Old rules for self-employed training costs

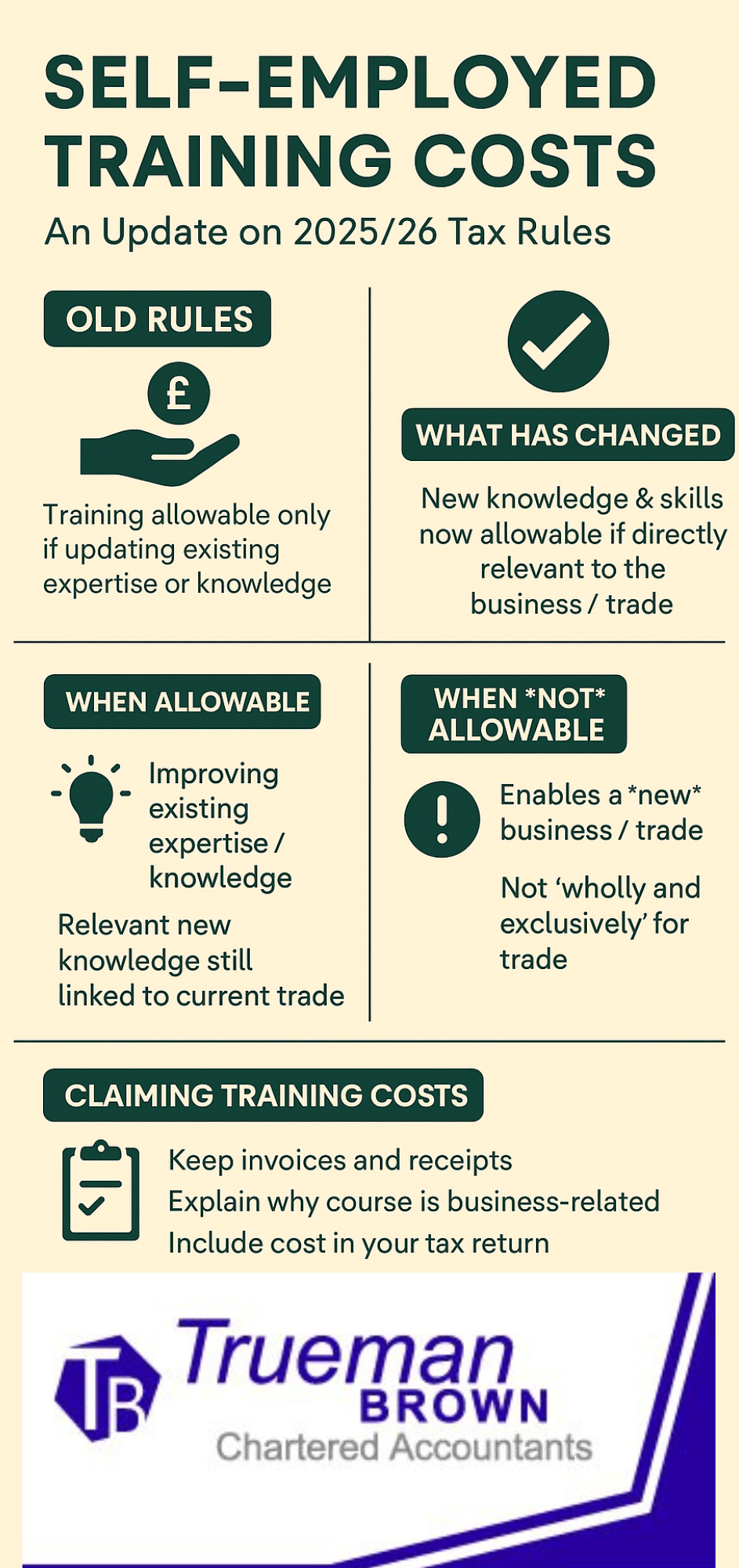

Previously, if you were self-employed, the tax rules only allowed a deduction for training costs if the course updated existing expertise or knowledge.

Training that provided you with wholly new skills or knowledge (for branching into a new business or trade) was classed as capital expenditure — and therefore not deductible.

What has changed in 2025/26?

