Self-Assessment 2024/25: Class 2 National Insurance Contributions Charged in Error

The Background: Class 2 NICs and Self-Assessment

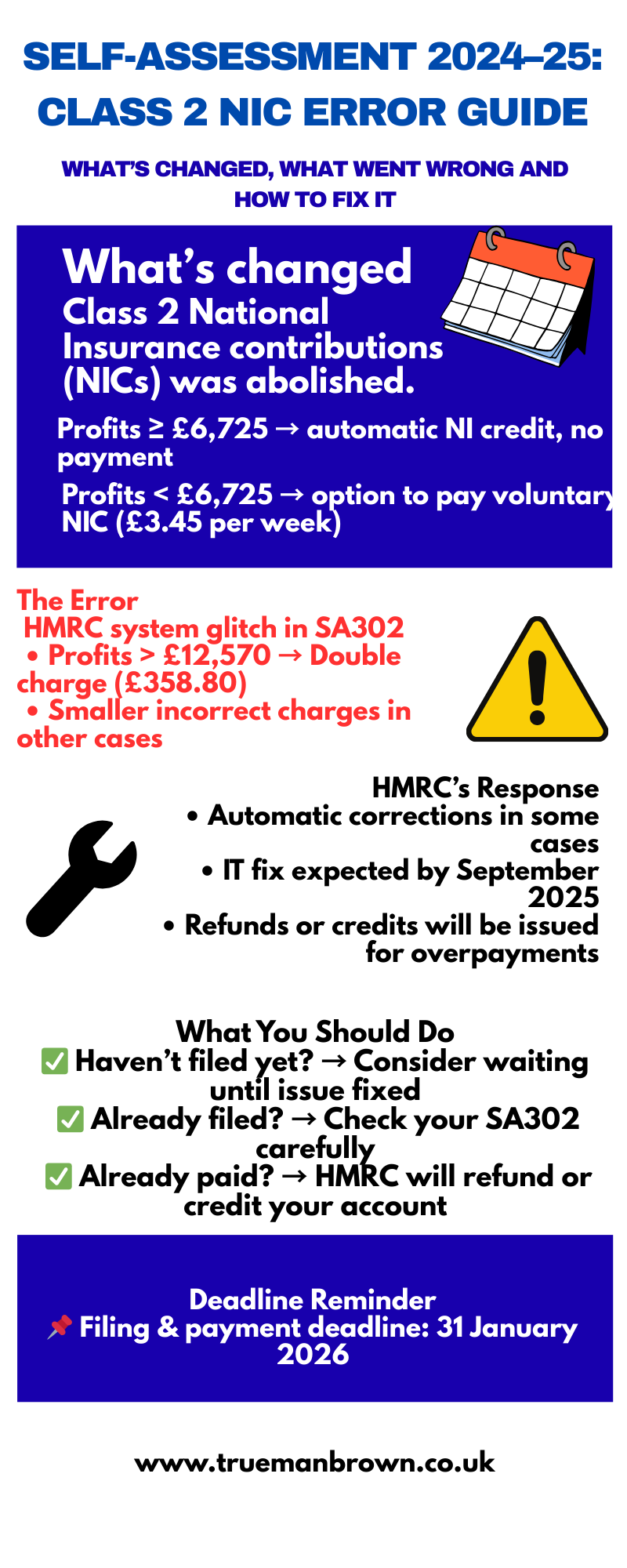

From 6 April 2024, the liability for self-employed earners to pay Class 2 National Insurance contributions (NICs) was abolished. Instead, Class 2 NICs are now a voluntary payment option for those with profits below the small profits threshold (£6,725 for 2024/25) who want to secure a qualifying year for State Pension and benefit purposes. When completing a self-assessment return, individuals will need to decide whether to make these voluntary contributions to protect their future entitlement.

For 2024/25:

-

If profits are below £6,725 → You may opt to pay Class 2 voluntarily (£3.45 per week / £179.40 annually).

-

If profits are between £6,725 and £12,570 → You receive a National Insurance credit without paying.

-

If profits exceed £12,570 → You are only liable for Class 4 NICs, not Class 2.

