VAT on Recharged Expenses – What Landlords Need to Know

If you’re a landlord using an agent to manage your property portfolio, the concept of VAT on recharged expenses is one you can’t afford to overlook.

In simple terms, when your letting agent incurs costs and then recharges them to you, those costs may carry VAT — and understanding when VAT applies is crucial for correct accounting and staying compliant

Recharge or Disbursement – distinguishing the two

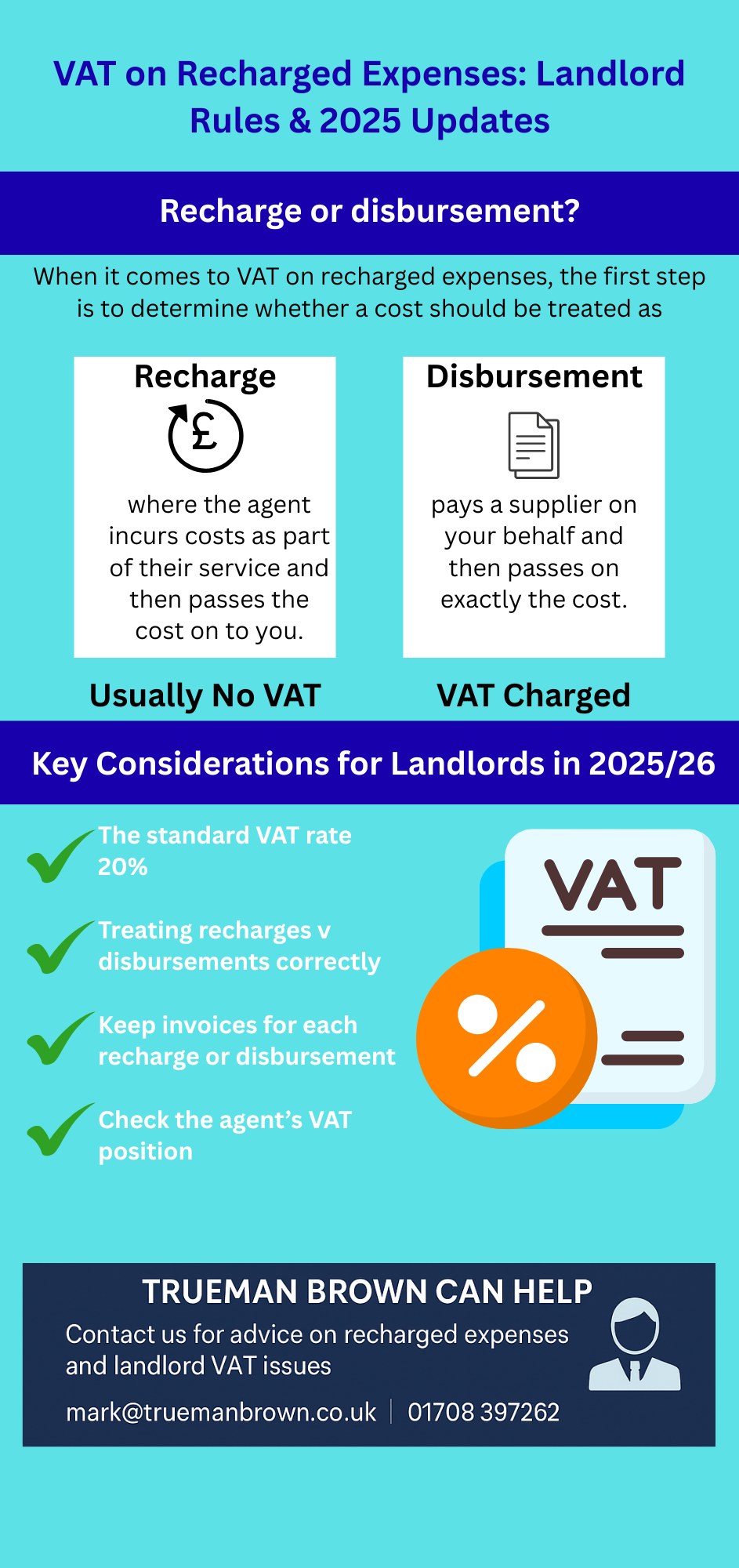

When it comes to VAT on recharged expenses, the first step is to determine whether a cost should be treated as a recharge (to be subject to VAT) or a disbursement (usually not subject to VAT).

The correct classification affects not only whether VAT is charged but also your agent’s right to reclaim input tax and your own VAT-position.

What are Disbursements?

If your letting agent simply pays a supplier on your behalf and then passes on exactly the cost, the item may qualify as a disbursement — meaning VAT on recharged expenses would typically not apply.

For example, the agent arranges for a plumber to fix a shower in a let property, pays the plumber, and passes the £180 cost straight through to you, showing it separately. In that scenario, the cost is treated as outside the agent’s supply of services, so no extra VAT is added.

To meet the disbursement rules, the following must generally hold:

-

The agent paid the supplier on the landlord’s behalf.

-

The landlord (you) received the benefit of the goods or services.

-

It was your responsibility to pay, not the agent’s.

-

The agent had your permission and you knew the supplier was someone else.

-

The exact cost is passed through and items are separately shown on the invoice.

