Understanding the VAT Reverse Charge

When you hear “VAT reverse charge,” it often causes confusion — but grasping it is essential for any VAT-registered business.

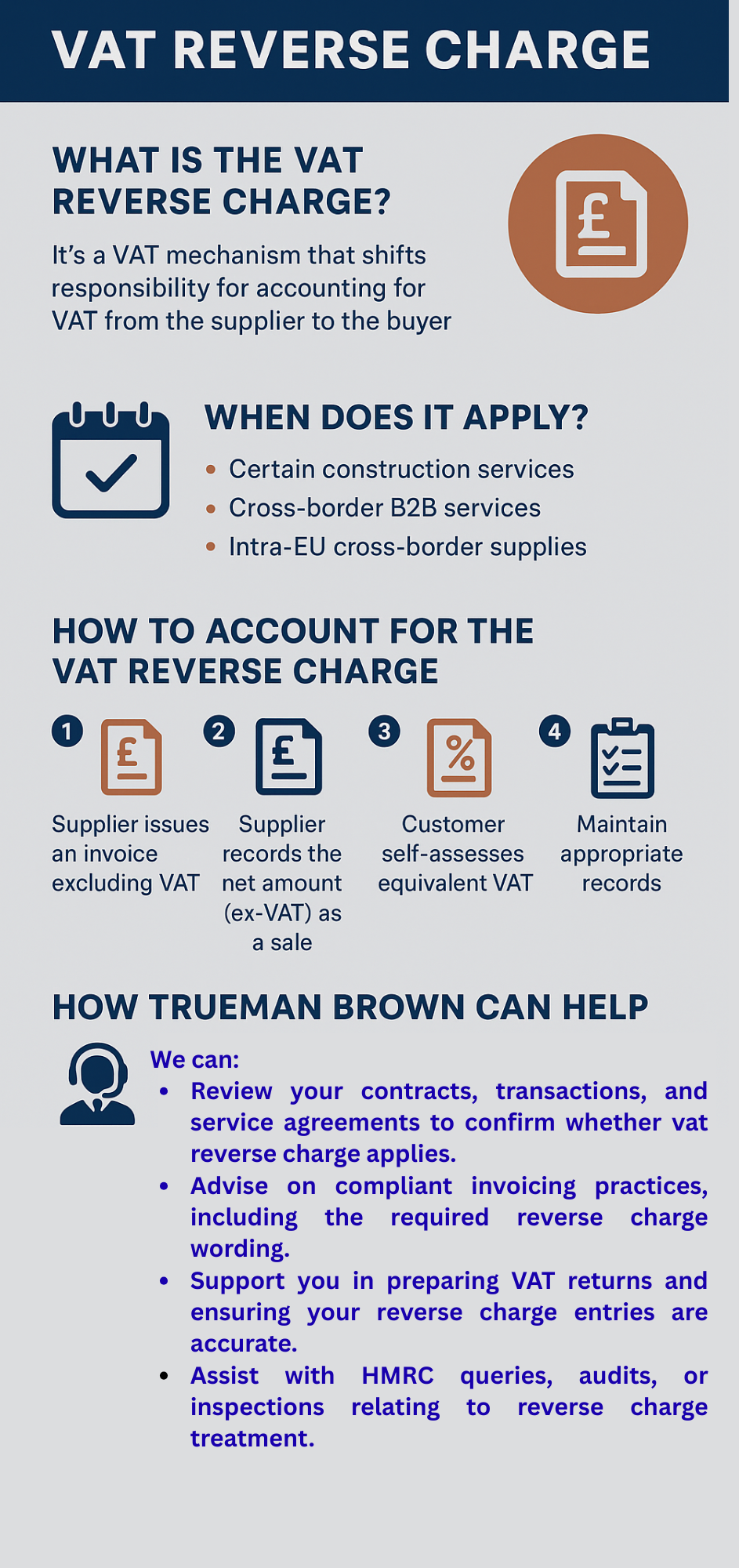

The VAT reverse charge mechanism shifts the responsibility for reporting output VAT from the supplier to the customer (in certain transactions), which is opposite to the usual VAT flow.

VAT is tricky enough — and the vat reverse charge is one of its more intricate features. In many standard transactions, the supplier charges and remits VAT to HMRC. Under a reverse charge, though, that charge is instead “reversed” onto the buyer to self-assess.

What Is the VAT Reverse Charge?

In typical VAT treatment, a supplier adds VAT to the sale and pays that VAT over to HMRC.

But with VAT reverse charge, the supplier issues a net invoice (no VAT added), and the customer (the buyer) must account both the output and input VAT (where applicable) in their VAT return.

