Termination Payments and National Insurance: What Employers Must Know in 2024

When ending an employment contract, understanding the link between termination payments and National Insurance is critical.

Whether you’re handling redundancy, negotiated exits, or furlough transitions, HMRC rules require employers to correctly classify and report payments—especially those exceeding £30,000.

What Are Termination Payments?

Termination payments are any sums paid to an employee when their employment ends. These may include:

- Statutory redundancy pay

- Payment in lieu of notice (PILON)

- Ex gratia or discretionary lump sums

- Compensation for breach of contract

- Payments for restrictive covenants

Each type of payment has different tax and National Insurance implications.

Misclassification can lead to unexpected liabilities under HMRC’s Real Time Information (RTI) system.

Tax Treatment of Termination Payments and National Insurance

Termination payments are split into two categories:

-

Contractual payments: taxed as earnings and subject to Class 1 National Insurance

-

Non-contractual payments: may qualify for the £30,000 tax exemption and are not subject to employee NIC

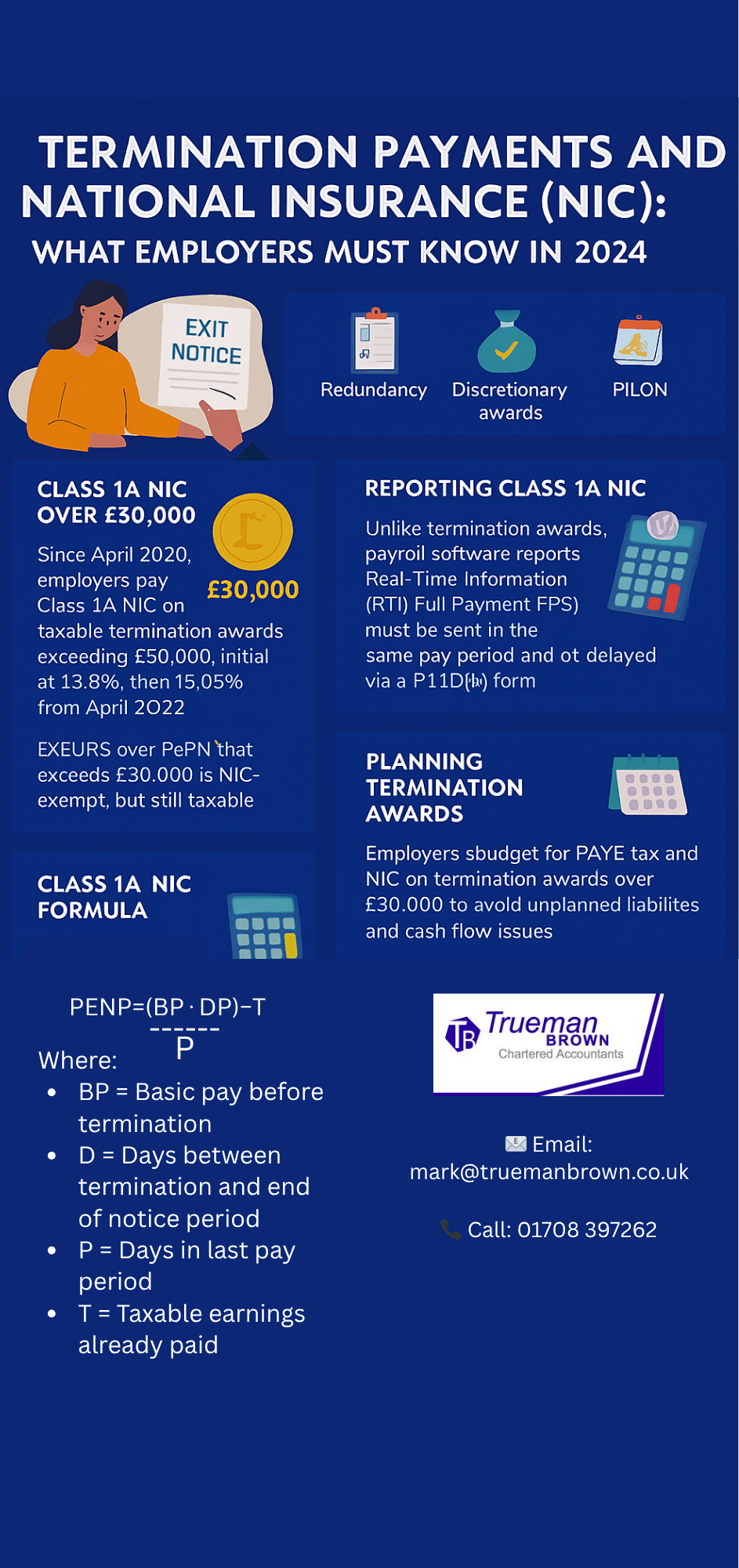

However, since 6 April 2020, employers must pay Class 1A National Insurance on the taxable portion of termination payments that exceed £30,000. This rate increased to 15.05% from April 2022.

PILON and PENP: Key Calculations

Payment in lieu of notice (PILON) is now treated as general earnings, even if not explicitly stated in the contract. HMRC uses the Post-Employment Notice Pay (PENP) formula to determine the taxable portion.

PENP Formula:

Where:

-

BP = Basic pay before termination

-

D = Days between termination and end of notice period

-

P = Days in last pay period

-

T = Taxable earnings already paid

Any amount above PENP may qualify for the £30,000 exemption, but the excess is still subject to Class 1A National Insurance.

Reporting Termination Payments and National Insurance to HMRC

Unlike Class 1A NIC on benefits-in-kind (reported via P11D(b)), Class 1A NIC on termination payments must be reported via RTI Full Payment Submission (FPS) in the same period the payment is made.

Payment deadlines are:

-

By 22nd of the month (electronic)

-

By 19th of the month (cheque)

This ensures alignment with PAYE and Class 1 NIC liabilities.

Example: Calculating Class 1A NIC on Termination Payments

An employee receives a termination payment of £100,000. Their PENP is £15,000, so the excess is £85,000.