If any of those criteria are missing, then the item is much more likely to be treated as a recharge rather than a disbursement — meaning VAT on recharged expenses comes into play.

What are Recharges – and how does VAT on recharged expenses apply?

A recharge is where the agent incurs costs as part of their service and then passes the cost on to you.

In that case, the cost is part of the agent’s supply, so VAT on recharged expenses generally applies.

For example, when your letting agent incurs travel costs or arranges cleaning/gardening on your behalf and then recharges you, VAT must be charged if they are VAT-registered.

Even if the original supplier’s costs did not carry VAT (for example a zero-rated ticket or exempt supply), the recharge may still attract VAT because it becomes part of the agent’s taxable supply.

In other words: if the cost contributes to the agent’s own service and you are being billed for it, then the standard VAT rules apply to that recharge.

Key Considerations for Landlords in 2025/26

-

The standard VAT rate remains at 20% for most taxable supplies.

-

The distinction between recharges and disbursements continues to be pivotal – mis-classifying a cost can lead to under-charging VAT, wrong VAT returns, and potential HMRC queries.

-

Registration threshold: if your agent’s VAT-taxable turnover (including recharges treated as part of their supply) exceeds the threshold (currently £90,000) they must register.

-

For landlords, there’s no specific new change in 2025/26 solely about VAT on recharged expenses in letting agent contexts — but you must keep documentation clear.

-

A recent update (for employers/pension funds) shows that from 18 June 2025, HM Revenue & Customs changed its policy on VAT deduction on investment costs — while not directly about landlords, it illustrates the HMRC environment where policy tweaks continue.

-

Make sure your agent appropriately invoices you: separate line items, clearly show when something is a recharge vs disbursement, and ensure VAT on recharges is properly charged.

Practical Steps for Managed Lets and Agents

-

Ask your letting agent for clarity: are they acting purely as your agent and passing on costs (i.e., disbursements) or are they incurring costs as part of their service (i.e., recharges)?

-

Review invoices: ensure any items labelled “recharged expense” include VAT if the agent is VAT-registered.

-

Ensure you keep original supplier invoices (for disbursements) or clear accruals for recharges.

-

Monitor your agent’s VAT status: if they are VAT-registered, they must charge VAT on recharges.

-

If you believe a cost is a disbursement but VAT has been charged, raise this with your agent — mis-charged VAT could affect your accounting.

How Trueman Brown Can Help You With VAT on recharged expenses

If you’re a landlord and uncertain about the implications of VAT on recharged expenses, we can assist you every step of the way.

At Trueman Brown we:

-

Help you review your letting agent’s invoicing practices to identify recharges vs disbursements.

-

Assess whether VAT has been correctly applied on any recharged expenses and advise on any corrections.

-

Provide clear guidance for your property accounting for 2025/26 to ensure compliance and minimise surprises.

-

Advise on VAT registration threshold impacts and whether your agent’s recharge practices affect your rental business.

For a friendly, no-obligation chat, contact us at mark@truemanbrown.co.uk or call 01708 397262. We’ll be happy to talk through your specific situation and make sure you’re getting it right.

Frequently Asked Questions on VAT on recharged expenses (FAQ)

Q1: What exactly is meant by “VAT on recharged expenses”?

A1: It refers to VAT that must be added when a letting agent (or other service provider) incurs a cost and then recharges it to you as part of their service. If the cost is treated as part of their supply (a recharge), then VAT is generally due. If it is a disbursement (the agent simply pays on your behalf and passes the cost straight through), then VAT normally doesn’t apply.

Q2: Can I avoid VAT being charged if the supplier’s original cost was zero-rated or exempt?

A2: No — even if the original cost was zero-rated or exempt, if it is a recharge by the agent (i.e., part of their service supply to you), then the VAT treatment follows the agent’s main supply. So you may still see VAT on recharged expenses.

Q3: Does this matter if I am not VAT-registered myself?

A3: Yes. Whether you are VAT-registered or not, your letting agent must apply VAT correctly on any recharges. If VAT is wrongly omitted, there could be accounting and compliance implications for the agent and for your overall financial records.

Q4: What should I ask my letting agent to ensure everything is correct?

A4: Ask whether they treat costs as disbursements or recharges; request separately itemised invoices showing original supplier costs (for disbursements); check that VAT is added for any recharge where they are VAT-registered; review the wording of the invoices to reflect correct treatment.

Q5: Have the rules changed for 2025/26 regarding VAT on recharged expenses for landlords?

A5: There are no major specific rule-changes in the letting agent/recharge vs disbursement area for 2025/26 beyond the usual VAT framework and general updates to HMRC policy. The key remains correct classification and documentation. As shown above, other areas of VAT policy (e.g., pension fund investment costs) have changed, highlighting that staying up to date is essential.

Q6: If I disagree with the agent’s treatment, what should I do?

A6: You should raise the issue with your agent, asking for a clear explanation and supporting documentation. If needed, you can seek independent advice (for example from Trueman Brown) to assess whether the cost was correctly classified and whether the correct VAT has been charged.

If you’d like help clarifying any of this or reviewing your letting agent’s invoices in respect of VAT on recharged expenses, we’re here to assist. Just get in touch at mark@truemanbrown.co.uk or call 01708 397262.

Recent Comments