Avoid the Traps: Understanding the Employer-Provided Eye Tests Exemption

Many employers overlook the details of the employer-provided eye tests exemption, risking unnecessary tax liabilities.

This exemption allows businesses to cover the cost of display screen equipment (DSE) eye tests and corrective lenses—provided they meet specific HMRC and Health and Safety Executive (HSE) conditions.

What Is the Employer-Provided Eye Tests Exemption?

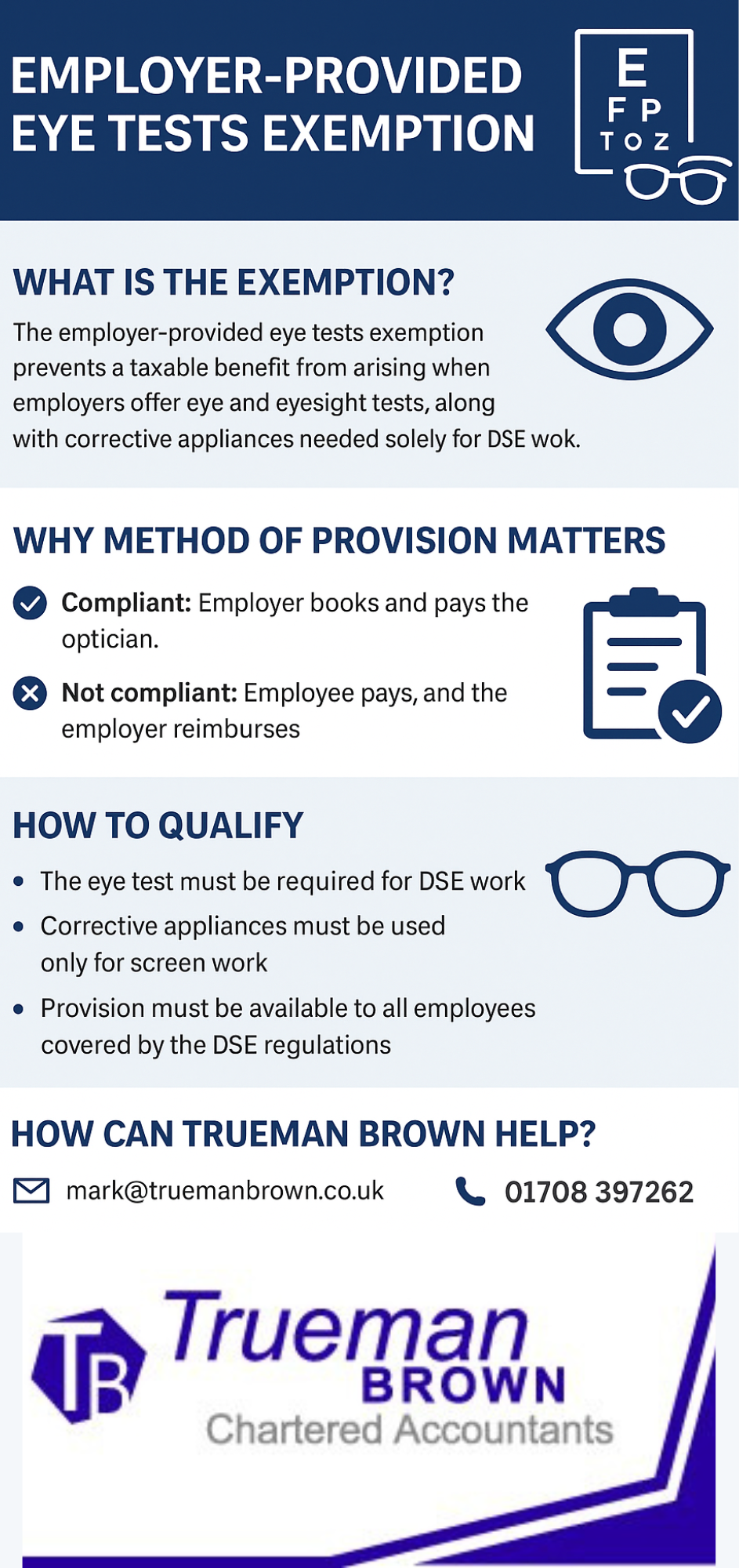

The employer-provided eye tests exemption prevents a taxable benefit from arising when employers offer eye and eyesight tests, along with corrective appliances needed solely for DSE work.

For 2025, the exemption still applies under Regulation 5 of the Health and Safety (Display Screen Equipment) Regulations 1992.

To qualify:

-

The eye test must be required for DSE work.

-

Any corrective appliances (like glasses) must be used only for screen work.

-

Provision must be available to all employees covered by the DSE regulations.

Employer-provided eye tests exemption – Why the Method of Provision Matters

Even if the cost outcome is identical, HMRC distinguishes between providing and reimbursing an expense.

For the employer-provided eye tests exemption to apply, the employer must arrange and pay the optician directly.

-

✅ Compliant: Employer books and pays the optician.

-

❌ Not compliant: Employee pays, and the employer reimburses.

Reimbursement counts as settling a private bill—making it taxable through payroll.

Employer Arranges and Pays for the Eye Test

When the employer arranges the appointment and pays the optician, this qualifies under the employer-provided eye tests exemption.

The same applies to corrective appliances when required solely for DSE use.

Employee Arranges and Employer Pays

If an employee books the test and the employer later pays the optician, HMRC treats this as settling a pecuniary liability—not as providing an exempt benefit.

To retain exemption status, employers should handle both booking and payment directly.

Reimbursing the Employee

Reimbursing employees for eye test costs fails the employer-provided eye tests exemption test.

Reimbursements are treated as taxable earnings unless they qualify for a deduction under s.336 ITEPA 2003—which eye tests do not.

Employer-provided eye tests exemption – Compliance Tips for 2025

HMRC guidance (EIM21763, updated 2024) confirms that:

-

Online or remote DSE eye tests qualify if employer-arranged.

-

Digital vouchers for approved opticians are acceptable.

-

Employers should document their DSE assessment process for audit readiness.

How Trueman Brown Can Help

At Trueman Brown, we help employers stay compliant with HMRC rules on benefits and exemptions, including the employer-provided eye tests exemption.

Our expert accountants and tax advisers ensure your policies are structured to maximise tax efficiency and meet HSE obligations.

📧 Email: mark@truemanbrown.co.uk

📞 Call: 01708 397262

Frequently Asked Questions

1. Can we use vouchers for eye tests and still claim the employer-provided eye tests exemption?

Yes—if the voucher is used with an approved optician and covers DSE eye tests only.

2. What if the employee needs glasses for both reading and DSE?

Only the portion relating to DSE use is exempt. General-use prescriptions fall outside the exemption.

3. Are remote workers entitled to the same exemption?

Yes—if they regularly use DSE for work purposes. The employer must still arrange or fund the test directly.

4. Do we need to report exempt eye tests on P11D?

No—qualifying benefits under the employer-provided eye tests exemption are non-reportable.

Recent Comments