VAT and Bad Debts: A Complete Guide for UK Businesses

If your business is VAT-registered, you probably know that VAT can become a headache when a customer fails to pay.

In this article, we explain how VAT and bad debts work together, and how you may be able to recover VAT on unpaid invoices under HMRC’s rules.

We also cover the steps, deadlines, and how VAT and bad debts relief interacts with other VAT accounting schemes.

What is bad debts relief?

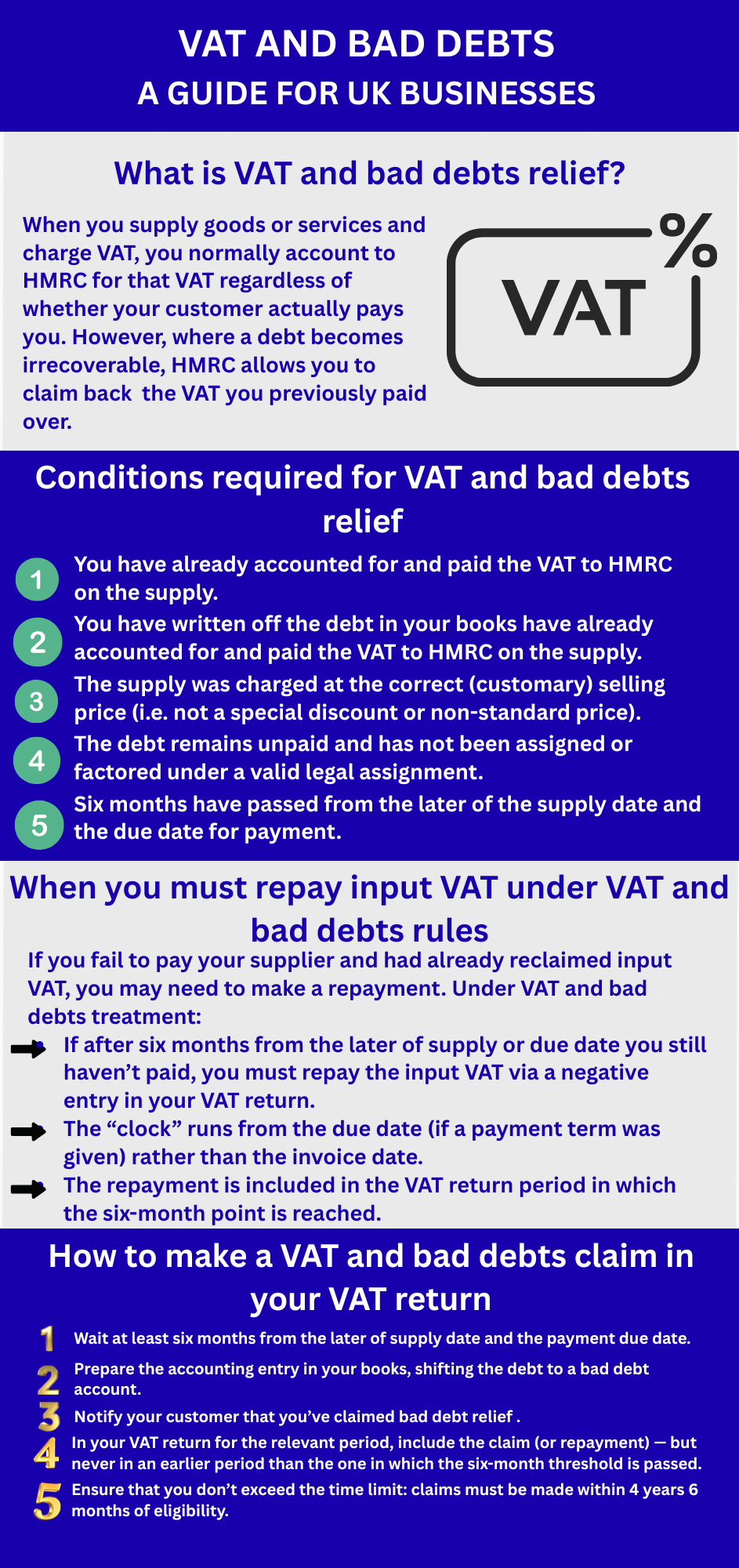

When you supply goods or services and charge VAT, you normally account to HMRC for that VAT regardless of whether your customer actually pays you.

However, where a debt becomes irrecoverable, HMRC allows you to claim back (in effect) the VAT you previously paid over — this is known as VAT and bad debts relief (or bad debt relief for VAT).

Put simply, VAT and bad debts relief means you can reduce your VAT liability when customers default — subject to conditions and time limits.