The Problem: Incorrect Class 2 Charges in Self-Assessment

Some self-employed taxpayers are discovering that their self-assessment tax return for 2024/25 has been incorrectly calculated.

-

In many cases, a Class 2 NIC charge of £358.80 (double the correct voluntary annual rate) has been added in error.

-

This error particularly affects taxpayers with profits above £12,570, who should only pay Class 4 NICs.

-

In other cases, smaller but still incorrect Class 2 charges have appeared.

HMRC’s Response and Corrections

HMRC has acknowledged the issue and confirmed that:

-

They are taking corrective action automatically where their records allow.

-

Some taxpayers have already seen their Self Assessment (SA302) calculation corrected.

-

Incorrect Class 2 NIC letters will continue to be sent until HMRC resolves the IT problem in September 2025.

-

Once resolved, HMRC will correct remaining errors and notify affected taxpayers.

-

Any incorrect payments will either be refunded or added as a credit to the taxpayer’s account.

What Self-Employed Taxpayers Should Do

If you’re self-employed and completing your self-assessment return for 2024/25, here’s how to handle the situation:

Haven’t filed yet?

You may wish to wait until HMRC resolves the IT issue before submitting.

Already filed?

-

-

-

Check your self-assessment calculation carefully.

-

If the Class 2 charge is wrong, contact HMRC to ensure it is corrected.

-

-

Already paid the incorrect charge?

HMRC will either refund you or apply the payment as a credit.

Don’t miss the deadline

The filing and payment deadline for 2024/25 Self Assessment is 31 January 2026.

Final Thoughts on Self-Assessment Errors

This HMRC IT error means many self-employed taxpayers could see incorrect Class 2 NIC charges on their self-assessment tax returns. While HMRC is working on a fix, it’s important to check your calculation, avoid overpaying, and make sure you get a refund or credit if you’ve already been charged incorrectly.

👩💼 Finding Expert Self-Assessment Services Near You

If you’re a business in South Ockendon, Thurrock, or the surrounding areas looking for reliable and compliant self-assessment services near me, we’re here to help.

We provide:

-

Tax Return Preparation & Filing

-

Tax Planning & Advisory

-

National Insurance Contributions (NICs)

-

Self-Employed & Sole Trader Support

-

Partnership & Director Returns

-

Tax Reconciliation & Amendments

-

Digital Tools & Software Support

-

End-of-Year Tax Reports

-

Advisory for Special Cases

📞 Contact us today to streamline your self-assessment, stay compliant, and focus on growing your business — while we handle the details.

FAQs – Self-Assessment 2024/25 & Class 2 NICs

1. Why am I being charged Class 2 National Insurance in my 2024/25 Self-Assessment?

Some self-employed taxpayers are mistakenly charged Class 2 NICs due to an HMRC IT issue. If your profits exceed £12,570, you should only pay Class 4 National Insurance, not Class 2. Always check your self-assessment 2024/25 calculation to ensure it is correct.

2. Do I need to pay Class 2 NICs through Self-Assessment for 2024/25?

No. From 6 April 2024, Class 2 NICs are voluntary for self-employed individuals with profits below £6,725. Voluntary contributions can help build qualifying years for your State Pension, but if your profits are above this threshold, Class 2 should not appear on your self-assessment.

3. What should I do if my Self-Assessment shows the wrong Class 2 NIC charge?

If you’ve filed your 2024/25 self-assessment and notice an incorrect Class 2 NIC charge, contact HMRC to request a correction. If you haven’t filed yet, consider waiting until HMRC resolves the issue (expected by September 2025).

4. What happens if I already paid the incorrect Class 2 NICs through Self-Assessment?

HMRC will refund or credit any incorrect Class 2 NIC payments to your self-assessment account once the error is fixed. Keep proof of payment and HMRC correspondence for reference.

5. When is the deadline for submitting my 2024/25 Self-Assessment?

The online filing and payment deadline for 2024/25 self-assessment is 31 January 2026. The HMRC Class 2 NIC error does not affect this deadline. Submit on time to avoid late filing penalties.

Recent Comments