Tax-Efficient Benefits in Kind: Smarter Than Salary or Dividends?

Tax-efficient benefits in kind are becoming a strategic alternative to salary and dividends for directors and employees seeking to reduce their tax burden.

With updated HMRC rules and incentives for electric vehicles, pensions, and salary sacrifice schemes, understanding how to structure your remuneration package around tax-efficient benefits in kind is more important than ever.

What Are Tax-Efficient Benefits in Kind?

Benefits in kind (BiKs) are non-cash perks provided by employers that carry a monetary value. Common examples include:

- Company cars and fuel

- Private medical insurance

- Mobile phones and laptops

- Gym memberships

- Accommodation and interest-free loans

When structured correctly, these can be tax-efficient benefits in kind, reducing both income tax and National Insurance liabilities.

Why Choose Tax-Efficient Benefits in Kind Over Salary?

Salary is taxed at your marginal rate and attracts employee and employer National Insurance.

Dividends, while more tax-efficient than salary, are subject to dividend tax and don’t count toward pensionable earnings.

By contrast, tax-efficient benefits in kind can:

- Lower your overall tax liability

- Offer perks with real-world value

- Be exempt or taxed at reduced rates if structured properly

- Avoid employee National Insurance in many cases

Tax-Efficient Benefits in Kind: 2025–2026 Updates

Recent HMRC updates have made BiKs even more attractive:

-

- Electric Vehicles (EVs): BiK rate remains at 2% for zero-emission cars in 2025–26. A Tesla Model 3 with a £45,000 list price creates just £360 in annual tax for a higher-rate taxpayer

- Salary Sacrifice Schemes: Pension contributions, EV leases, and cycle-to-work schemes remain valid and tax-efficient.

- Mandatory Payrolling: From April 2027, most BiKs must be reported through payroll in real time. Employers should prepare now for this shift.

Structuring Tax-Efficient Benefits in Kind

To maximise efficiency:

- Choose benefits with low BiK rates (EVs, pensions, mobile phones)

- Use salary sacrifice to exchange taxable salary for exempt benefits

- Ensure proper documentation and valuation (P11D or payroll reporting)

- Avoid benefits that trigger high Class 1A NICs without offsetting value

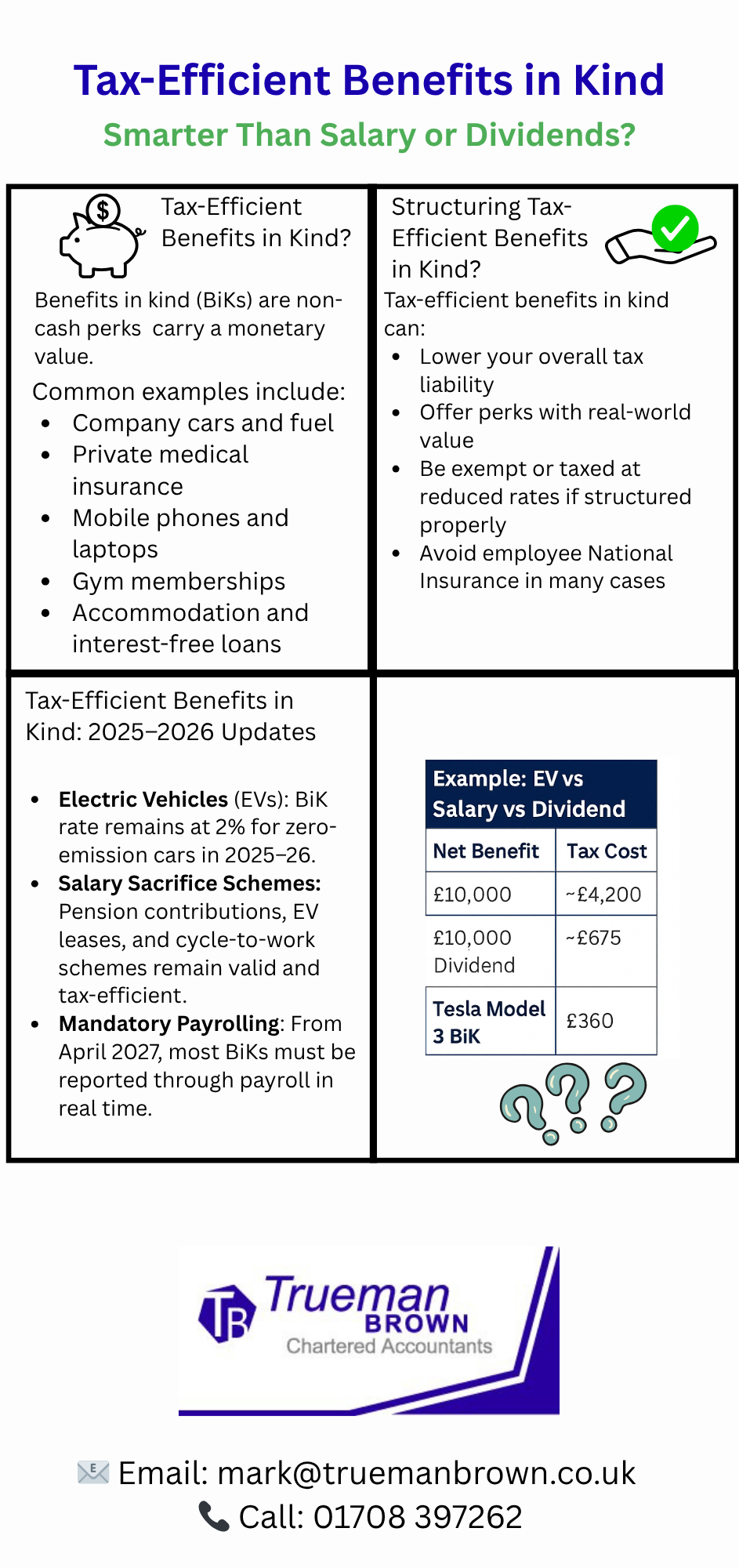

Example: EV vs Salary vs Dividend

|

Option |

Net Benefit |

Tax Cost (Higher Rate) |

|---|---|---|

| £10,000 Salary | ~£5,800 | ~£4,200 |

| £10,000 Dividend | ~£6,750 | ~£3,250 |

| Tesla Model 3 BiK | ~£9,640 | £360 |

Tax-efficient benefits in kind clearly outperform traditional remuneration in this scenario.

How Trueman Brown Can Help You Optimise Tax-Efficient Benefits in Kind

At Trueman Brown, we help directors and employers design tax-efficient remuneration packages using benefits in kind. Whether you’re considering EVs, salary sacrifice, or private medical cover, we’ll guide you through:

- Strategic benefit selection

- HMRC compliance and reporting

- P11D and payroll integration

- Employer and employee tax planning

📧 Email: 📞 Call: 01708 397262

Let’s make your compensation package work harder for you.

FAQ: Tax-Efficient Benefits in Kind

Q1: What are tax-efficient benefits in kind?

They are non-cash perks that reduce your tax liability when structured properly, such as EVs or pensions.

Q2: Are electric vehicles still tax-efficient in 2025?

Yes. EVs attract just 2% BiK rate, making them one of the most efficient benefits available.

Q3: What’s changing with BiK reporting?

From April 2027, most BiKs must be reported through payroll in real time under HMRC’s mandatory payrolling rules.

Q4: Can I use salary sacrifice for benefits in kind?

Yes. Pension contributions, EV leases, and cycle-to-work schemes are valid salary sacrifice options.

Q5: How can Trueman Brown help?

We offer tailored advice, compliance support, and strategic planning to maximise your tax efficiency.

Recent Comments