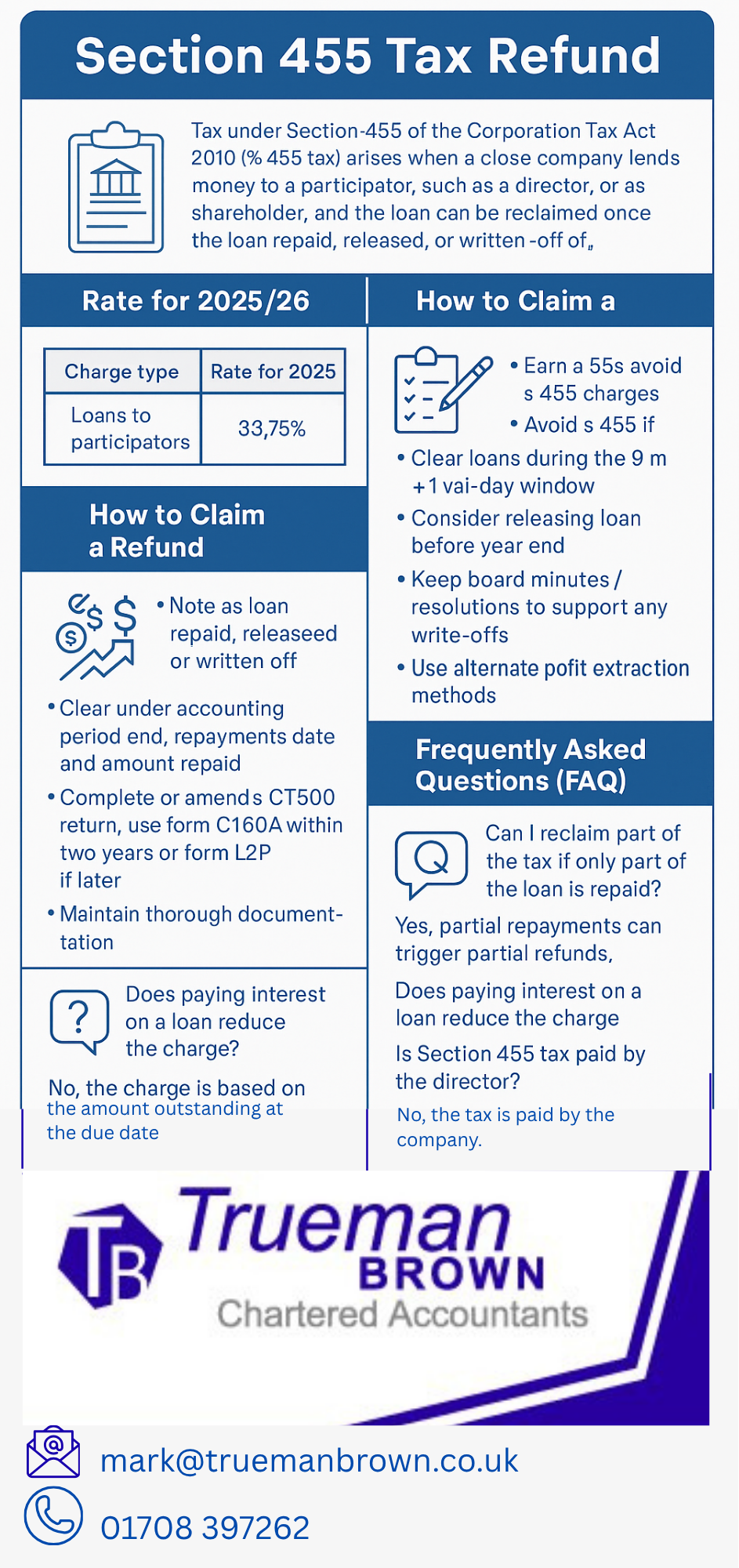

While this may appear convenient, it can trigger a liability to a Section 455 Tax Refund scenario — in other words, the requirement to pay a charge under Corporation Tax Act 2010, section 455 (often shortened to “s 455 tax”) and then reclaim it when the loan is repaid.

