Investing in Woodlands – Woodlands Tax Implications of an Unusual Type of Investment

Investing in woodland might seem like a picturesque sideline, but the woodlands tax implications are far from simple.

If you’re thinking about buying woodland or already own it, it’s crucial to understand how taxes apply to this unusual type of investment.

In this article we walk through income tax, capital gains tax (CGT), inheritance tax (IHT) and recent changes for the 2025/26 tax year, all with a view to helping you assess whether woodland makes sense and how to plan properly.

Tax on Profits: Understanding Woodlands Tax Implications for Income & Corporation Tax

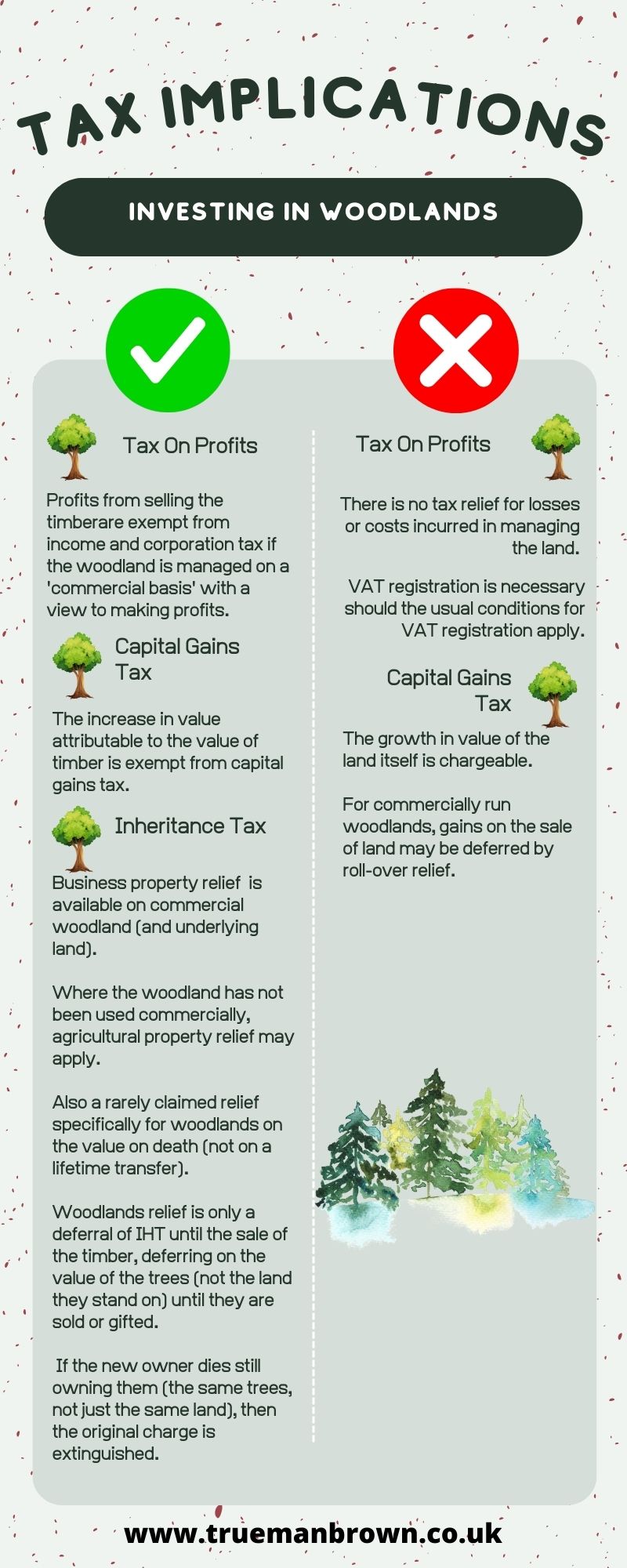

If your woodland is managed on a commercial basis (that is, with a genuine view to profit from timber or other forest products), the woodlands tax implications can be favourable in relation to income tax and corporation tax. Specifically:

-

Profits from the sale of timber — whether felled or standing — are exempt from income tax or corporation tax if the woodland is run on a commercial basis.

-

However, that exemption also means you cannot claim losses or set off management costs against other income.

-

The commercial basis test is strict: there needs to be active management, separate accounts, often VAT registration, and a clear profit motive.

-

One further complication: the exemption does not extend to VAT – woodland sales may still bring VAT obligations if turnover thresholds are passed.

In short: to benefit from the favourable treatment under the woodlands tax implications regime, you must genuinely treat your woodland as a business.

Capital Gains Tax and Woodlands Tax Implications

When you come to sell your woodland or the timber within it, the woodlands tax implications for CGT are worth considering:

-

The value of growing timber in a commercially managed woodland is exempt from CGT.

-

The land itself (i.e., the “solum” on which the trees grow) remains potentially chargeable to CGT, so separation of timber value and land value is necessary.

-

If the woodland qualifies as a business asset, CGT reliefs such as rollover relief or gift/handoff relief may apply, subject to conditions.

Thus, under the woodlands tax implications umbrella, the CGT treatment can be a major incentive — but only when the right criteria are met.

Inheritance Tax – Critical Woodlands Tax Implications

The woodlands tax implications in the IHT arena are especially relevant for estate planning and inter-generational transfers:

-

If the woodland is run on a commercial basis, it may qualify for Business Property Relief (BPR) at 100% (at present) for IHT – i.e., leaving the value free of IHT.

