Employers, are you paying the Minimum Wage in 2025/26?

If you run a business in Essex, getting Thurrock minimum wage compliance right is non-negotiable.

From 1 April 2025 to 31 March 2026, the National Living Wage (NLW) and National Minimum Wage (NMW) have risen, with stricter enforcement and a higher accommodation offset.

This guide explains who’s entitled, what counts as pay, how to avoid common mistakes, and how to calculate the new rates so your Thurrock minimum wage compliance stays watertight.

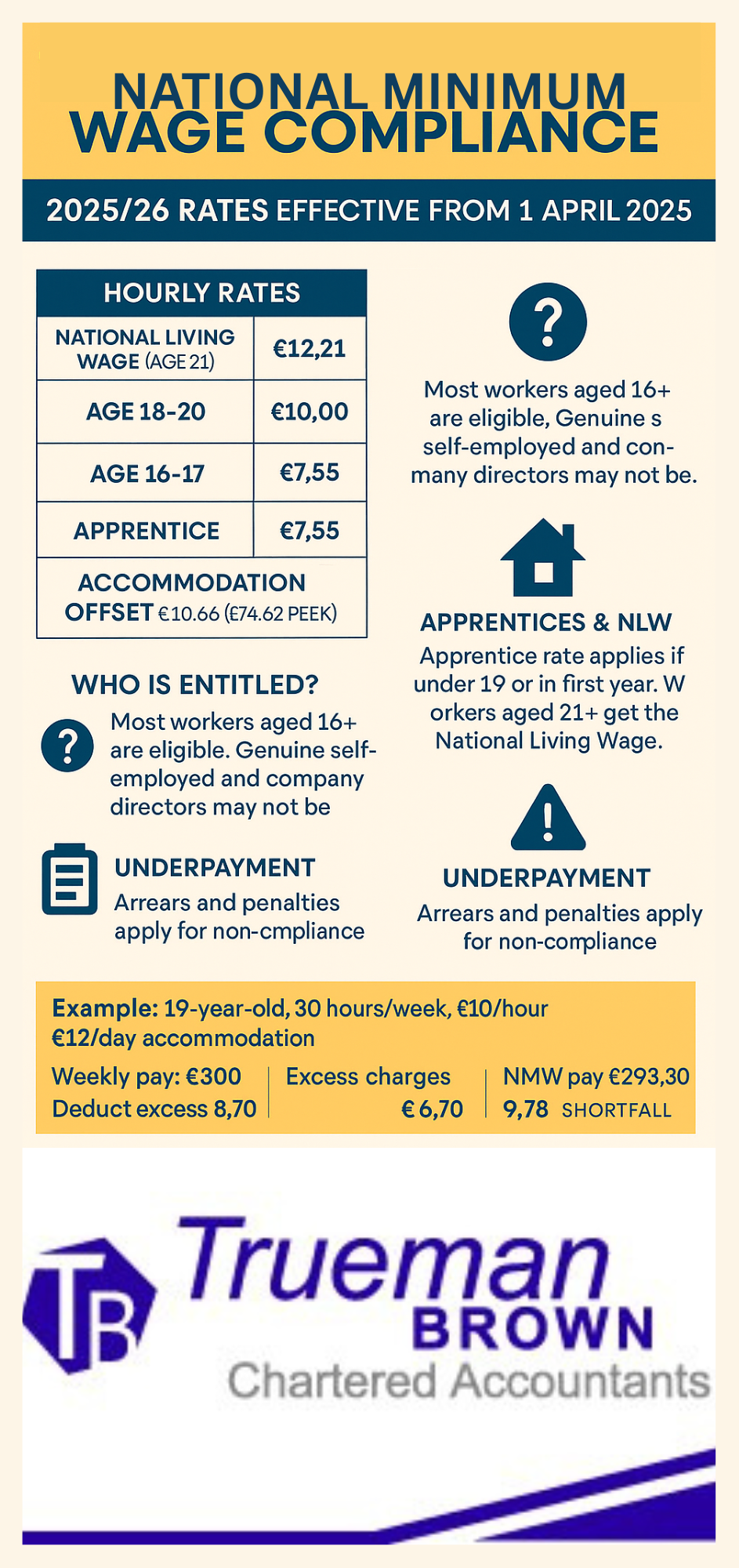

2025/26 statutory rates at a glance (effective 1 April 2025)

| Category | Hourly rate |

|---|---|

| National Living Wage (age 21+) | £12.21 |

| Age 18–20 | £10.00 |

| Age 16–17 | £7.55 |

| Apprentice (under 19, or 19+ in first year) | £7.55 |

Accommodation offset (maximum amount that can count towards pay when accommodation is provided):

£10.66 per day (£74.62 per week).

