Incidental Expenses: A Useful Tax Relief for Overnight Business Travel

When employees stay away overnight on business, they often incur incidental expenses—small costs such as newspapers, laundry or phone calls.

The relief for incidental expenses enables employers to reimburse or pay a small allowance without triggering a tax charge, provided certain HMRC rules are met.

In this post we explain how incidental expenses work, recent changes, and when they apply.

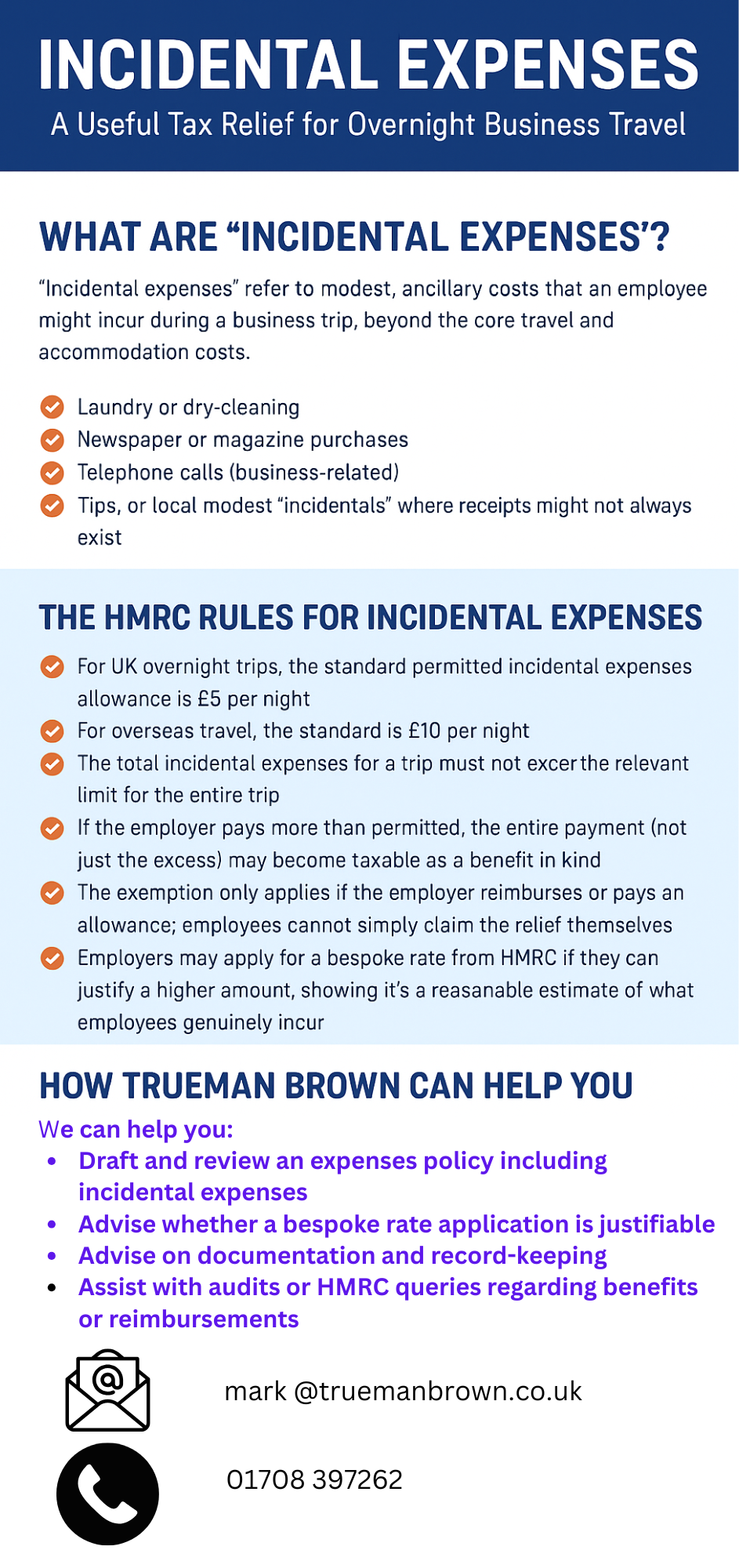

What Are “Incidental Expenses”?

“Incidental expenses” refer to modest, ancillary costs that an employee might incur during a business trip, beyond the core travel and accommodation costs.

