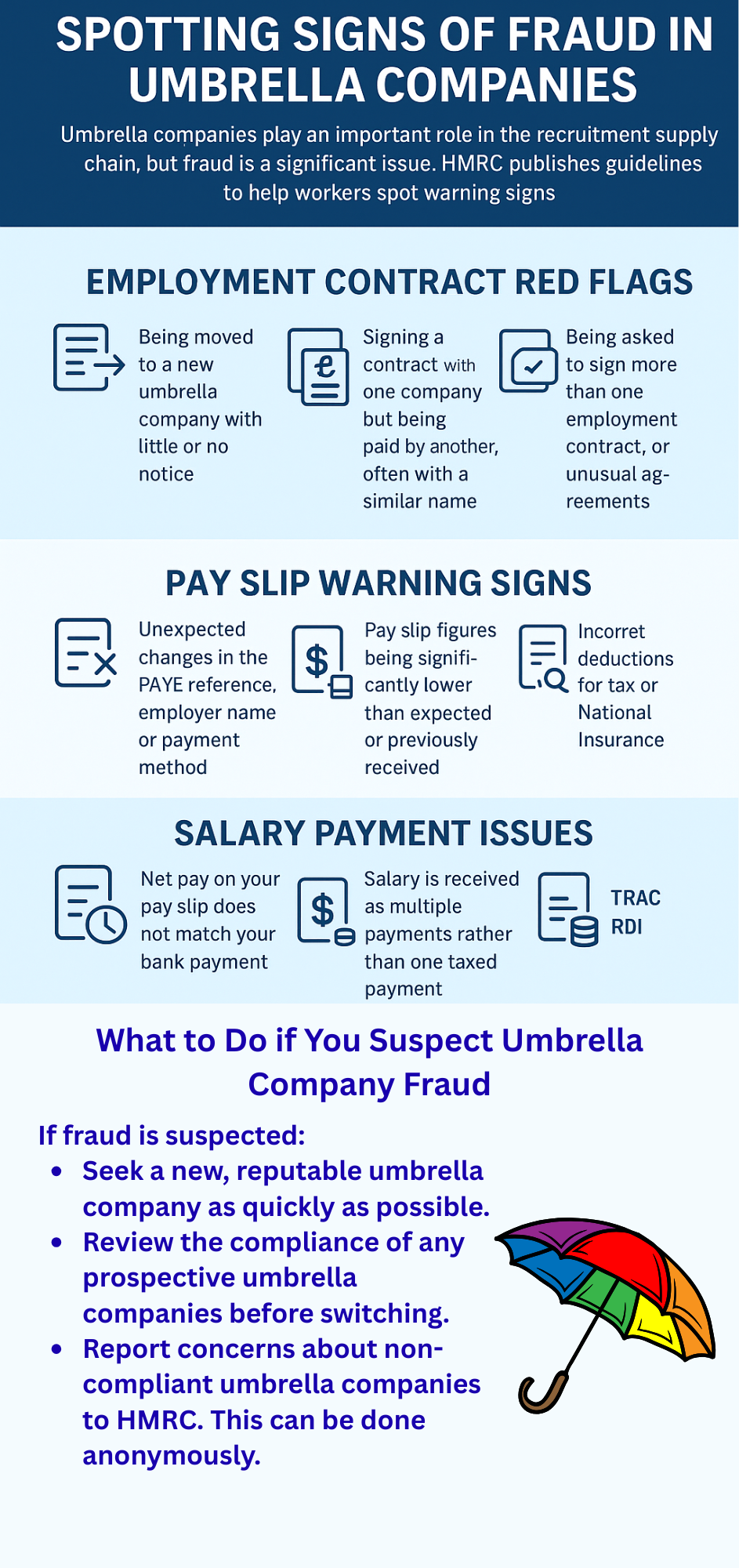

Spotting the Signs of Fraud in Umbrella Companies

Umbrella companies play an important role in the recruitment supply chain, offering a way for temporary workers to receive payment through PAYE.

However, not all umbrella companies are compliant, and umbrella company fraud remains a significant issue. HMRC is working to clamp down on fraudulent umbrella companies, with measures such as education campaigns and the publication of Spotlight 71, which highlights warning signs of tax avoidance. Workers are strongly encouraged to review their employment contracts, pay slips, and salary payments to ensure everything is above board.

Employment Contract Red Flags with Umbrella Companies

Your employment contract should be transparent and straightforward. Warning signs that an umbrella company may be engaging in tax avoidance include:

-

Being moved to a new umbrella company with little or no notice.

-

Signing a contract with one company but being paid by another, often with a similar name or an overseas base.

-

Being asked to sign more than one employment contract, or unusual agreements such as annuity agreements, alongside your employment contract.

Multiple contracts are not standard practice and may indicate movement into a non-compliant scheme.

Pay Slip Warning Signs

Workers have a legal right to a clear and accurate pay slip. Some indicators that an umbrella company may not be compliant include:

-

Unexpected changes in the PAYE reference, employer name, or payment method.

-

Pay slip figures being significantly lower than expected or previously received.

-

Net pay shown on the pay slip not matching the payment made into your bank account.

-

Incorrect deductions for tax or National Insurance.

-

A sudden switch from online pay slips to hard copies.

-

Losing access to the online portal of the previous umbrella company following a payroll switch.

Salary Payment Issues and Umbrella Companies

Checking that your salary payments align with your pay slips is essential. Workers should be wary if:

-

Net pay on their pay slip does not match their bank payment.

-

Salary is received as multiple payments rather than one taxed payment.

These discrepancies can be signs that an umbrella company is operating outside of tax compliance.

Unexpected Moves to New Payroll Systems

Another warning sign linked to umbrella companies is being told you are moving to a new payroll system without clear justification.

Workers are sometimes told this is due to “too many people” on the current payroll, but this is misleading.

Payrolls are not capped by headcount. Such explanations should raise immediate red flags.

What to Do if You Suspect Umbrella Company Fraud

If concerns arise, raise them directly with your umbrella company. A compliant provider will be transparent and answer your questions. However, if fraud is suspected:

-

Seek a new, reputable umbrella company as quickly as possible.

-

Review the compliance of any prospective umbrella companies before switching.

-

Report concerns about non-compliant umbrella companies to HMRC. This can be done anonymously.

How Trueman Brown Can Help with Umbrella Companies

If you are worried about fraud or non-compliance with umbrella companies, Trueman Brown can guide you in identifying and avoiding high-risk providers.

Our team offers expert advice on recognising fraudulent practices and can help you choose a compliant umbrella company that protects your pay and tax status.

📧 Contact us at mark@truemanbrown.co.uk

📞 Call us on 01708 397262

We are here to ensure you feel confident and secure when working with umbrella companies.

FAQs on Umbrella Companies

What is an umbrella company?

An umbrella company acts as an employer for temporary workers, handling payroll through PAYE and deducting tax and National Insurance.

Are all umbrella companies safe to use?

No. While many are compliant, some umbrella companies use tax avoidance schemes. Always check contracts, pay slips, and payments carefully.

How can I check if an umbrella company is compliant?

Look for transparency in contracts, accurate pay slips, and clear tax deductions. HMRC’s Spotlight 71 is a useful guide for spotting risks.

What should I do if I suspect fraud?

Switch to a compliant umbrella company quickly and report your concerns to HMRC.

Can Trueman Brown help me choose an umbrella company?

Yes. Trueman Brown provides expert advice on selecting compliant umbrella companies and avoiding fraudulent ones.

Recent Comments