-

Alternatively, if the woodland is ancillary to agricultural land or pasture (not run as a business), it may qualify for Agricultural Property Relief (APR).

-

Where neither BPR nor APR apply, there’s the specific Woodlands Relief which defers IHT on the value of growing timber until disposal.

However — and this is critical — upcoming rule changes materially affect how these reliefs apply.

Upcoming Rule Changes That Affect Woodlands Tax Implications

For the tax year 2025/26 and beyond, the woodlands tax implications are further shaped by recent announcements:

-

From 6 April 2025, the scope of APR is extended to land managed under certain environmental agreements with the government or approved bodies.

-

From 6 April 2026, the rate of relief for BPR (and APR) will reduce: the first £1 million of qualifying business/agricultural assets will continue to get 100% relief, but beyond that 50% relief will apply.

-

HMRC has broadened guidance around woodland taxation — for example specifying that woodlands relief and APR only apply to UK-located property from 6 April 2024.

-

Although profits from commercially managed woodland remain exempt from income tax and corporation tax, the commercial management criteria remain strictly enforced.

In practical terms: if the woodland value (or combined qualifying assets) exceeds the £1 million cap from 2026 for BPR/APR, your effective relief could be halved. You also need to ensure your woodland is genuinely run as a commercial enterprise to benefit. These are key factors under the banner of woodlands tax implications for 2025/26.

Practical Considerations for Investors: Navigating the Woodlands Tax Implications

When you’re looking at woodland investment, the practical side of the woodlands tax implications matters just as much as the headline reliefs. Some points to bear in mind:

-

Ensure your woodland is commercially managed: budget plans, timber-harvesting schedules, separate accounting, evidence of profit motive. Without this, you may lose the favourable treatment.

-

Be cautious of land-use changes: if the woodland also supports grazing, leisure or other recreational uses, these may jeopardise the commercial basis or create taxable activities.

-

VAT can catch you out: the timber-sale exemption for income tax does not equate to no VAT issues. If your taxable turnover triggers VAT registration, you may face additional obligations.

-

Consider disposal timing: the timber value is exempt for CGT, but when you sell or gift, especially if under woodlands relief for IHT, the timing and valuation of disposal matter.

-

Estate-planning implications: if the total of your qualifying BPR/APR assets exceeds £1 million (from 2026), you may need to rethink structure. That makes the woodlands tax implications planning even more crucial.

How Trueman Brown Chartered Accountants Can Help

At Trueman Brown, we understand the specialised nature of woodland investment and the range of woodlands tax implications that arise. Whether you’re purchasing woodland, already own it, or planning for the future, we’re here to support you.

We can help you by:

-

Analysing your woodland ownership structure and objectively assessing if it meets the commercial basis required for favourable tax treatment.

-

Advising on CGT and IHT relief planning, including preparing the required documentation, management plans and valuation splits (timber vs land).

-

Guiding you through the upcoming relief changes (e.g., post-2026 BPR/APR cap) and their implications for your estate.

-

Working with you on VAT, income tax, corporation tax and other potential tax traps arising from woodland ownership.

-

Providing ongoing compliance support, including preparation of accounts and tax returns tailored for woodland ownership.

If you’d like to talk this through, please contact us at mark@truemanbrown.co.uk or call 01708 397262.

We’ll be happy to discuss your situation, explore how the woodlands tax implications apply to you, and help you build a strategy.

FAQ

Q: Does every woodland investment qualify for tax reliefs?

A: No. The favourable tax treatment hinges on whether the woodland is run on a commercial basis (for timber production or other forestry business) and meets the specific criteria for each relief. Non-commercial or amenity woodlands may not qualify.

Q: What counts as “commercial basis” for woodland?

A: Having a profit motive, active management, separate accounting, timber harvesting schedules, possibly VAT registration, and treating the woodland as a business rather than just ownership of land for personal use.

Q: What are the main tax reliefs for woodland?

A: For income/corporation tax, the sale of timber from commercially managed woodland can be exempt. For CGT, the growing timber may be exempt. For IHT, BPR or APR may apply, or in some cases woodlands relief may defer tax.

Q: How do the rule changes for 2026 affect woodland tax planning?

A: From 6 April 2026, the first £1 million of qualifying BPR/APR assets will still get 100% relief, but above that only 50% relief applies. This means if your estate or woodland business assets exceed that threshold, your effective relief may be halved.

Q: If I sell woodland, how is tax treated?

A: If the woodland is commercially managed, the value of the growing timber is exempt from CGT, but the land element remains subject. For IHT, if woodlands relief has been claimed on death, tax may be deferred until sale or disposal. Proper valuation split is essential.

Q: Can losses from woodland management offset my other income?

A: No — if the woodland is treated as a commercial business for tax reliefs, the upside (exempt timber profits) comes at the cost that loss relief is generally not available against other income.

Q: What happens if the woodland fails to meet commercial criteria later?

A: If the woodland ceases to be run on a commercial basis, or evidence of active business is lacking, you risk losing the benefit of tax reliefs and may face retrospective tax charges.

Q: Should I seek professional advice?

A: Absolutely. The woodlands tax implications are complex and depend heavily on individual circumstances, estate value, business structuring and evolving legislation. Early planning is key.

Woodland ownership can offer attractive tax incentives — but only if managed and structured correctly. Understanding the woodlands tax implications and staying ahead of rule changes for 2025/26 will help you make informed decisions.

If you’d like to explore how this may apply to you, feel free to reach out to us at mark@truemanbrown.co.uk or 01708 397262.

Recent Comments