The tax implications of renting accommodation to your business

When you consider the tax implications renting accommodation to your business, it’s essential to weigh both opportunities and risks from the outset.

Renting a property you own to your company may appear tax-efficient, but the rules have changed for the 2025/26 tax year and you’ll want to ensure you remain compliant while maximising benefit.

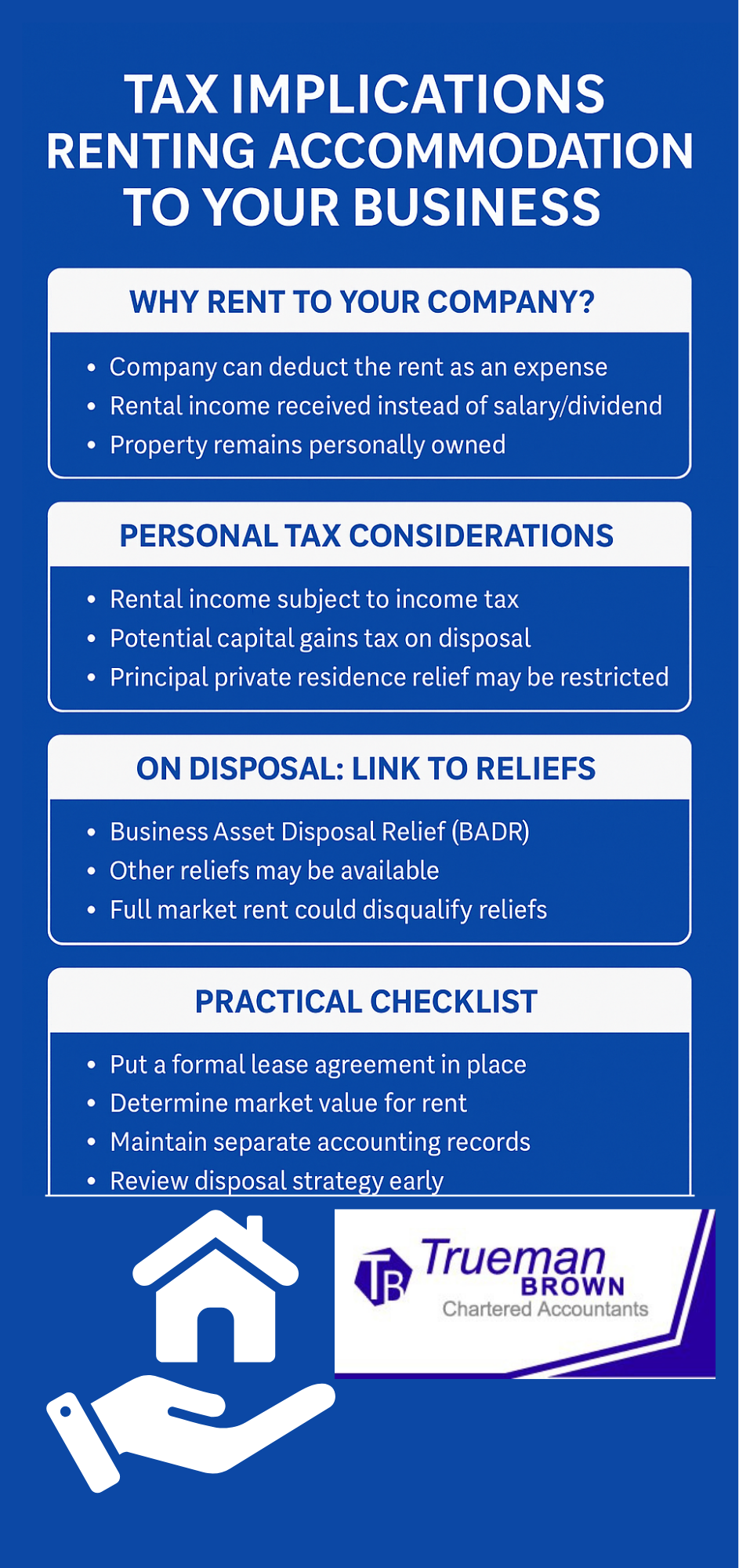

Why rent the property to your company?

Renting a personal or personally-owned property to your company can bring immediate benefits. The tax implications renting accommodation to your business mean that:

-

The company can deduct the rent as a normal expense, reducing its taxable profits.

-

You, as the landlord (director or shareholder), receive rental income rather than salary or dividend, which can avoid National Insurance contributions.

-

You retain ownership of the property personally, offering separation between business and asset ownership.

However, you must remember that the rental income will be subject to income tax on your personal tax return and you must treat the rent at a commercial market rate (or justify the rate) to avoid issues.

