Unlocking Tax Relief on Business Loans: What UK Businesses Need to Know

Securing tax relief on business loans can significantly reduce the cost of borrowing for UK businesses.

Whether you’re financing new equipment, expanding operations, or injecting working capital, understanding how and when interest qualifies for relief is essential to avoid costly mistakes and maximise deductions.

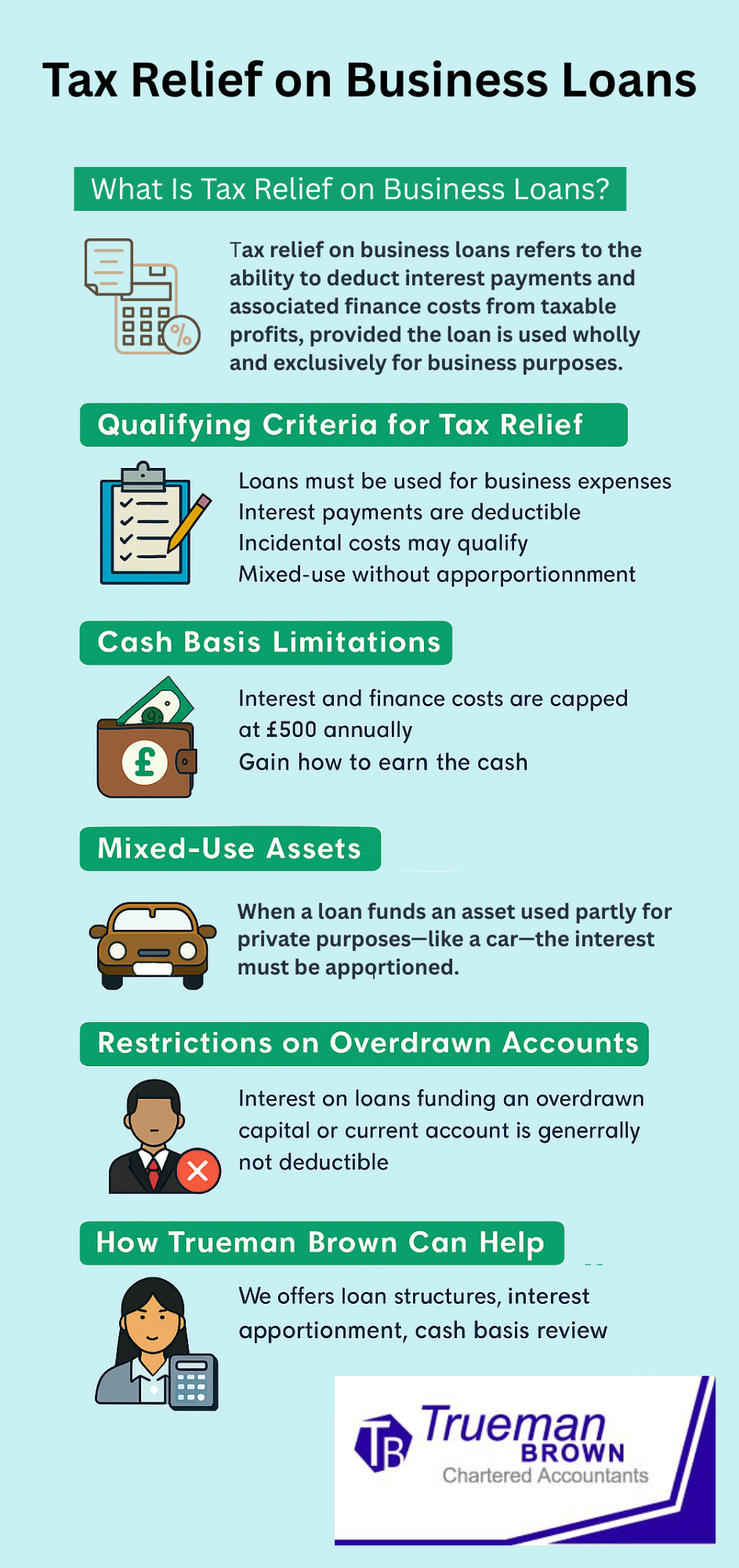

What Is Tax Relief on Business Loans?

Tax relief on business loans refers to the ability to deduct interest payments and associated finance costs from taxable profits, provided the loan is used wholly and exclusively for business purposes.

This includes loans for purchasing capital assets like machinery, vehicles, or property improvements.

Qualifying Criteria for Tax Relief

To claim tax relief on business loans, the loan must meet HMRC’s “wholly and exclusively” test. This means:

- The loan must be used for business-related expenses.

- Interest payments—not capital repayments—are deductible.

- Incidental costs like arrangement fees may also qualify.

For example, interest on a loan used to buy a van for business deliveries is deductible, but the repayment of the loan principal is not.

Even if a loan starts as qualifying, relief can be lost if:

-

The capital is repaid (even partially).

-

Funds are re-borrowed for non-qualifying purposes.

-

The loan is used for mixed personal and business use without proper apportionment.

A typical scenario: Bob borrows £100,000 and lends it to his business. If £50,000 is repaid within a year, half the interest relief is lost.

Re-borrowing the same amount shortly after does not reinstate the relief.

Tax Relief on Business Loans Under the Cash Basis

Businesses using the cash basis for accounting face restrictions. Interest and finance costs are capped at £500 annually.

If your business exceeds this threshold, consider opting out of the cash basis to claim full relief.

Key update for 2025: HMRC continues to enforce the £500 cap under the cash basis. Businesses anticipating higher interest costs should switch to accruals-based accounting to preserve full deductibility.

Mixed-Use Assets and Interest Apportionment

When a loan funds an asset used partly for private purposes—like a car—the interest must be apportioned.

For instance, if a vehicle is used 40% for business, only 40% of the loan interest is deductible.

However, if you claim mileage using HMRC’s fixed rate, no interest deduction is allowed.

Interest paid on loans used to fund an overdrawn capital or current account is generally not deductible.

HMRC treats this as a personal expense unless clear business use is demonstrated.

How Trueman Brown Can Help You Claim Tax Relief on Business Loans

At Trueman Brown Chartered Accountants, we specialise in helping businesses navigate HMRC’s complex rules around tax relief on business loans. Our services include:

- Loan Structuring Advice: Ensuring your borrowing qualifies for relief from day one.

- Interest Apportionment: Calculating allowable deductions for mixed-use assets.

- Cash Basis Review: Advising whether to opt out for full relief.

- Ongoing Compliance: Monitoring loan repayments to preserve relief eligibility.

📧 Email: 📞 Call: 01708 397262

Let us help you maximise your deductions and stay compliant.

Q1: Can I claim relief on a personal loan used for business?

Yes, if the funds are introduced into the business and used exclusively for qualifying business purposes.

Q2: Is capital repayment ever deductible?

No. Only interest and incidental finance costs qualify.

Q3: What if I repay part of the loan early?

Partial repayments reduce the qualifying loan balance, which may reduce or eliminate future relief.

Q4: Can I claim relief under the cash basis?

Yes, but only up to £500 annually. Consider switching to accruals-based accounting if costs exceed this.

Q5: What records do I need?

Maintain clear documentation showing the loan purpose, interest payments, and business use of funded assets.

Recent Comments