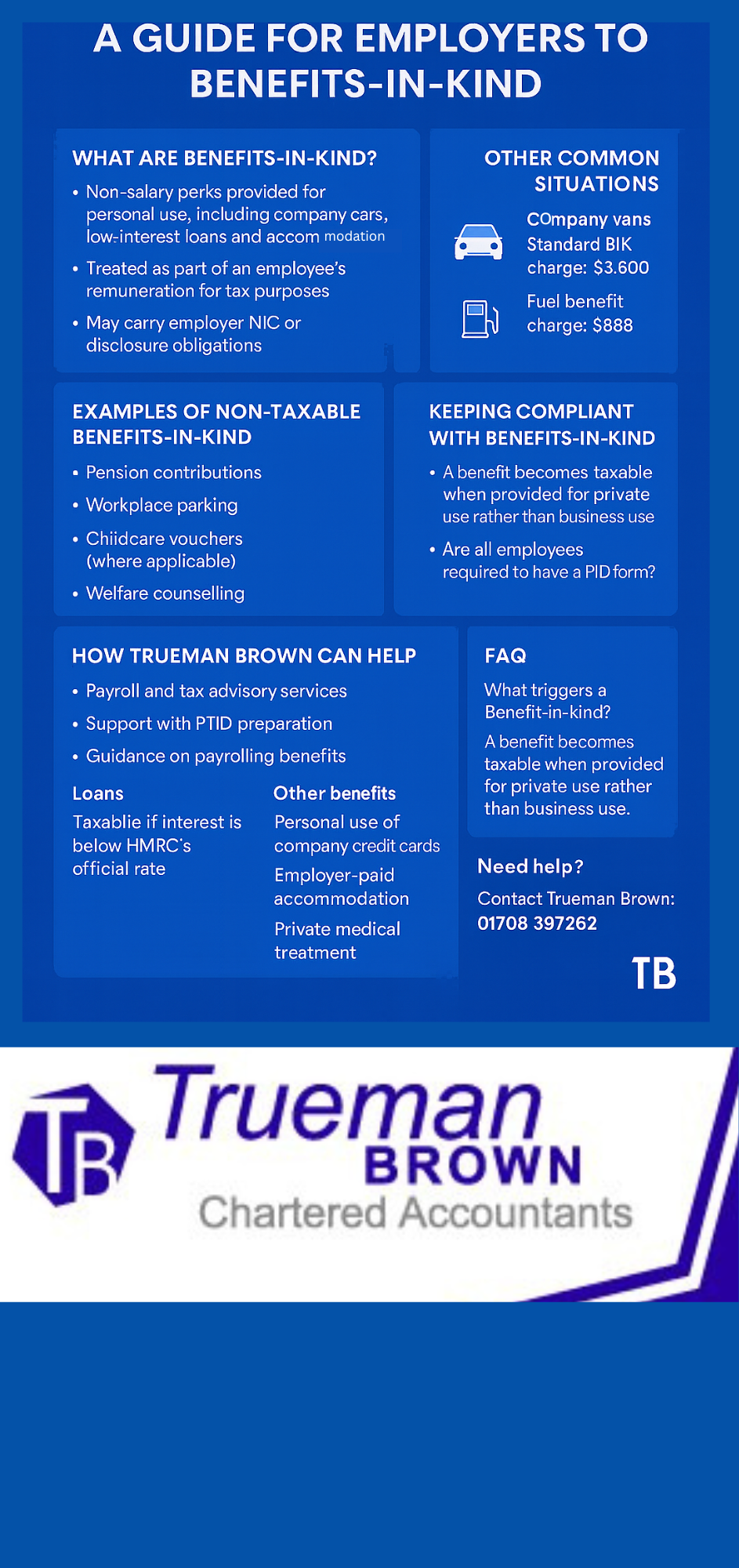

A guide for employers to Benefits-in-kind

If you’re an employer, it’s important to understand how Benefits-in-kind work — what counts as a benefit, how it’s taxed, how it impacts both employees and the business.

These rules apply to directors and employees alike, and failing to manage Benefits-in-kind properly can lead to unwanted tax, National Insurance and administrative burdens.

What are Benefits-in-kind?

In simplest terms, Benefits-in-kind are non-salary perks provided to an employee (including directors) by the employer.

The benefit might be a company car for personal use, interest-free (or low-interest) loans, subsidised private travel, or accommodation.

Although the benefit is not cash salary, HMRC treats it as part of the employee’s remuneration for tax purposes.

It’s worth noting that just because it isn’t taxed doesn’t mean there are no implications — some benefits may still carry employer National Insurance liability, or require disclosure via form P11D.

Thorough record-keeping remains key for all Benefits-in-kind.

When do Benefits-in-kind trigger tax and National Insurance?

An employer must complete form P11D for each employee and director in respect of any taxable Benefits-in-kind they provide.

The value of each benefit must be included in the employer’s Class 1A National Insurance liability (at the rate applicable) and in the employee’s taxable income as part of the benefit value.

For 2025/26, the employer retains the responsibility to report benefits accurately.

For the employee, the taxable amount is calculated by taking the “P11D value” (which is the list price (or other value where specified) of the benefit) and applying the appropriate percentage band, then multiplying by the employee’s marginal tax rate (20%, 40% or 45% depending on income) to determine the tax payable.

Examples of non-taxable Benefits-in-kind

Some perks provided as Benefits-in-kind may nonetheless fall outside the taxable regime.

These include (among others):

-

Contributions to registered pension schemes (within limits)

-

Workplace car, motorcycle or bicycle parking facilities at or near the employer’s premises

-

Up to £55 per week of childcare vouchers (where the scheme applies)

-

Welfare counselling services, staff canteen/dining facilities open to all employees, sports facilities for employees, removal expenses subject to conditions, long-service awards up to approved limits.