Corporately: what the company gains

From the company’s perspective, the tax implications renting accommodation to your business include:

-

Full corporation tax relief on the rent if the arrangement is bona fide and at market value.

-

No employer National Insurance to pay as the rent is not a salary or bonus.

-

Improved cash-flow for the company if the rental cost is less than alternative premises cost.

Nevertheless, it is vital to ensure the lease or tenancy agreement is robust, arms-length terms are set, and that HMRC would regard the arrangement as genuine.

Personal tax for the landlord: things to watch

When you rent your property to your company, you must consider the personal side of the tax implications renting accommodation to your business:

-

Rental income is subject to income tax at your marginal rate, after deducting allowable expenses (e.g., mortgage interest, maintenance, repairs).

-

If the property is your former private residence or mixed-use, there may be other considerations around principal private residence relief.

-

On disposal of the property, capital gains tax could apply — and this links into the reliefs discussed below.

On disposal: link to reliefs & 2025/26 changes

One of the most critical areas where the tax implications renting accommodation to your business come into play is at the point of disposal of either the property or the business.

Previously, it was common to hold the premises personally so that your exit from the business could be structured to benefit from Business Asset Disposal Relief (BADR).

What’s changed for 2025/26: Tax implications renting accommodation to your business

-

From 6 April 2025, the CGT rate for BADR qualifying gains increased from 10% to 14%.

-

From 6 April 2026 it will increase further to 18%.

-

The lifetime gains limit remains at £1 million.

-

Anti-forestalling rules apply for contracts entered into between 30 October 2024 and 6 April 2025.

If you rent property to your company and subsequently dispose of it, the tax treatment will need careful analysis:-

-

If the company pays full market rent, the property may be treated as an investment asset rather than a business asset, potentially disqualifying some reliefs.

-

If rent is below market or the property is treated differently, relief may be partially available but subject to apportionment.

Hence the tax implications renting accommodation to your business demand proactive planning.

Practical checklist when renting to your business

To manage the tax implications renting accommodation to your business, you should ensure:

-

A formal lease agreement is in place setting the rent, term, review provisions, and market terms.

-

The rent is evidenced as market value (e.g., via a valuation or comparable rents).

-

The property is used wholly and exclusively by the business (or the business has sole exclusive use) if relying on business asset reliefs.

-

You maintain separate accounting records: the company shows rent expense; you show rental income and expenses personally.

-

You review the disposal strategy early, given the 2025/26 changes to BADR and CGT.

-

Regularly assess whether the arrangement remains commercially justifiable and not purely tax-motivated.

How Trueman Brown can help you with the tax implications renting accommodation to your business

If you’d like to understand the tax implications renting accommodation to your business and how they apply in your circumstances for 2025/26 and beyond, Trueman Brown can assist.

We can help you:

-

Draft or review the lease agreement with your company.

-

Determine the appropriate rent and market comparables.

-

Advise on the personal tax and corporation tax treatment.

-

Plan the exit/disposal strategy to optimise the availability of reliefs such as BADR.

-

Keep you informed of upcoming changes to tax legislation.

For tailored advice, please contact us at:

📧 mark@truemanbrown.co.uk

📞 01708 397262

We look forward to helping you navigate the complexities and mitigate risk.

Frequently Asked Questions with the tax implications renting accommodation to your business (FAQ)

Q 1. Does the rent I charge to my company have to be exactly the market rate?

Yes, ideally you should charge a rent at or close to market value. The tax implications renting accommodation to your business are affected if the rent is significantly above or below market, as HMRC may challenge the arrangement.

Q 2. If the property is retained personally, can I still claim relief when I sell the business?

Possibly — but you must ensure that the property was used by the business and meets the conditions for BADR (or other reliefs). Charging full market rent could convert the property to an investment asset meaning relief might be lost or reduced.

Q 3. I rent the property to my company and then later sell the property — what CGT rate applies?

If your disposal qualifies for BADR and you meet all conditions, the CGT rate is 14% for disposals between 6 April 2025 and 5 April 2026. After that the rate is 18%. If it doesn’t qualify, the standard CGT rates on property apply.

Q 4. What happens if I don’t have a formal lease with the company?

Without a formal lease the arrangement may be challenged. For the tax implications renting accommodation to your business, the absence of a properly documented lease can undermine the legitimacy of the rent deduction and relief claims.

Q 5. Do I need to review the arrangement each year?

Yes – annual review is prudent. The commercial justification, market rent, and usage should be revisited. Also, given the recent tax changes (2025/26 onwards), your overall strategy may need adjustments.

Recent Comments