This ensures that the VAT is still captured in the supply chain, but with the burden of accounting shifted.

The customer effectively becomes treated as if they both sold and purchased the same service or goods (for VAT purposes) under the reverse charge regime.

When Does the VAT Reverse Charge Apply?

Not all transactions are subject to VAT reverse charge rules — they apply only in specific scenarios. Some common cases include:

-

Domestic construction services under the Construction Industry Scheme (CIS)—a UK subcontractor supplying a service to a contractor must not charge VAT; the contractor accounts via reverse charge.

-

Certain cross-border B2B supplies of services, where the place of supply rules trigger reverse charge.

-

Intra-EU cross-border supplies (where allowed and relevant) where VAT is not charged by the supplier but accounted for by the customer.

Because the correct treatment depends on the nature of the supply, the parties involved, and the location of the business, it’s important to check whether your transaction falls under vat reverse charge rules.

How to Account for the VAT Reverse Charge

If VAT reverse charge rules apply, the accounting treatment generally involves:

-

The supplier sends an invoice excluding VAT, but with a note such as “VAT to be accounted for by the recipient under reverse charge.”

-

The supplier records the net amount (ex-VAT) as a sale (Box 6 on the VAT return) subject to any partial exemption adjustments.

-

The customer (recipient) then self-assesses: they include the equivalent VAT as output tax and, if allowed, as input tax (subject to partial exemption rules).

-

Appropriate records must be maintained to support that reverse charge treatment.

Challenges & Pitfalls with VAT Reverse Charge

Using VAT reverse charge correctly isn’t always straightforward. Key pitfalls include:

-

Misidentifying which services or supplies are covered.

-

Dealing with partially exempt customers who may not recover all input VAT.

-

Missing to note the reverse charge on invoices, making it unclear to the recipient.

-

In cross-border transactions, misapplying the place of supply rules or assuming reverse charge when it doesn’t apply.

-

Failing to keep proper documentation and audit trails.

Because of these complexities, errors can lead to VAT assessments, penalties, or lost recoverable VAT.

Benefits of Applying the VAT Reverse Charge Correctly

Getting VAT reverse charge right has several advantages:

-

Reduces risk of being challenged by HMRC for incorrect VAT treatment.

-

Ensures proper VAT flow in supply chains, avoiding gaps or overcharging.

-

Gives clarity to both supplier and customer on who is responsible for VAT.

-

Helps maintain clean audit trails and financial transparency.

How Trueman Brown Can Help You With VAT Reverse Charge

Navigating VAT reverse charge rules across different transactions and sectors can be daunting.

That’s exactly where Trueman Brown can step in and support you.

We can:

-

Review your contracts, transactions, and service agreements to assess whether VAT reverse charge should apply.

-

Advise on correct invoicing practices, to include the necessary reverse charge wording.

-

Help you with VAT return preparation and ensure the reverse charge entries are correct.

-

Assist in dealing with HMRC queries or inspections related to reverse charge treatment.

If you’d like expert assistance, feel free to get in touch:

-

Email: mark@truemanbrown.co.uk

-

Phone: 01708 397262

We’re happy to walk you through the application of vat reverse charge in your specific circumstances and help you remain compliant.

FAQ on VAT Reverse Charge

Q: What is the difference between reverse charge and standard VAT charging?

A: Under standard VAT, the supplier charges VAT and remits it. Under vat reverse charge, the buyer accounts for the VAT instead, with the supplier issuing a net invoice.

Q: Does vat reverse charge apply to all VAT-registered businesses?

A: No — it only applies in designated types of supplies (e.g. construction under CIS, specific international services) and when both parties meet the necessary conditions (such as being VAT-registered).

Q: Can the buyer reclaim the VAT when using reverse charge?

A: Yes, provided the buyer’s business is entitled to deduct input VAT (i.e. they use the purchase in making taxable supplies). However, if partially exempt, the entitlement may be limited.

Q: What must the supplier put on the invoice under reverse charge?

A: The supplier should omit VAT from the invoice and include a note such as “VAT to be accounted for by the recipient under reverse charge (reverse charge mechanism applies).”

Q: What happens if you apply reverse charge incorrectly?

A: You risk HMRC assessments, penalties, or loss of input VAT recovery. It could also lead to disputes with customers.

Q: How do I know whether my service or supply is subject to vat reverse charge?

A: It depends on the nature of the service or goods, whether it’s under a specific scheme (like construction), and the location of both parties. You should check VAT legislation or seek professional advice (for example, from Trueman Brown).

If you need help understanding whether vat reverse charge applies in your case, reach out to us at mark@truemanbrown.co.uk or call 01708 397262.

Recent Comments