Employers should check HMRC guidance on qualifying conditions.

Although non-taxable, correct classification and documentation are still required so that these are not inadvertently taxed as Benefits-in-kind.

Company cars and Benefits-in-kind: what’s changed for 2025/26

One of the most common areas for Benefits-in-kind is the provision of a company car for private use.

As at 6 April 2025 the tax treatment for such benefits has updated, including:

-

For petrol/hybrid cars, the rate now depends on CO₂ emissions and electric-range (for plug-in hybrids), and continues to rise gradually in future years.

-

For example, a petrol car producing 75-79 g/km CO₂ may face a rate in the low 20s% for 2025/26.

-

Employers must continue to include fuel benefits where private fuel is provided; for 2025/26 the fuel benefit multiplier is £28,200.

-

The writing-down allowance, first-year allowances and lease cost relief for cars also depend on emission bands — important for the employer side of car-related Benefits-in-kind.

In short: choosing lower-emission vehicles reduces the taxable value of the car benefit significantly — a key strategy to manage Benefits-in-kind costs.

Vans, loans and other common Benefits-in-kind situations

Beyond cars, the Benefits-in-kind regime covers many other employer-provided rewards. Some notable examples:

Company vans

If a company van is made available for private use, a standard flat benefit of £3,600 applies and £688 where fuel is provided for private use.

If there is no significant private use, the benefit may not apply. Employers should assess van usage carefully when measuring Benefits-in-kind.

Interest-free or cheap loans

If an employer gives an employee a loan on favourable terms (i.e., interest lower than HMRC’s official rate), the difference between interest paid and official rate is treated as a taxable Benefit-in-kind (a “beneficial loan”).

The rules for 2025/26 remain unchanged but the official rate should be checked each year.

Other taxable amenities

Use of a credit card for personal purchases (provided by employer) gives a taxable benefit equal to the cost borne by employer. Private use of accommodation, private medical treatment paid for by the employer, company-paid household expenses — all can fall under Benefits-in-kind unless carefully structured and documented.

Keeping compliant with Benefits-in-kind: employer obligations

When managing Benefits-in-kind, employers should ensure the following:

-

Proper records of all benefits provided and expenses paid or reimbursed

-

Complete form P11D for each employee/director where required, and pay Class 1A National Insurance on time

-

Consider payrolling of benefits: although not yet mandatory for all benefits-in-kind, many employers choose to payroll certain benefits to simplify tax treatment and avoid year-end surprises

-

Assess schemes such as dispensations (which may reduce P11D requirements) and salary sacrifice arrangements (which influence the taxable value of the benefit)

-

Review company car policies, loan arrangements and van use to ensure classification aligns with 2025/26 Benefits-in-kind rules and future-proofing (given that BIK rates will increase in coming years).

Being proactive and methodical helps turn Benefits-in-kind from a compliance risk into an effective employment reward strategy.

How Trueman Brown can help you with Benefits-in-kind

Managing Benefits can be complex, particularly with the rule changes for the 2025/26 tax year and beyond.

At Trueman Brown, we provide expert payroll and tax advisory services to ensure your business handles benefits correctly and cost-effectively.

Whether it’s company car schemes, salary-sacrifice arrangements, loans or accommodation benefits, we can help you design policies that optimise tax efficiency while remaining fully compliant.

Get in touch with us at mark@truemanbrown.co.uk or call 01708 397262 to discuss your requirements and schedule a consultation.

FAQ: Frequently asked questions about Benefits-in-kind

Q: What exactly triggers a Benefit-in-kind for tax purposes?

A: A benefit triggers tax if it is not purely business use, or if the employer provides something of value (non-cash) for the employee’s private use. That becomes a taxable Benefit, subject to both income tax (employee) and Class 1A NIC (employer).

Q: If a car is used for both business and private travel, how is the car benefit calculated?

A: For company cars used privately, you use the car’s list price (P11D value) and apply the relevant Benefits-in-kind percentage band for 2025/26 (for example 3 % for zero-emission cars). The taxable benefit is that percentage of the list price; you then multiply by the employee’s tax rate to find the additional tax they owe.

Q: Are all employees required to have a P11D form completed?

A: Generally yes, where taxable Benefits are provided. If you opt to payroll the benefit, you might avoid P11D for certain employees, but you must ensure the payroll process is correctly set up and HMRC notified where required.

Q: How will the Benefits-in-kind rates change after 2025/26?

A: According to current guidance, the BIK rate for electric cars will rise to 4 % in 2026/27 and 5 % in 2027/28. For ultra-low emission plug-in hybrids the rate also increases gradually until 2027/28, after which higher rates apply.

For other vehicle bands the top rate remains 37 % for highest-emission cars.

Q: What mistakes do employers often make with Benefits-in-kind?

A: Common errors include failing to record all benefits (e.g., private fuel, home broadband paid by employer), mis-classifying assets (like vans vs cars), forgetting the employer NIC on benefits, wrongly applying salary sacrifice without adjusting for benefit introduction, and not keeping up with changes (e.g., 2025/26 car BIK rate changes). These can lead to unexpected tax bills for employer or employee.

Q: Can salary sacrifice arrangements reduce the tax on Benefits-in-kind?

A: Yes — effectively if an employee gives up gross salary in return for a benefit, the taxable salary is reduced and the benefit may be lower. However, the benefit remains subject to Benefits-in-kind rules and you must assess whether the benefit is genuinely a reduction in salary, how the employer NIC applies, and whether the arrangement triggers reporting via P11D or payrolling.

Recent Comments