Changes to Pensions and Inheritance Tax from April 2027

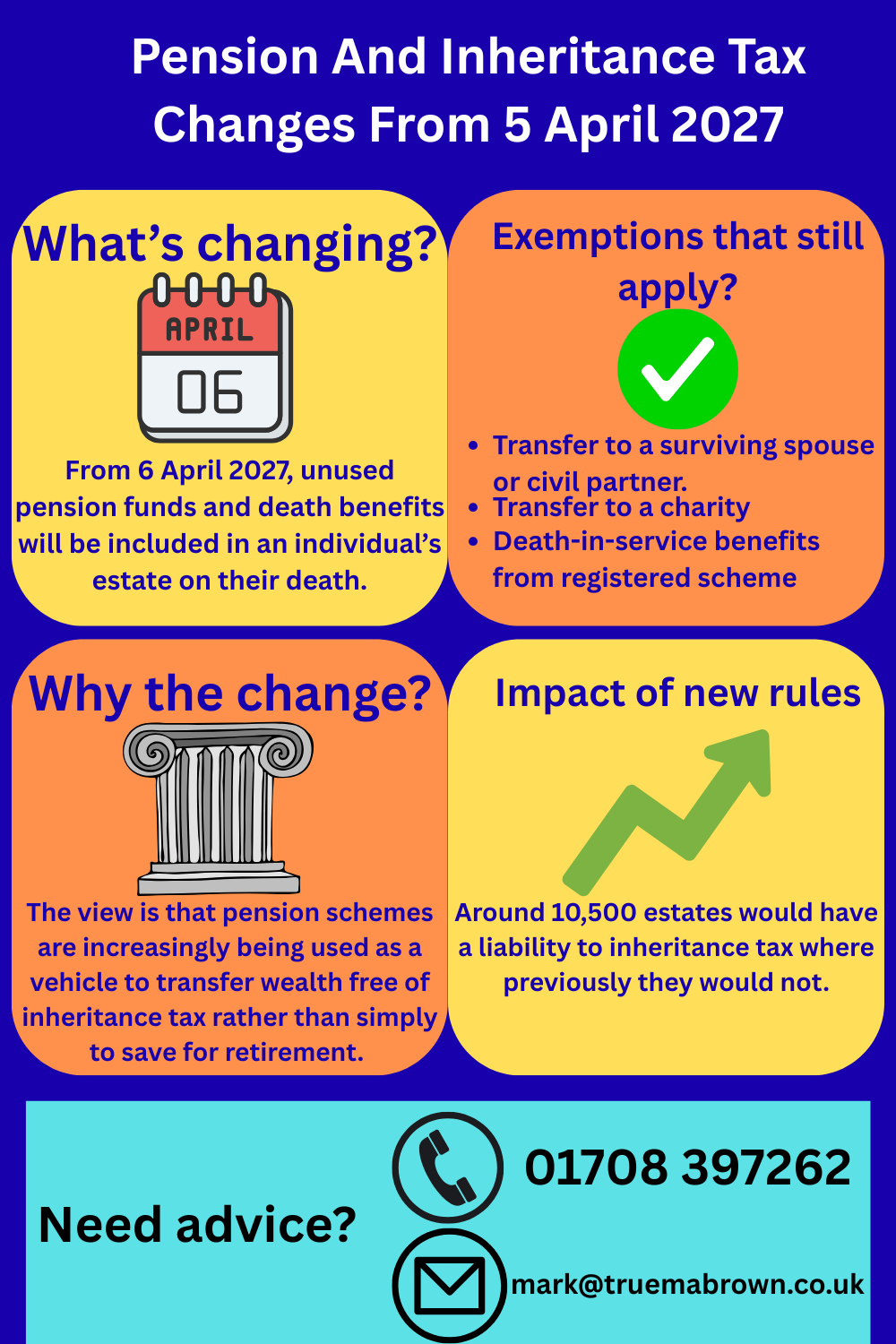

From 6 April 2027, pensions will no longer provide the same protection from inheritance tax as they do today.

At present, unused pension funds in most UK discretionary schemes can pass to beneficiaries outside of the estate and free of inheritance tax.

This has made pensions an attractive way to pass on wealth.

However, under new rules announced in the Autumn 2024 Budget, unused pensions and death benefits will be counted within an individual’s estate and subject to inheritance tax.

Pensions and Inheritance Tax: What’s Changing in 2027?

The treatment of pensions and inheritance tax currently depends on the type of scheme:

-

Discretionary pensions (most UK schemes): Unused pensions are usually excluded from the estate and free of inheritance tax.

-

Non-discretionary pensions (e.g. NHS and judicial schemes): Pension funds are already part of the estate and subject to inheritance tax.

From 6 April 2027, unused pensions will always be included in the estate, regardless of scheme type.

This means more families will face inheritance tax bills connected to pensions.

Inheritance Tax Exemptions That Still Apply to Pensions

Not all pensions will be treated the same. Some important inheritance tax exemptions continue:

-

Pensions left to a surviving spouse or civil partner remain free of inheritance tax.

-

Pensions gifted to charities also remain exempt.

-

Death-in-service pensions from registered schemes will still be excluded from inheritance tax.

Why the Government is Changing the Rules on Pensions and Inheritance Tax

The Government has signalled that pensions were increasingly being used for inheritance tax planning rather than solely for retirement income.

The concern has grown since the lifetime allowance was abolished, allowing unlimited pension savings.

By changing the rules, pensions and inheritance tax will now be more aligned with how other assets are treated.

The Impact of New Inheritance Tax Rules on Pensions

Government estimates show:

-

10,500 estates will become liable for inheritance tax where they previously paid none.

-

38,500 estates will pay more inheritance tax due to pensions being included in estates.

This could significantly affect individuals relying on pensions as a tax-efficient way to transfer wealth.

Planning Ahead: Managing Pensions and Inheritance Tax

The changes highlight the importance of proactive financial planning. If pensions are no longer a shield from inheritance tax, individuals may need to:

-

Review how pensions fit into their estate planning strategy.

-

Consider drawing down pensions earlier, gifting other assets, or using trusts.

-

Seek professional advice to reduce the impact of inheritance tax on pensions.

How Trueman Brown Can Help With Pensions and Inheritance Tax

At Trueman Brown, we understand how complex the interaction between pensions and inheritance tax can be. Our experienced team can:

-

Review your pensions in light of the new inheritance tax rules.

-

Assess your estate’s likely tax exposure.

-

Recommend strategies to reduce inheritance tax while making the most of your pensions.

📞 Contact us today on 01708 397262 or email mark@truemanbrown.co.uk to discuss how we can help protect your family wealth.

Frequently Asked Questions About Pensions and Inheritance Tax

1. Will all pensions be subject to inheritance tax from April 2027?

Yes. Unused pensions and death benefits will be included in the estate for inheritance tax purposes, regardless of the type of scheme.

2. Are death-in-service pensions still tax-free?

Yes. Death-in-service benefits from registered schemes remain free of inheritance tax.

3. What exemptions apply to pensions and inheritance tax?

Pensions left to a spouse or civil partner remain exempt, and pensions gifted to charities are also free from inheritance tax.

4. Why has the Government changed the rules on pensions and inheritance tax?

The Government believes pensions were being used as inheritance tax planning vehicles, especially since the removal of the lifetime allowance.

5. How should I prepare for the new pensions and inheritance tax rules?

Review your pensions and estate plans now, consider alternatives for passing on wealth, and seek expert advice to minimise inheritance tax.

Recent Comments