Company Demerger: How to Split a Business Tax-Efficiently

A company demerger can be a strategic move for businesses looking to separate distinct operations, streamline ownership, or prepare for sale.

Whether driven by family succession planning, departmental independence, or shareholder divergence, executing a company demerger correctly is essential to avoid unnecessary tax liabilities and regulatory pitfalls.

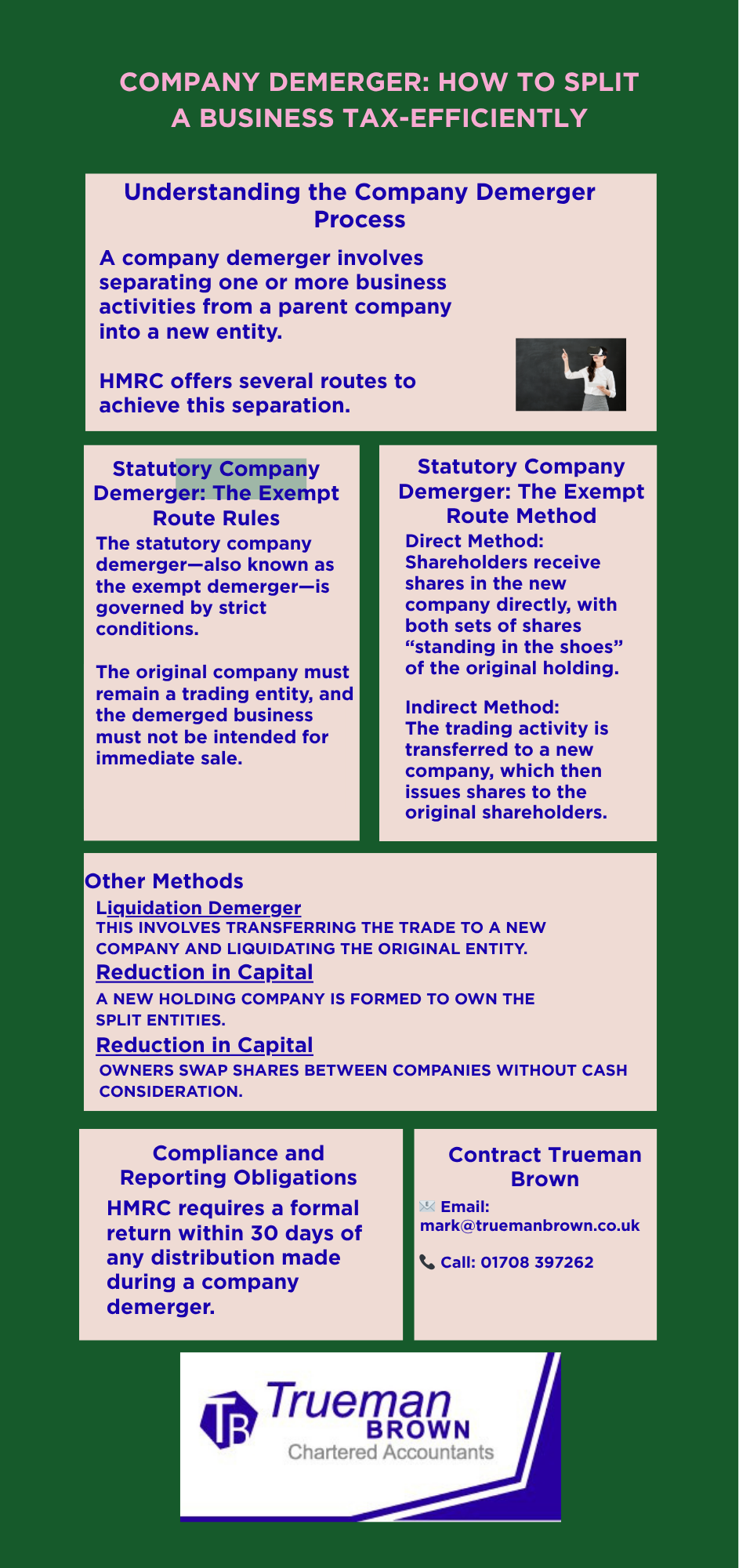

Understanding the Company Demerger Process

A company demerger involves separating one or more business activities from a parent company into a new entity.

This can be done for operational clarity, succession planning, or to facilitate a future sale.

HMRC offers several routes to achieve this separation, each with its own tax implications and compliance requirements.

Statutory Company Demerger: The Exempt Route

The statutory company demerger—also known as the exempt demerger—is governed by strict conditions.

The original company must remain a trading entity, and the demerged business must not be intended for immediate sale.

If these conditions are met, the distribution of assets can be treated as a capital transaction rather than income, avoiding dividend tax rates.

There are two main methods:

- Direct Method: Shareholders receive shares in the new company directly, with both sets of shares “standing in the shoes” of the original holding.

- Indirect Method: The trading activity is transferred to a new company, which then issues shares to the original shareholders.

In both cases, capital gains tax (CGT) may apply, but reliefs such as “no gain, no loss” transfers and base cost apportionment can mitigate the impact.

Stamp duty may also be triggered, but mirror shareholdings can qualify for relief.

Liquidation Demerger: When Statutory Conditions Don’t Apply

If the statutory route isn’t viable, a liquidation company demerger may be appropriate. This involves transferring the trade to a new company and liquidating the original entity. The liquidator then distributes assets to shareholders. While more complex, this method can still be tax-efficient if structured correctly.

Alternative Methods of Company Demerger

When neither statutory nor liquidation routes are suitable, other options include:

- Reduction in Capital: A new holding company is formed to own the split entities. This avoids income tax and defers CGT.

- Share-for-Share Exchange: Owners swap shares between companies without cash consideration. If values are equal, the transaction is tax-neutral.

These methods require careful planning to ensure compliance with HMRC’s anti-avoidance rules, particularly around VAT and business separation legitimacy.

Compliance and Reporting Obligations

HMRC requires a formal return within 30 days of any distribution made during a company demerger.

This must include a justification for exemption status.

Updated guidance emphasises that only genuine business separations qualify—arrangements designed to avoid VAT or other taxes may be challenged.

How Trueman Brown Can Help with Your Company Demerger

At Trueman Brown, we specialise in guiding businesses through the complexities of company demerger planning and execution.

From choosing the right method to preparing documentation and liaising with HMRC, we ensure your demerger is both compliant and tax-efficient.

📧 Email: 📞 Call: 01708 397262

Whether you’re restructuring for growth, succession, or sale, our expert team is here to help you navigate every step with confidence.

FAQ: Company Demerger Explained

Q1: What is a company demerger?

A company demerger is the process of separating one or more business activities from a parent company into a new entity.

Q2: Will I pay tax on a company demerger?

Not necessarily. If structured correctly, a demerger can qualify for exemptions from income tax and defer CGT.

Q3: Which method is best for my business?

It depends on your goals—statutory demergers suit retained businesses, while liquidation or share-for-share exchanges may suit sales or restructures.

Q4: Do I need to notify HMRC?

Yes. A formal return must be submitted within 30 days of any distribution, explaining why the transaction qualifies for exemption.

Q5: Can Trueman Brown help with HMRC submissions?

Absolutely. We handle all aspects of compliance, from strategy to documentation and communication with HMRC.

Recent Comments