The first £30,000 is tax-free.

The remaining £55,000 is taxable and subject to Class 1A NIC.

At 13.8%, the employer pays £7,590 in Class 1A NIC. This must be submitted with PAYE for the same period.

Budgeting for Termination Payments and National Insurance

Employers must budget not only for the gross termination award but also for:

-

PAYE tax on taxable elements

-

Class 1 NIC on contractual payments

-

Class 1A NIC on excess over £30,000

Failure to plan for these costs can lead to cash flow issues and HMRC penalties.

How Trueman Brown Can Help

At Trueman Brown, we help businesses across Essex and beyond manage the tax and NIC implications of termination payments. Our services include:

-

Structuring termination packages tax-efficiently

-

Calculating PENP and Class 1A NIC

-

RTI reporting and compliance

-

HMRC dispute resolution

📧 Email: 📞 Call: 01708 397262

Let us help you stay compliant and cost-effective when managing employee exits.

-

Class 1A NIC on excess over £30,000

Failure to plan for these costs can lead to cash flow issues and HMRC penalties.

How Trueman Brown Can Help

At Trueman Brown, we help businesses across Essex and beyond manage the tax and NIC implications of termination payments. Our services include:

-

Structuring termination packages tax-efficiently

-

Calculating PENP and Class 1A NIC

-

RTI reporting and compliance

-

HMRC dispute resolution

📧 Email: 📞 Call: 01708 397262

Let us help you stay compliant and cost-effective when managing employee exits.

FAQs: Termination Payments and National Insurance

Q1: Are termination payments always subject to National Insurance?

No. Only contractual payments and taxable portions over £30,000 attract NIC. Employee NIC is not due on the excess, but employer Class 1A NIC is.

Q2: What is Class 1A NIC and when is it applied?

Class 1A NIC is a charge on employers for taxable benefits and termination payments over £30,000. It’s currently 15.05% and must be reported via RTI.

Q3: Is PILON always taxable?

Yes. Since April 2018, PILON is treated as general earnings and taxed under PAYE, regardless of contract wording.

Q4: How do I report Class 1A NIC on termination payments?

Via RTI FPS in the same period the payment is made—not through the P11D(b) process used for benefits-in-kind.

Q5: Can Trueman Brown help with termination payment planning?

Absolutely. We offer tailored advice, calculations, and HMRC reporting support to ensure full compliance.

Recent Comments