Examples include:

-

Laundry or dry-cleaning

-

Newspaper or magazine purchases

-

Telephone calls (business-related)

-

Tips, or local modest “incidentals” where receipts might not always exist

These are not travel or subsistence costs per se, but small side expenses that are incidental to the purpose of the trip.

The HMRC Rules for Incidental Expenses

To ensure the incidental expenses exemption applies, you need to satisfy the broader “wholly, exclusively and necessarily” test: the expenses must be incurred in performance of employment duties (not private).

But the incidental expenses relief gives some flexibility for small personal items when an employee is away overnight.

Key points:

-

For UK overnight trips, the standard permitted incidental expenses allowance is £5 per night.

-

For overseas travel, the standard is £10 per night.

-

The total incidental expenses for a trip must not exceed the relevant limit for the entire trip.

-

If the employer pays more than permitted, the entire payment (not just the excess) may become taxable as a benefit in kind.

-

The exemption only applies if the employer reimburses or pays an allowance; employees cannot simply claim the relief themselves.

-

Employers may apply for a bespoke rate from HMRC if they can justify a higher amount, showing it’s a reasonable estimate of what employees genuinely incur.

If extras like gym access, pay-per-view movie charges, or other hotel facilities are separately billed, they are generally taxable if borne by the employer.

Who Can Use the Relief?

The incidental expenses allowance is intended for employees. Directors employed by their companies may benefit (so long as they are on payroll as employees), but self-employed individuals cannot claim “incidental expenses” under this scheme because there is no employer-employee relationship.

Additionally, the policy or practice must be applied consistently and documented so an employer can show they followed HMRC’s guidance.

Recent Changes or Updates to the Rules

As of 2025, the core rates (£5 UK, £10 overseas) remain in place. HMRC has not increased these limits, so many businesses still operate under the same allowances. However, some considerations:

-

HMRC continues to emphasise that the allowance must not exceed actual costs (or reasonable estimates).

-

The employer should keep supporting evidence and maintain policy documentation.

-

If newer travel or subsistence regimes are introduced, always check the current HMRC Employment Income Manuals or relevant updates.

-

Employers applying for a bespoke rate must prepare clear justification, including survey or sample cost data.

-

Where accommodation includes an “all-inclusive” tariff covering services or facilities (e.g. meals, entertainment), analysis is needed to allocate incidental costs versus taxable benefits.

If you are unsure whether your scheme is compliant, review your travel/expense policy in light of the relief rules and consult professional advice.

How Trueman Brown Can Help You

If you run a business and wish to ensure your treatment of incidental expenses is HMRC-compliant, Trueman Brown can assist. We can help you:

-

Draft and review an expenses policy

-

Advise whether a bespoke rate application is justifiable

-

Advise on documentation and record-keeping

-

Assist with audits or HMRC queries regarding benefits or reimbursements

To get in touch:

Email: mark@truemanbrown.co.uk

Phone: 01708 397262

We’ll work with you to ensure your incidental expenses arrangements are both efficient and compliant.

Frequently Asked Questions (FAQ)

Q: Can I reimburse incidental expenses without proof of receipts?

A: Yes — that is one of the features of the relief. The allowance is intended for small costs where receipts may not always be available, so strict evidencing is not required. But you must not exceed the permitted rate and must document your policy.

Q: What happens if I reimburse more than £5 (UK) or £10 (overseas)?

A: If you pay above the permitted rate (unless you have a bespoke rate authorised by HMRC), the entire payment becomes taxable as a benefit in kind, not just the excess amount.

Q: Can self-employed individuals claim incidental expenses?

A: No. This relief only applies in employer-employee relationships. Self-employed people should look to other allowable business expense rules.

Q: What’s a bespoke rate and how do I apply?

A: A bespoke rate is a higher allowance that you can apply for from HMRC. You must provide justification (e.g. evidence that your employees’ actual costs exceed the standard rates) and show the amount is reasonable.

Q: Do directors qualify?

A: Yes — if the director is employed by the company and treated as an employee, they may claim under incidental expenses rules (subject to the same limits and conditions).

Q: Does the allowance replace subsistence or meal allowances?

A: No. Incidental expenses is a separate relief for small, ancillary costs, not covering meals, travel or accommodation.

If you have any further questions or want tailored advice, please contact Trueman Brown (mark@truemanbrown.co.uk / 01708 397262).

Recent Comments