Understanding this mechanism is vital for owner-managed businesses, especially for the tax year 2025/26.

Here we explain what triggers a Section 455 Tax refund opportunity, how the charge works, the current 2025/26 rates and rules, how to make a claim, and what you should be doing now.

What is a Section 455 Tax Refund?

When a close company (see definition below) lends money to a participator (for example a director or shareholder) and that loan remains outstanding at the end of the company’s accounting period and also at the corporation tax payment date (nine months and one day after year-end), the company becomes liable for tax under section 455.

The effect is that the company must pay tax on the outstanding loan amount — but critically this is a

temporary tax: once the loan is repaid, written off or otherwise dealt with, the company can claim a Section 455 Tax refund from HMRC.

The term “refund” is used because although the tax is payable by the company at the same time as corporation tax, the company is entitled to reclaim that tax when the underlying loan is cleared.

Which companies are caught?

What is a “close company”?

A “close company” for section 455 purposes is broadly a company controlled by five or fewer participators (shareholders), or by participators who are also directors.

In practice, many small, owner-managed companies fall into this category.

Who is a “participator”?

A participator is someone who participates in the profits or capital of the company — a shareholder or sometimes a director with equity rights.

Loans to associates of participators may also be caught.

What sort of loans trigger the charge?

The loan (or advance) must be from the company to a participator (or associated party), and remain outstanding at the end of the accounting period and at the corporation tax payment date (nine months and one day after year-end). It is not limited to straight director’s loans: any arrangement that results in an amount owed by a participator may trigger the charge.

When does the Section 455 Tax Refund come into play?

If at the year-end of the accounting period the loan (or advance) is outstanding and remains outstanding at the corporation tax due date (nine months and one day after year end), the company must pay the section 455 charge.

However, when the loan is repaid, released or written off, the company can claim a refund of the s 455 tax previously paid.

Important timing points:

-

The loan must be outstanding at year end.

-

The charge arises if it remains unpaid at corporation tax due date (accounting period end + 9 m 1 day).

-

The company becomes eligible for the refund once the loan (or part of it) is cleared. It does not have to wait until the full loan is cleared; partial repayments can trigger partial refunds.

Rate of the Charge & Refund for 2025/26

Here are the current rates and some key figures you need for the 2025/26 tax year:

| Charge type | Rate for 2025/26 | Notes |

|---|---|---|

| Section 455 charge on loans to participators | 33.75% | Applies for loans made on or after 6 April 2022. |

Thus, if the loan remains outstanding at the due date, the company must pay 33.75% of the outstanding balance as s 455 tax.

When the loan is cleared, the company may claim back that amount (the “refund”) via the relevant claim forms.

Key Rule Changes and Reminders for 2025/26

Several important points and recent changes relate to the Section 455 Tax refund and the s 455 regime more broadly:

-

From 30 October 2024, the government introduced changes to strengthen the anti-avoidance rules under the loans to participators regime (including s 455). This means that where arrangements are found to be avoidance schemes, the tax may be payable even if the loan is repaid.

-

The rate remains at 33.75% for the 2025/26 year.

-

The repayment window remains the same: 9 months and one day after accounting period end.

-

It is still essential to report director’s loans and to ensure clear record-keeping. Whilst not specific to s 455 only, oversights in this area increase HMRC risk.

-

Partial repayments can trigger partial refunds; you do not need to wait to clear an entire loan.

-

The claim forms remain: CT600A (supplementary) if reclaiming within 2 years, and L2P if outside that window.

How to Reclaim Your Section 455 Tax Refund

Here’s a step-by-step guide to claiming the refund:

-

At the date when the loan (or part of it) is repaid, released or written off, note the accounting period end, the date of repayment, and the amount repaid.