Conditions required for bad debts relief

You can only claim VAT and bad debts relief if all the following conditions are met:

-

You have already accounted for and paid the VAT to HMRC on the supply.

-

You have written off the debt in your books (i.e. transferred it from trade debtors to a bad debt account).

-

The supply was charged at the correct (customary) selling price (i.e. not a special discount or non-standard price).

-

The debt remains unpaid and has not been assigned or factored under a valid legal assignment.

-

Six months have passed from the later of the supply date and the due date for payment.

If you use the cash accounting scheme for VAT or a retail scheme (which allows daily adjustments for debtor balances), then you generally won’t need to claim VAT and bad debts relief — because VAT is only due on amounts actually received.

Also, note that the claim must be made within 4 years and 6 months from the date you become eligible for relief (i.e. after the six-month waiting period).

When you must repay input VAT under VAT and bad debts rules

Just as you can claim relief when your customers don’t pay, the flip side is that if you fail to pay your supplier and had already reclaimed input VAT, you may need to make a repayment.

Under VAT and bad debts treatment:

-

If after six months from the later of supply or due date you still haven’t paid, you must repay the input VAT via a negative entry in your VAT return.

-

The “clock” runs from the due date (if a payment term was given) rather than the invoice date.

-

The repayment is included in the VAT return period in which the six-month point is reached.

That way, HMRC ensures that the VAT system remains fair: you can’t indefinitely benefit from reclaimed VAT if you never settle your supplier bills.

How to make a VAT and bad debts claim in your VAT return

Here’s how to proceed:

-

Wait at least six months from the later of supply date and the payment due date.

-

Prepare the accounting entry in your books, shifting the debt to a bad debt account.

-

Notify your customer that you’ve claimed bad debt relief (this is a requirement).

-

In your VAT return for the relevant period, include the claim (or repayment) — but never in an earlier period than the one in which the six-month threshold is passed.

-

Ensure that you don’t exceed the time limit: claims must be made within 4 years 6 months of eligibility.

Because you must wait six months, in practice you will have paid VAT over to HMRC first, and then claim it back later via your return.

Recent rule changes or clarifications (2025 update)

-

The basic rules around VAT and bad debts remain as above, but HMRC has emphasised stricter compliance with documentation and audit trails, especially in cases of factoring or assignment of debt.

-

HMRC may more closely scrutinize whether the debt was genuinely irrecoverable (i.e. you have taken all reasonable steps to recover it).

-

There is ongoing pressure for faster digital reporting and transparency; keeping good records of communications with the customer, correspondence, legal steps taken, etc., is more important than ever.

-

Always check for specific scheme interactions (e.g. if you use the Flat Rate Scheme or Annual Accounting Scheme) — these may restrict or alter your ability to claim VAT and bad debts relief.

How Trueman Brown can help you with VAT and bad debts

If you’re dealing with complex or substantial debts and want to understand your rights for VAT and bad debts relief,

Trueman Brown is here to assist. Whether you need help assessing whether a particular debt qualifies, preparing the accounting entries, or submitting your VAT returns properly — we can support you every step of the way.

Get in touch with us at mark@truemanbrown.co.uk or call 01708 397262 and we’ll guide you through your options and ensure you comply with HMRC’s rules.

FAQ: VAT and bad debts

Q1: Can I claim VAT on debts that are only partly paid?

A: No, the relief only applies to the portion of the supply that remains unpaid after the six-month period. You must first account for VAT on what you did receive, and then claim relief for the unpaid portion, provided the conditions are satisfied.

Q2: What if the debt is past six months but the customer makes a payment later?

A: If you’ve already claimed VAT and bad debts relief and then receive payment later, you may need to adjust your VAT return and repay the VAT relief you claimed (i.e. you’ll “reverse” part of it).

Q3: Can I make the claim in any VAT return?

A: No — the claim cannot go into an earlier return than the one in which the six-month point is passed. But you must make it within 4 years 6 months.

Q4: Does factoring or assignment of debt disqualify relief?

A: Yes — if the debt has been validly factored or legally assigned to a third party, you can’t claim VAT and bad debts relief, because you’re no longer debtor to the original customer.

Q5: How should I notify my customer?

A: HMRC requires that you inform the customer that you are making a bad debt relief claim. A simple written notice (letter or email) referencing the debt, amount, supply date, and that you intend to claim VAT relief is acceptable.

Q6: Does using the cash accounting or retail scheme affect the need for VAT and bad debts relief?

A: Yes — if you’re under cash accounting or some retail schemes, you pay VAT only on what you actually receive, so there’s no need to claim relief for unpaid debts.

If you have more questions or want personalised advice, just let me know — or reach out via mark@truemanbrown.co.uk / 01708 397262.

Recent Comments