The key change is that HM Revenue & Customs (HMRC) has clarified that training costs incurred by the self-employed may be deductible provided that they are incurred wholly and exclusively for the purposes of the trade and are revenue (not capital) expenditure.

Effectively, the updated position means that self-employed training costs can now be allowable if they either:

-

update your existing expertise or knowledge in your existing business/trade; or

-

provide new expertise or knowledge, provided it is still directly connected to your current business area (such as keeping up with technological or regulatory changes).

By contrast, costs are still unlikely to be deductible if the training enables you to start a completely new business or enter a new trade altogether.

When self-employed training costs are allowable

To help you assess whether you can treat training as an allowable expense, here are some practical examples of when you can claim self-employed training costs, under the 2025/26 guidance:

- A wedding photographer pays for an online course in advanced photo-editing software to widen her offering.

- A plumber takes a beginners’ bookkeeping course to run his business finances more efficiently – here the training is ancillary, yet related, so the training cost may be deductible.

-

A web-designer enrols on a short course in AI applications relevant to her design business – the cost may be deductible because the new knowledge is relevant to her existing trade.

When self-employed training costs are not allowable

There are still clear limits. You cannot claim self-employed training costs if:

-

The course is aimed at starting a new business or entering a new trade unrelated to your current business. For example, a taxi driver taking a painting and decorating course in order to enter the decorating business would normally not be able to deduct the training cost.

-

The training is not incurred “wholly and exclusively” for the purposes of your current trade.

-

If the primary purpose is private or for personal development unrelated to business activity, the cost will not be allowable.

Record-keeping and how to claim self-employed training costs

To support a claim for self-employed training costs in 2025/26, you should ensure you:

-

Keep invoices and receipts for the training course, clearly showing the cost and purpose.

-

Be able to explain how the course relates to your existing trade, or keeps your business up to date with developments.

-

Include the cost as part of your allowable business expenses when calculating your trading profit under your self-assessment return. See also HMRC’s guidance on training courses for the self-employed.

-

Be ready to explain to HMRC why the training is business-related (and not personal) if asked.

How Trueman Brown Chartered Accountants can help

If you’re wondering whether your proposed training qualifies as an allowable expense under the rules for self-employed training costs, we can help.

Trueman Brown can review your planned training, assess whether it meets the “wholly and exclusively” test, ensure your records are compliant, and help you include the cost properly in your tax return. Reach us at:

-

Email: mark@truemanbrown.co.uk

-

Phone: 01708 397262

We’ll guide you through the details so that you make informed decisions about training investments and maximise your allowable expenses while staying within HMRC rules.

FAQ – Frequently Asked Questions

Q1: What exactly are self-employed training costs?

A1: They are the costs you incur on training courses when you’re self-employed, which may be treated as business expenses (deductible) if they are incurred wholly and exclusively for the purposes of your existing trade.

Q2: Can I claim the cost of a course to enter a completely new trade?

A2: Generally no. Training costs incurred to enable you to start a new trade or business will not qualify as allowable self-employed training costs – HMRC treats them as capital expenditure.

Q3: What if the training gives me a brand new skill, but it’s still related to my business?

A3: Yes — under the updated rules for 2025/26, if the new skill is relevant to your existing trade (for example, technological advances or regulatory changes), then the cost of that training may qualify as deductible self-employed training costs.

Q4: Do I need to worry about mixing personal and business purposes in the training?

A4: Yes. You must ensure the training is truly for your business (wholly and exclusively). If there is a significant personal benefit or the training is only partly business-relevant, HMRC may disallow part or all of the cost.

Q5: Does the method of delivery (online, classroom, part-time) affect whether the cost is deductible?

A5: No. The form of delivery is generally irrelevant. What matters is the purpose of the training and its relation to your trade.

Q6: How do I include self-employed training costs on my self-assessment tax return?

A6: You include them as allowable business expenses when calculating your trading profit or loss. Make sure your accounting records support your claim. You may wish to consult an accountant (such as Trueman Brown) to ensure accuracy and compliance.

If you’d like further guidance on claiming self-employed training costs, or any other tax-related issue for your business, please feel free to contact us at mark@truemanbrown.co.uk or call 01708 397262.

Recent Comments