-

Your company must complete or amend its CT600 return and include the CT600A supplementary page (for reclaim within 2 years) or submit form L2P (for reclaim outside that window) to HMRC.

-

Provide required details:

-

Unique Taxpayer Reference (UTR)

-

Bank details

-

Accounting period start and end dates

-

Date loan made

-

Date loan repaid, released or written off

-

Amount of loan repaid etc.

-

-

Once HMRC processes your claim, the previously paid s 455 tax will be set against any corporation tax due first, with any excess refunded.

-

Maintain documentation: company records, director’s loan account, board minutes for any loan release/write-off etc.

Planning Tips to Maximise Your Section 455 Tax Refund

-

Monitor the director’s loan account(s) regularly—if the loan is cleared within the 9 m + 1 day deadline you avoid any s 455 charge at all.

-

Consider clearing or releasing loans before year end so that the loan is not outstanding at the year end date. If not possible, aim to clear by the corporation tax due date.

-

If you anticipate a loan being outstanding at the deadline, plan for the 33.75% charge and confirm the refund timeline.

-

Ensure board minutes, shareholder resolutions etc support any write-off or release of loans.

-

Be aware of anti-avoidance rules: aggressive structures aimed solely at avoiding the loan account charge may be caught by the new TAAR (targeted anti-avoidance rule) regime introduced for s 455.

-

When extracting profits from the company, consider whether a salary, dividends, pension contributions or director’s loan is most tax efficient — the s 455 regime must form part of that consideration.

How Trueman Brown Chartered Accountants can help you with your Section 455 Tax refund

If you’d like professional support navigating the s 455 charge and reclaim process, we at Trueman Brown are here to help.

Our experts can assist you with:

-

Reviewing your company’s director loan account and identifying any s 455 exposure.

-

Advising on the tax-efficient extraction of funds (salary / dividend / loan) tailored to your circumstances.

-

Preparing the appropriate claim documentation (CT600A, form L2P) and liaising with HMRC on your behalf.

-

Ensuring your company records support any loan write-off or release, to maximise the likelihood of a successful Section 455 Tax refund.

Contact us today:

-

Email: mark@truemanbrown.co.uk

-

Phone: 01708 397262

Let us help you ensure compliance and optimise your position on director loans and the s 455 regime.

Frequently Asked Questions (FAQ)

Q: What happens if a loan is outstanding at year-end but repaid after the corporation tax payment date?

A: In that case the company will have paid the 33.75% s 455 charge. Once the loan is repaid, the company can claim the refund of that tax. The refund does not negate the charge; the refund process simply gives you back the tax paid once the loan is cleared.

Q: Can I reclaim a partial amount of s 455 tax if only part of the loan is repaid?

A: Yes. If part of the loan is repaid or released, you can claim a refund for the corresponding proportion of the tax charged.

Q: Does the rate change each year?

A: Currently, for 2025/26, the rate is 33.75% and that matches the higher rate dividend tax band.

Q: Does paying interest on the loan reduce the s 455 charge?

A: No. The s 455 charge is based on the outstanding loan balance, not interest. If the loan exceeds £10,000 and no interest (or interest below official rate) is charged, other tax consequences (benefit in kind) may apply, but they do not reduce the s 455 charge.

Q: Is the s 455 tax payable by the director or the company?

A: The tax under section 455 is payable by the company. The company will carry the liability and will claim the refund once the loan is cleared.

Q: How long do I have to claim the refund?

A: Generally you have up to four years from the end of the accounting period in which the repayment was made. For earlier periods, you may need to use form L2P.

Q: Are there any avoidance risks?

A: Yes. The government has strengthened the anti-avoidance rules for loans to participators/close companies from 30 October 2024. If arrangements are viewed as designed to avoid the s 455 charge, the charge may be applied even if the loan is repaid.

If you’d like tailored advice on your company’s director loan account or want help processing your Section 455 Tax refund, please reach out to us at mark@truemanbrown.co.uk or call 01708 397262.

Recent Comments