Who is entitled — and how that affects Thurrock minimum wage compliance

Most workers over school-leaving age are entitled to NMW/NLW, including part-time staff, agency workers, zero-hours workers, trainees and apprentices.

Directors without a contract of employment, genuine self-employed contractors, volunteers and some live-in family workers are excluded.

Ensuring the right status is step one in Thurrock minimum wage compliance.

What counts towards pay (and what doesn’t)

Include: basic pay and most performance-related pay.

Exclude: tips and service charges not paid through payroll, deductions for items you require staff to buy for work (e.g., uniforms/tools), and most non-cash perks. If you provide accommodation, apply the accommodation offset correctly to maintain Thurrock minimum wage compliance.

Thurrock minimum wage compliance: the accommodation offset explained

If you charge more than £10.66/day, the excess reduces pay for minimum wage purposes. If you charge less (or nothing), add up to £10.66/day to pay for the calculation.

Misapplying this rule is a common reason HMRC finds Thurrock minimum wage compliance failures.

Age bands, apprentices, and the 21+ NLW

Since April 2024 the NLW applies from age 21 (still true in 2025/26). Apprentices under 19—or 19+ in their first year—can be paid the apprentice rate; after the first year, they must get the rate for their age.

Keep robust onboarding checks to sustain Thurrock minimum wage compliance.

Worked examples to protect your Thurrock minimum wage compliance

Example A — 21-year-old on salaried hours

-

Contracted 40 hours/week; monthly salary £2,115.

-

Equivalent hourly rate (assuming 52 weeks ÷ 12 ≈ 4.333 weeks/month):

40 × 4.333 = 173.32 hours; £2,115 ÷ 173.32 ≈ £12.20 → Non-compliant (below £12.21). -

Raise salary to at least £2,118 to hit £12.21.

Example B — 19-year-old with accommodation

-

30 hours at £10.00/hour = £300.

-

Accommodation charged at £12/day for 5 days = £60. Offset max is 5 × £10.66 = £53.30.

-

Excess £6.70 reduces pay counted towards NMW: £300 − £6.70 = £293.30 → effective hourly £9.78 (shortfall).

-

Reduce charge to £10.66/day or increase pay to keep Thurrock minimum wage compliance.

Record-keeping that proves Thurrock minimum wage compliance

Keep: hours worked (including salaried hours regimes), pay records, deductions/charges, apprenticeship evidence, and age/date-of-birth changes.

Retain for at least 3 years and be ready for HMRC spot checks that test your Thurrock minimum wage compliance.

Penalties and naming — why Thurrock minimum wage compliance matters

Underpayment triggers arrears (back to the point of underpayment) and financial penalties (up to 200% of arrears, subject to caps), and employers can be named publicly.

HMRC targets sectors with complex pay patterns and accommodation—staying ahead on Thurrock minimum wage compliance protects your brand and budget.

Sector pitfalls that trip up Thurrock minimum wage compliance

-

Hospitality/retail: uniforms, till shortages, unpaid pre-shift tasks.

-

Care/transport: unpaid travel time between visits.

-

Construction: mis-classified self-employment; apprentices on wrong rate after year one.

-

Leisure: deductions for training or equipment. Tight controls keep Thurrock minimum wage compliance intact.

How Trueman Brown can help (Thurrock minimum wage compliance specialists)

Need a hands-on review of contracts, payroll, salaried hours, and accommodation charges?

We offer:

-

A NMW/NLW health-check and risk report.

-

Payroll configuration for 2025/26 rates and alerts when birthdays or year-two apprenticeship thresholds hit.

-

Back-pay calculations, arrears modelling, and HMRC enquiry support.

Speak to us today: mark@truemanbrown.co.uk or 01708 397262.

Let’s lock in your Thurrock minimum wage compliance.

FAQ (2025/26)

When do the 2025/26 rates apply?

From 1 April 2025 until 31 March 2026.

What are the main rates this year?

£12.21 (21+), £10.00 (18–20), £7.55 (16–17), £7.55 (apprentice).

What’s changed for apprentices?

The apprentice rate rose sharply to £7.55; after year one (and if aged 19+), pay the age-appropriate rate.

How do accommodation charges affect pay?

Apply the £10.66/day (£74.62/week) offset. Charging more reduces pay that counts for NMW calculations.

Does the NLW still start at age 21?

Yes, the NLW applies from 21 and over for 2025/26.

Where can I check official guidance quickly?

See GOV.UK for current rates and the accommodation rules, plus ACAS for entitlement guidance.

These are the sources we use to keep your Thurrock minimum wage compliance current.

Sources for 2025/26 updates: UK Government announcements and Low Pay Commission materials confirming the rates from 1 April 2025, and accommodation offset rules.

Recent Comments